DATA

Mergers and acquisitions in metals and mining total $20.7bn globally in Q2 2022

Total Metals and mining merger and acquisition (M&A) deals worth $20.7bn were announced globally in Q2 2022, led by Gold Fields’ $6.7bn acquisition of Yamana Gold

Powered by

The value marked an increase of 156.01% over the previous quarter of $8.07bn and a rise of 35.9% when compared with the last four-quarter average, which stood at $15.2bn.

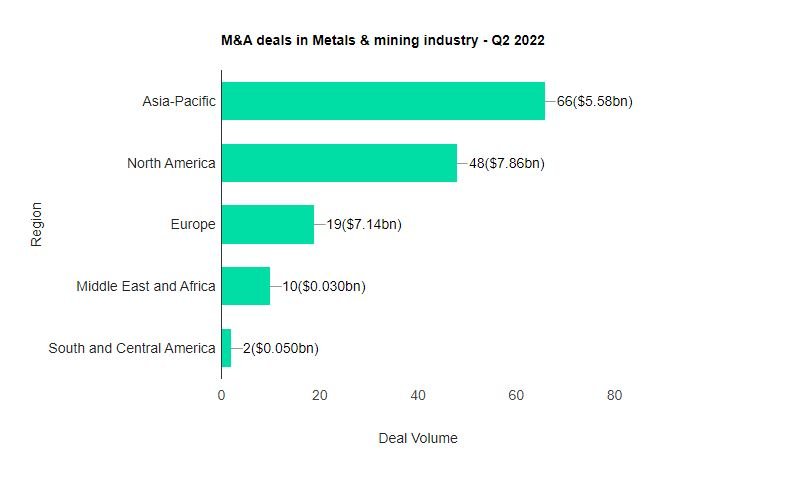

Comparing M&A deals value in different regions of the globe, North America held the top position, with total announced deals in the period worth $7.86bn. At the country level, the Canada topped the list in terms of deal value at $7.78bn.

In terms of volumes, Asia-Pacific emerged as the top region for Metals & mining industry M&A deals globally, followed by North America and then Europe.

The top country in terms of M&A deals activity in Q2 2022 was the Canada with 30 deals, followed by Australia with 26 and China with 15.

In 2022, M&A deals worth $28.73bn were announced globally in metals and mining industry, marking an increase of 104.6% year on year.

Top deals in Q2 2022

The top five M&A deals in the metals and mining industry accounted for 104.6% of the overall value during Q2 2022. The combined value of the top deals stood at $17.21bn, against the overall value of $20.7bn recorded for the quarter.

The top five metals and mining deals of Q2 2022, as tracked by GlobalData, were:

- Gold Fields $6.7bn acquisition deal with Yamana Gold

- The $6.3bn acquisition of 30% stake in Polyus by the Akropol Group

- Seroja Investment’s $2bn acquisition deal with Denway Development

- The $1.57bn acquisition of China Aluminum Zhongzhou Aluminum and Chinalco Shandong by China Aluminum New Materials

- Sandstorm Gold $646.37m acquisition deal with Nomad Royalty