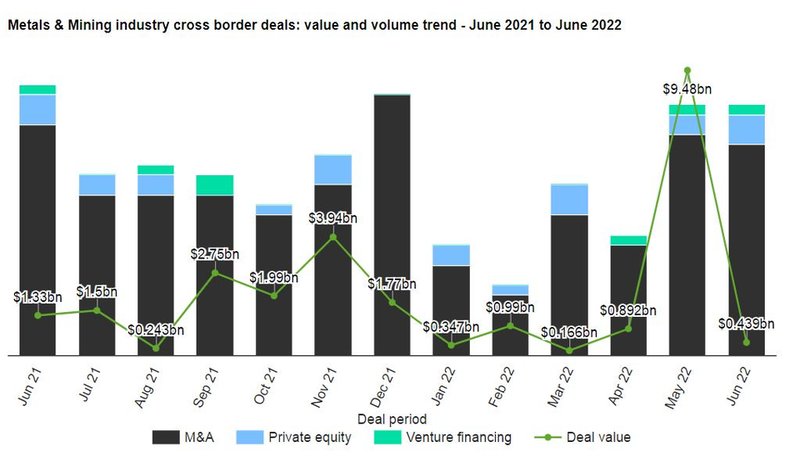

The value marked a decrease of 95.4% over the previous month of $9.48bn and a drop of 79.3% when compared with the last 12-month average of $2.12bn.

In terms of number of cross-border deals, the sector saw a rise of 38.89%, with 25 deals in June 2022 when compared to the last 12-month average of 18 deals. In value terms, North America led the activity, with cross border deals worth $217.11m in June 2022.

Top cross-border deals

The top five cross-border deals accounted for 86.2% of the overall value during June 2022. The combined value of the top five cross border deals stood at $377.88m, against the overall value of $438.6m recorded for the month.

The top five metals and mining industry cross border deals of June 2022 tracked by GlobalData were:

- Uranium Energy’s $161.59m acquisition of UEX

- The $92.72m acquisition of Altus Strategies by Elemental Royalties

- Stellantis’ $52.6m deal for an 8% stake in Vulcan Energy Resources

- The $38.62m acquisition of Minagoldchoix by QNB Metals

- Divine Token’s $32.35m acquisition of Billions Steel International