Interlate improves the profitability of mines.

Interlate is an industrial productivity improvement specialist that uses the power of connected machines and world-leading technical innovation to deliver superior value for customers. Operating from a state-of-the-art Operations Intelligence Centre in Australia, Interlate’s solutions help natural resource companies to reduce operating risk and increase productivity.

Scroll down to read the article

Imagine what you could do with an extra financial quarter

Interlate is a data business. We are transforming the mining sector, harnessing the power of connected machines, expert human skill and world-leading technical innovation. We provide solutions that reduce operating risk and increase productivity in real-time.

Mining companies are continually seeking ways to increase profitability. Minimising costs and maximising productivity have become increasingly important focus areas, and these are the efforts that mine operators can control.

Interlate’s solutions are filling the mining sector’s need for innovation. Since its foundation, Interlate has taken the lead in the mining sector as a productivity specialist. Through a unique blend of technology, expertise and big data analytics, we can prevent production interruptions, optimise production output and improve operations in the most cost-efficient way.

To provide rapid and sustainable productivity solutions, Interlate uses its Galaxy Engine™ which is a hypervariate analytical platform, capable of processing millions of data points across discrete operating scenarios simultaneously at great speed. We combine this capability with subject matter expertise and site operating context to develop analytical tools that can be used to optimise the plant. This can provide up to 15% productivity improvement in our clients’ operations without additional capital expenditure.

Interlate maintains an operational culture that allows us to act as an extension of site teams, integrating and collaborating seamlessly and solving problems in real-time. We maintain a close connection with the operations teams we serve and provide sites with an additional layer of decision-making support that, over time, embeds knowledge in the site teams. Together, we uncover value that is already there, waiting to be unlocked.

Unlocking value in mining through a successful IoT strategy

The need to uphold revenues and reduce costs has become even more essential in an increasingly competitive environment.

As the global economy becomes ever more complex and orebodies become more inaccessible, a more sophisticated approach to productivity optimisation is needed.

Traditional performance interventions are transient due to geographical dislocation of skills and data.

Using an Internet of Things (IoT) approach gives miners an opportunity to substantially improve performance without adding significant capital.

IoT has been heralded as the primary conduit to improve operational efficiency in manufacturing and the same could be said for mining. But in today’s environment, companies can also benefit greatly by seeing it as a path for finding value from unexpected quarters.

In the future, successful mining companies will use the IoT to capture new growth through three approaches: boost revenues by increasing production, use intelligent technologies to fuel innovation and transform their workforces.

The promise of IoT is that by connecting machines through communication networks and allowing them to quickly process data and share insights will enable intelligent systems to optimise processes and economic outcomes.

