Latest Deals

Credit: Roman Bodnarchuk / Shutterstock

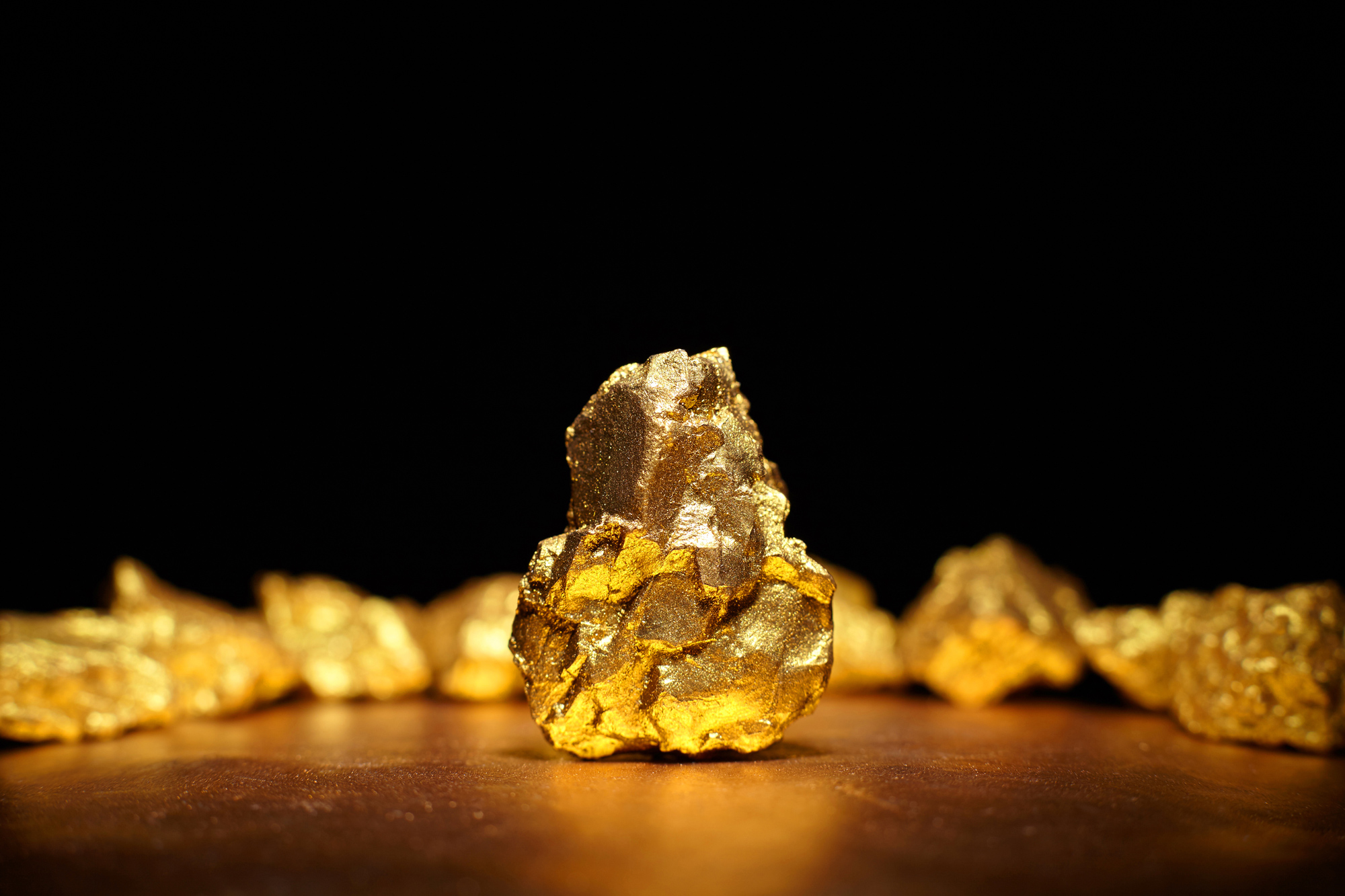

Australian gold producer Ramelius to acquire rival Spartan Resources

Ramelius Resources will acquire its smaller rival Spartan Resources in a deal valuing the latter at approximately A$2.4bn ($1.5bn). The acquisition is expected to bolster Ramelius’ position in the gold mining sector and grant Ramelius ownership of Spartan’s flagship Dalgaranga gold project in Western Australia. The deal is set to create a leading Australian gold producer, with projected output surpassing 500,000oz annually by 2030.

MTM Critical Metals, Vedanta partner to recycle bauxite tailings

MTM Critical Metals partners with Vedanta to explore alumina waste recycling. The collaboration will utilise MTM’s proprietary flash joule heating technology to recycle Vedanta’s red mud, or bauxite tailings, to recover valuable metals. Vedanta will supply bauxite residue from its alumina operations to MTM. The production will focus on creating a red mud product suitable for green cement.

Eclipse Metals, Boss Energy sign earn-in deal for Liverpool uranium project

Eclipse Metals and Boss Energy have entered into a binding option and earn-in agreement to advance exploration at the Liverpool uranium project. Boss Energy is spending A$250,000 ($157,633) on exploration during the 12-month option period. Boss Energy has an initial 49% interest and the right to earn up to 80% by providing up to A$8m in exploration funding.

Adelong partners with GDM to advance Adelong gold project

Adelong Gold has finalised an agreement with Great Divide Mining (GDM) to develop the Adelong Gold Project in New South Wales. The partnership aims to achieve first gold production within 12 months, leveraging GDM’s expertise and resources. GDM will invest A$300,000 ($188,535) for an initial 15% stake in Adelong Gold’s subsidiary Challenger Gold Mines.