Comment

Rising fuel and power costs continue to affect miners

Fuel and power are the biggest driver of increases in mine operating costs, according to a recent survey by GlobalData.

Credit:

According to a GlobalData survey of miners in October and November 2023, fuel and power costs remain the area where prices are increasing the most.

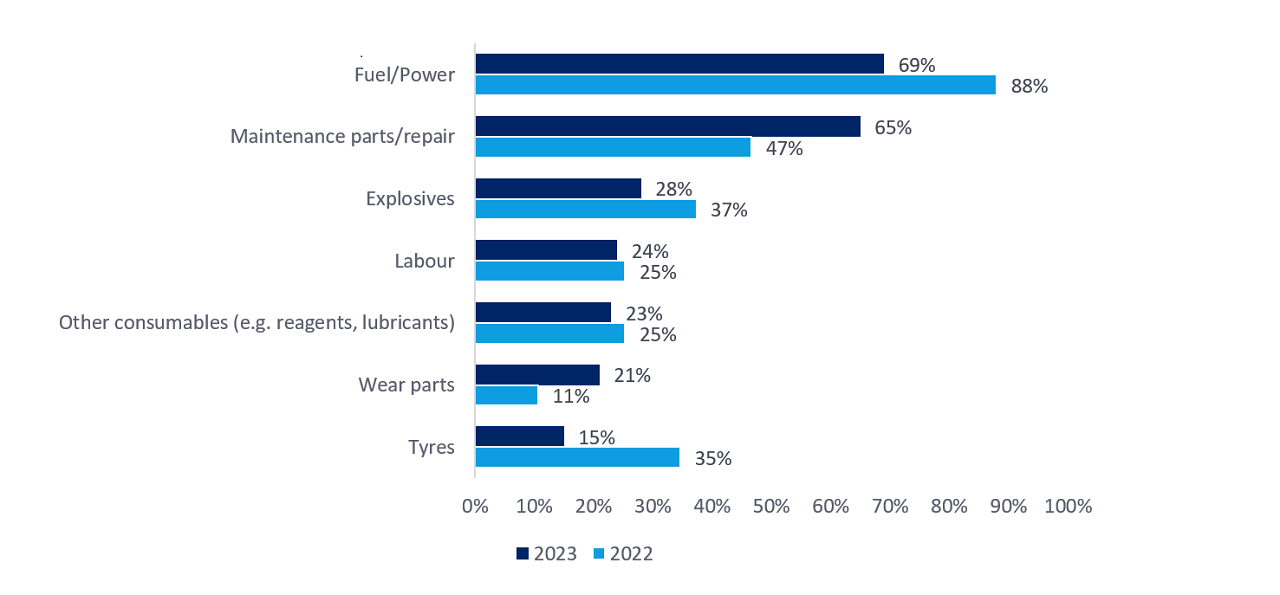

When asked where they were seeing the greatest increases in mining operating costs at present, 69% of respondents selected fuel and power as one of the top three areas, just ahead of maintenance parts/repair (65% of respondents) and then explosives (28%).

The ranking was similar to the results of another survey conducted in the first quarter of 2022, although the share citing fuel/power was lower, down from 88%, helped by a decline in oil prices since the highs seen in mid-2022.

Where are you seeing the greatest increases in mining operating costs at present? (choose up to three), 2023 versus 2022, sample of 75 mines. Credit: GlobalData.

Overall, 24% of respondents included labour as one of their top areas for cost increases, a similar share as in 2022, while wear parts were cited by a higher share (21% in 2023 versus 11% in 2022) and tyres by a lower share (15% in 2023 versus 35% in 2022).

Overall, the increases being experienced for all cost areas were not as severe in 2023 as in 2022.

For example, for fuel and power, in 2022, some 89% of respondents had experienced fuel and power price increases of 11% or more over the previous year, but this share was down to 52% in 2023, and those citing an increase of more than 30% in costs was down from 48% to 17%.

Price increases are still encouraging miners to seek out new suppliers. Overall, 40% of survey respondents strongly agreed, and 35% agreed, with the statement ‘We have looked for alternative suppliers more this year than before because of higher prices’.

Some 83% confirmed they had specifically looked for a new supplier for maintenance parts/repair, up from 70% in 2022, while 67% had looked for new suppliers for both wear parts and other consumables (reagents and lubricants, for example), albeit down from 70% and 75%, respectively, in 2022. The share of respondents looking for a new supplier for fuel/power was also down, at 36%, versus 45% in 2022.