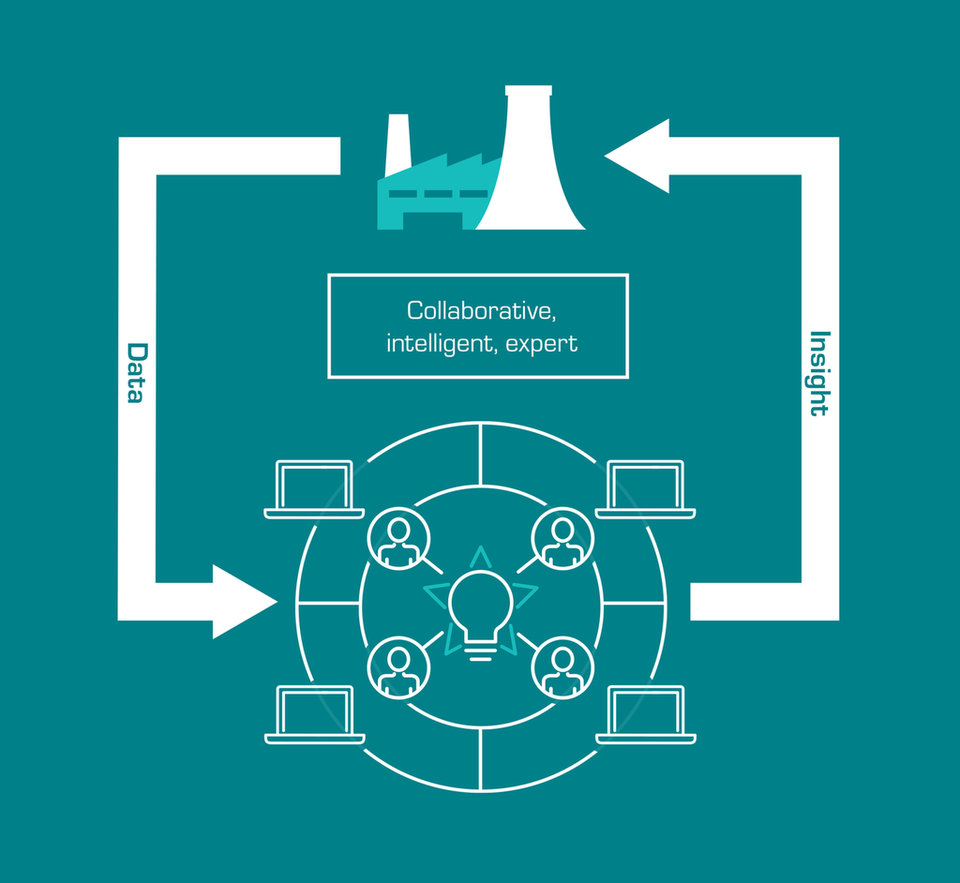

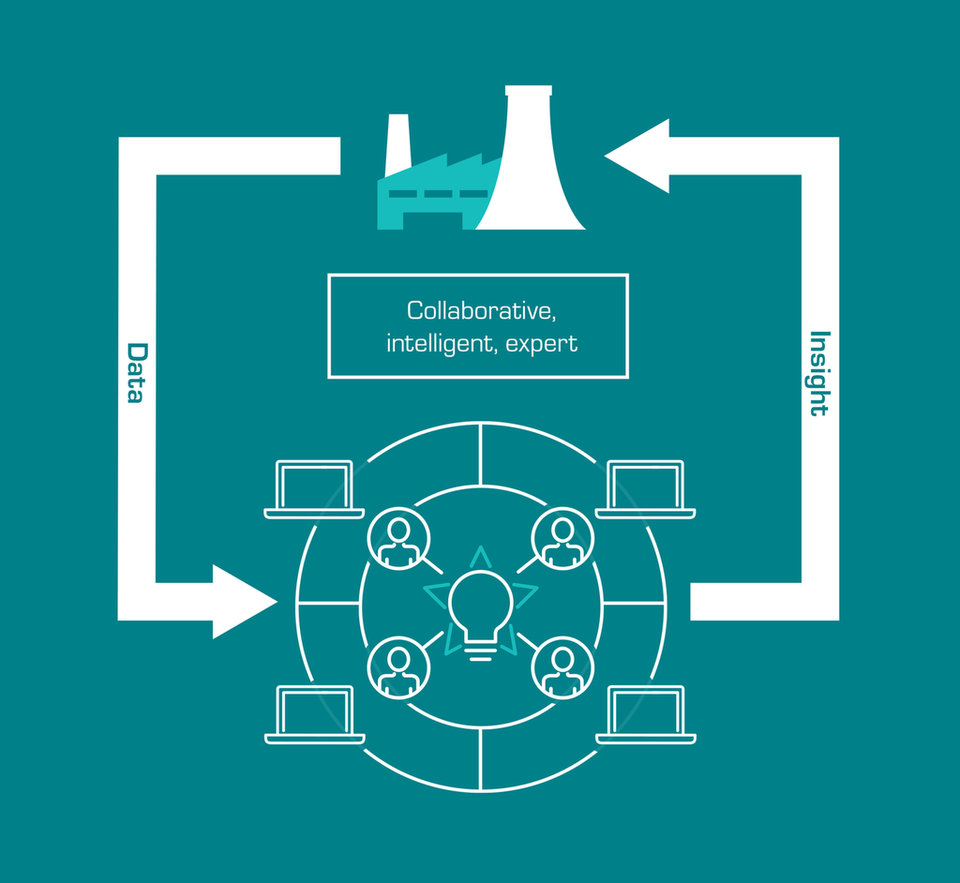

However, machines alone cannot revolutionise the mining industry. Our industry is centred around people that apply specialised knowledge and experienced thinking to transform data into insight. For the mining industry, an essential component of a successful IoT strategy is the role that people play in building the algorithms that create insight; as well as carrying out the actions to implement new knowledge.

The automation trend in mining is maturing. Well-understood and repeatable tasks are increasingly automated which is a boon for productivity improvement through the

removal of variability.

However, leaps in productivity are made when insights are harnessed and used to improve the outcome of complex processes. These insights arrive from people’s experience and skill being applied to data.

The role that people have in transforming productivity is inescapable. A successful IoT strategy blends expertise, experience and technology in a way that generates actionable insights for teams of people on operating sites, allowing them to make informed and timely decisions in order to improve productivity and, ultimately, profit.

IoT has been heralded as the primary conduit to improve operational efficiency in manufacturing and the same could be said for mining

During the first ten months of 2017, Ukraine spent $2.15bn on coal imports

Separatist complications

The wage arrears and other concerns have built up in the coal mining industry in Ukraine for a number of reasons. Allegations of corruption have been made by many, including Oleksandr Kharchenko, managing director at Energy Industry Research Center in Kiev. He claimed that the money from state-run mines has been redirected, which has been a key cause of the wage arrears.

Others claim that the deep nature of Ukrainian coal operations and low productivity of many mines has made them unprofitable; they have therefore been heavily dependent on government subsidies for years. The level of these subsidies has changed with each government, without great reform to the industry.

