Covid-19 briefing

Powered by

Download GlobalData’s Covid-19 Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 16 December

While current consensus forecast for global GDP remains negative, many countries are seeing their own GDP level off after weeks of decline.

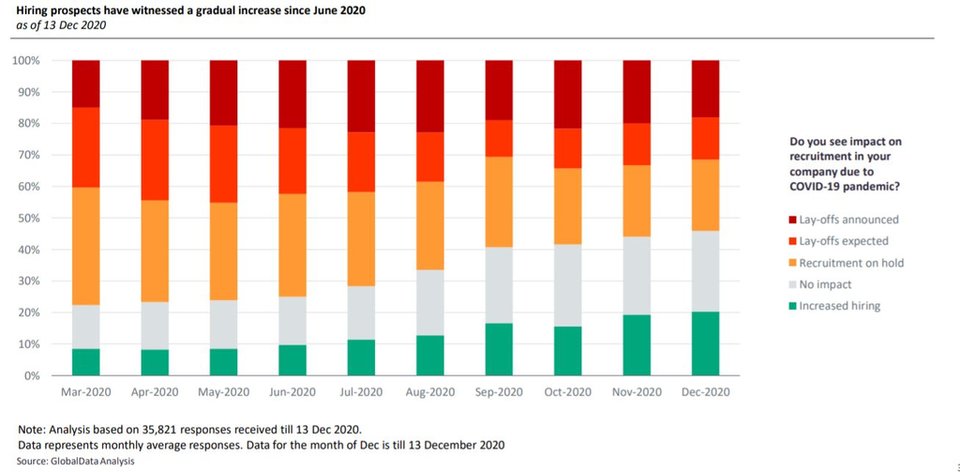

Polls show that employment prospects have consistently improved since July, with most employees favouring working remotely full-time.

21%

According to the World Trade Organization, merchandise exports declined by 21%

YoY in Q2 2020.

0.4%

Real GDP growth in the UK slowed to 0.4% in October from the 1.1% growth recorded in

September 2020.

Impact of Covid-19 on employment outlook

- SECTOR IMPACT: MINING -

Latest update: 8 January

demand side impact

2.9%

The current forecast for global construction output growth is a decline of 2.9%, versus initial expectations of growth of 3.1% for 2020.

Excluding China, the decline would be 5.3%.

-3%

The slowdown in construction is forecast to result in copper and iron ore demand having fallen by 3% across 2020. Whilst lower automotive manufacturing will also impact demand for steel, aluminium, platinum, and palladium. Platinum demand is forecast to have declined by 7% in 2020, with light vehicle sales estimated to have fallen by 31.3% in Q2.

operational impacts

Mining companies are undertaking a range of measures to minimise the potential for infections and the impact of Covid-19 on mining operations. However, despite efforts to minimise the spread of the virus, cases are still being identified.

For example, as of 4 January 2021, the Minerals Council of South

Africa reported a total of 19,905 cases, of which 367 were active – a

significant increase on mid-December. There have been a total of 206

deaths across the mining sector, while over 66,000 tests had been

taken at mines across South Africa, equal to 14% of workers.

Key commodity developments