Ukraine crisis briefing

Powered by

Download GlobalData’s Ukraine Crisis Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 7 July

The Ukrainian Government has announced a blueprint for rebuilding the country at a conference in Switzerland. The plan lists several key infrastructure and security projects, which include a focus on the digital economy and efforts to diversify the country’s energy resources, primarily using renewables.

The World Bank lowered its global growth forecast from 4.1% to 2.9%, with a warning that many countries may see recessions. Against this backdrop, GlobalData forecasts that the world economy will grow at just 3.3% in 2022, following 5.9% growth in 2021.

10

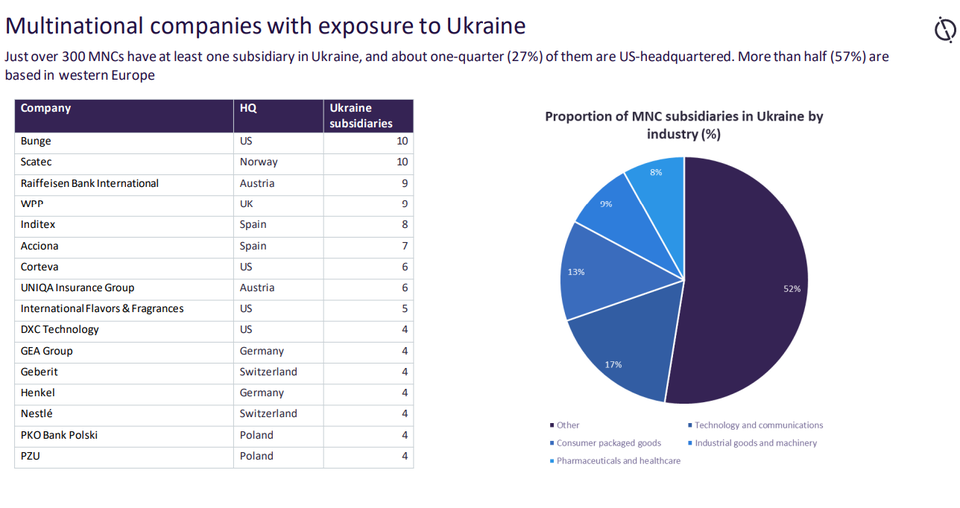

US-based agribusiness Bunge and Norwegian renewables firm Scatec are the two multinational companies with the greatest exposure to events in Ukraine, with 10 subsidiaries in Ukraine each.

5,000

Russian agricultural company Ros Agro leads the world in new job postings in Russia, with over 5,000 new jobs based in Russia listed between January 2020 and March 2022.

// Asterisk (*) denotes the company HQ is in a country imposing economic sanctions on Russia. Companies with HQ in Russia are not included in these charts.

- SECTOR IMPACT: MINING -

Latest update: 7 July

SUPPLY CHAIN

There has been a significant impact on the mining industry’s supply chain, as Russia is among the top three producers of diamond, gold, platinum group metals and nickel. It is also a key supplier of seaborne coal, met coal, iron ore, steel and aluminium.

OVERSEAS RESTRICTIONS

Russian diamond miner Alrosa has been heavily restricted from raising money through the US market, with President Biden’s executive order forbidding them from engaging in transactions with Alrosa involving “new debt of longer than 14 days maturity or new equity”. The company is also closing its US office.

OPERATIONAL IMPACTS

While Nornickel has stated that operations are continuing and Polymetal reported on 9 March that all its operations in Russia and Kazakhstan continue undisrupted, Canadian miner Kinross announced that it was suspending all activities in Russia.

INTERNATIONAL TRADE

Polymetal has advised that sales of silver and gold to China, Kazakhstan and East Asia remain unaffected by sanctions, and “physical demand for gold in Russia has been supported by the decision of the Russian Central Bank to resume gold purchases in the domestic market”.