Communication failures between the MECI and state-run mining companies and unions have allowed the situation to reach the critical point it is at today.

“We urge the Ukrainian Government to re-launch social dialogue with the unions, and take effective measures to solve the problems affecting the coal industry,” said IndustriALL Global Union general secretary Valter Sanches in a letter to the Prime Minister of Ukraine. “We stand in solidarity with our affiliated trade unions and our fellow miners in the Ukraine and support their legitimate demands and necessary legal steps required to protect the rights of workers.”

Political and military upheaval has complicated the situation. In April 2014, pro-Russian separatists formed a militia that took Donetsk and Luhansk out of the Ukrainian Government’s control. In July 2017, they announced that they had founded a new country called Malorossiya, or Little Russia in English.

The four Selidivvugillya mines that have been striking this year lie very close to the eastern border with the People’s Republic of Donetsk, increasing the tension in the region. Many miners are concerned that due to unpaid wages they could not afford to move in an emergency, putting them and their families at risk.

Furthermore, 85 coal mines lie inside this disputed region. The resource-rich area accounted for 57% of production up until 2014, when reports stopped. Only 35 state-run mines are outside of this region, which must continue producing coal for domestic use. It is currently illegal to purchase coal from the separatist regions; however, there are reports that it is being sold to Russian, Polish and other European companies.

Since 2014, Ukraine has engaged in numerous coal import deals to make up for the lost supply created by the loss of territory. The majority of coal has been imported from Russia, which provided 55.7% - $1.2bn worth - between January and October 2017. The country has also begun importing American coal for the first time in its history, in particular anthracite, the price of which America has tripled since 2016. Overall, during the first ten months of 2017, Ukraine spent $2.15bn on coal imports.

With the significant challenges caused by the separatist movements drawing focus, many miners feel ignored by the government. As government officials in Kiev try to limit illegally sold coal and avoid an energy crisis, communication has broken down with the remaining coal miners.

With the significant challenges caused by the separatist movements drawing focus, many miners feel ignored by the government. As government officials in Kiev try to limit illegally sold coal and avoid an energy crisis, communication has broken down with the remaining coal miners.

More than half of the country’s coal mines are managed by pro-Russian separatist militia. Credit: DmyTo/Shutterstock.

A time for communication

Ukrainian state mines currently employ 51,000 workers, and are the main source of employment in regions such as the Donetsk coal basin. Mine closures over the last few years have already decimated towns and the government does not desire to close more but there is little clarity on how to progress in a profitable and sustainable way.

“The development of state-owned mines is possible in a stable environment, but wages must be paid on time,” said Trade Union of Coal Industry Workers of Ukraine deputy chair Valery Mamchenko. “Last year, UAH2.8bn ($100m) was allocated for the development of the coal industry, including the wage fund, but this year the amount is less than half.”

Without communication with unions and workers, many fear that Ukraine’s coal mining industry will remain stuck in its cycle of non-payment, protests and emergency measures. “It is essential to pay wage arrears in full; stamp out corruption in the industry; appoint managers of enterprises and mines on merit alone; and establish an effective social dialogue with trade unions,” said the Independent Trade Union of Miners of Ukraine president Mychailo Volynets.

The next few years will determine the future of Ukraine’s mining industry; now is the time for the government to focus on and support coal communities. Whether or not mining is to continue to play an important part in Ukraine’s economy and the lives of its citizens, or if it is time for the subsidies to be reduced and new energy industries to be grown, a plan must be made.

Ukrainian state mines currently employ 51,000 workers, and are the main source of employment in regions such as the Donetsk coal basin. Mine closures over the last few years have already decimated towns and the government does not desire to close more but there is little clarity on how to progress in a profitable and sustainable way.

“The development of state-owned mines is possible in a stable environment, but wages must be paid on time,” said Trade Union of Coal Industry Workers of Ukraine deputy chair Valery Mamchenko. “Last year, UAH2.8bn ($100m) was allocated for the development of the coal industry, including the wage fund, but this year the amount is less than half.”

Without communication with unions and workers, many fear that Ukraine’s coal mining industry will remain stuck in its cycle of non-payment, protests and emergency measures. “It is essential to pay wage arrears in full; stamp out corruption in the industry; appoint managers of enterprises and mines on merit alone; and establish an effective social dialogue with trade unions,” said the Independent Trade Union of Miners of Ukraine president Mychailo Volynets.

The next few years will determine the future of Ukraine’s mining industry; now is the time for the government to focus on and support coal communities. Whether or not mining is to continue to play an important part in Ukraine’s economy and the lives of its citizens, or if it is time for the subsidies to be reduced and new energy industries to be grown, a plan must be made.

It is essential to pay wage arrears in full [and] stamp out corruption in the industry

Ready for next productivity revoloution?

PO Box 946

Travelers Rest

SC 29690

United States of America

See the potential benefits we can offer your mine here

www.interlate.com/value-stories