Global zinc production is expected to grow by 2% to 12.5Mt in 2024, according to GlobalData’s latest report on the commodity. The increase will predominantly be fuelled by rising output from Russia, which accounted for 2.8% (341kt) of the total global zinc supply in 2023.

Russia’s zinc production is expected to grow by 41% to reach 480.9kt in 2024, driven by the scheduled start of production at the Ozernoye mine, which will have an annual capacity of 317.5kt, in the third quarter of 2024. The project has faced challenges, including Western sanctions and a plant fire in November 2023, delaying its initial production.

Meanwhile, global zinc production in 2024 will be further bolstered by increasing output from Mexico and India. Production from Mexico is expected to reach 735.9kt in 2024, up by 9.3% versus 2023 due to higher production from the Peñasquito mine following its resumption in October 2023. Meanwhile, production in India is expected to increase by 5.2% in 2024 to reach 886.8kt, owing to the expected higher production from the Zawar and Sindesar Khurd mines.

In contrast, production is expected to continue to decline in Ireland, the US, Australia and Canada. This will primarily be due to the temporary shutdown of operations amid weakened market conditions. Locations affected include the Tara mine in Ireland, the 777 and Bracemac-McLeod mines in Canada, the Middle Tennessee and East Tennessee mines in the US, and the Dugald River and Jaguar mines in Australia.

In December 2023, Australia updated its list of strategic minerals and established a new list, which includes zinc.

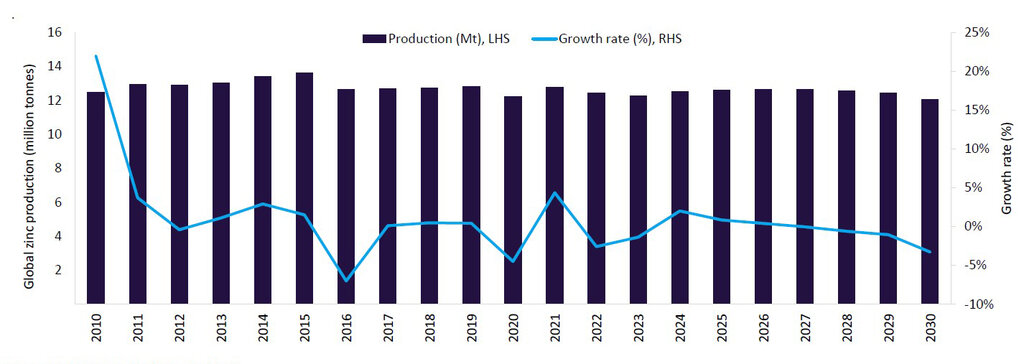

Global zinc production to 2030. Source: GlobalData, International Lead and Zinc Study Group

Global zinc production is expected to remain relatively flat in 2025, with a forecast growth rate of 0.9% to reach 12.6Mt. Growth will be limited by expected lower production from China and the US. Production in the US will primarily be impacted by planned lower production at the Red Dog mine.

Over the forecast period of 2024 to 2030, global zinc mine production is then expected to fall to 12Mt by 2030, reflecting expected lower production from Peru, India, China, Bolivia and Kazakhstan. In contrast, production in Australia and Canada is predicted to rise significantly within the same period.