DEALS ANALYSIS

Deals activity: Asia-Pacific leads in YoY growth; gold continues sector growth

Powered by

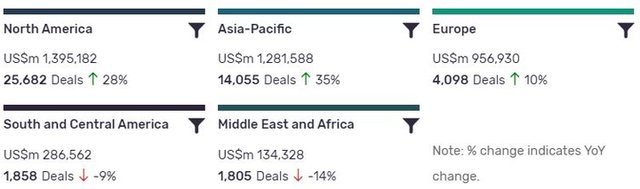

Deals activity by geography

Mining industry deals, as captured by GlobalData’s Mining Intelligence Centre, are largely up year-on-year (YoY) across all regions.

North America is leading in terms of deal value, ($1,395,182m) but its 28% YoY growth has been bested by Asia-Pacific (35%). Europe has also managed to maintain a positive growth, with an increase of 10%.

The volume of deals recorded by GlobalData decreased YoY however in Middle East and Africa and South and Central America, with the former seeing a decline of 14% and the latter one of 9%.

Deals activity by type

| Deal type | Total deal value (US$m) | Total deal count | YoY change (volume) |

| Equity Offering | 440627 | 22827 | 1 |

| Asset Transaction | 525792 | 10297 | -17 |

| Acquisition | 2050762 | 8902 | -4 |

| Debt Offering | 781935 | 2423 | -6 |

| Partnership | 3404 | 1367 | -85 |

| Private Equity | 60444 | 634 | 95 |

| Venture Financing | 1361 | 214 | -81 |

| Merger | 52539 | 203 | -80 |

A breakdown of deals by type and volume shows a general downtrend, with acquisitions down -17% YoY, mergers down -80%, partnerships down -85%, and asset transactions down -17%. Financing deals have seen a similar downturn, with venture financing down -81% YoY and debt offerings down -6%, although equity offerings are up 1%. Private equity has seen surprisingly good growth, with a 95% increase.

Deals activity by sector

The most notable development apparent in GlobalData’s analysis of mining industry deals by sector is the strength of gold's growth. While all sectors have seen some growth, though admittedly only slightly in sectors such as uranium and zinc, gold has continued to rise, with deals increasing by around 1,200 YTD in 2020.

Note: All numbers as of 18 January 2020. Deals captured by GlobalData cover M&As, strategic alliances, various types of financing and contract service agreements.

For more insight and data, visit GlobalData's Mining Intelligence Centre.

Latest deals in brief

Yansteel to acquire 50% stake in Thunderbird Mineral Sands Project

YGH Australia Investment (Yansteel) has signed definitive binding documents with Sheffield Resources related to the proposed A$130m ($101.3m) investment to acquire 50% stake in the Thunderbird Mineral Sands Project.

The move will lead to the formation of an equally owned joint venture (JV) for the project and associated tenements.

Norfolk Iron & Metal wraps up acquisition of Cd’A Metals

Carbon steel products manufacturer Norfolk Iron & Metal (NIM) has closed the acquisition of Inland Northwest’s full-line metal service centre Coeur d’Alenes Company (Cd’A Metals).

The companies did not disclose the value of the transaction.

Sandvik to acquire DSI Underground for $1.15bn

Sandvik has signed an agreement for the acquisition with DSI Underground’s owner Triton, a private equity investment firm, and will acquire 100% ownership of DSI Underground for a purchase price of €943m ($1.15bn) on a cash and debt-free basis.

Metso Outotec sells aluminium business to REEL International

Metso Outotec has signed an agreement with French material handling systems and lifting equipment company REEL International to divest its aluminium business.

Financial details of the deal have not been disclosed by both companies.

Orea Mining signs binding LOI to acquire gold assets in Colombia

Orea Mining has signed a binding letter of intent to acquire gold assets located in the Department of Bolivar, northern Colombia.

The company will acquire full interest in 13 mining concessions in three separate blocks with a combined surface area of 250km², including multiple artisanal gold mines.

Rhizen signs oncology drug development deal with Curon

Swiss biopharma company Rhizen Pharmaceuticals has signed an exclusive licensing agreement with Curon Biopharmaceutical to develop and commercialise Tenalisib for oncology in the Greater China region. Tenalisib, a highly selective dual PI3K delta and gamma inhibitor, is currently in Phase II clinical development for haematological malignancies. The US FDA granted fast track and orphan drug designations for the drug candidate Tenalisib as a treatment for relapsed/refractory peripheral T-cell lymphoma and cutaneous T-cell lymphoma.