Unregulated small-scale mining, pictured here in Ghana, remains a challenge for West Africa’s gold sector. Credit: Drone Ghana / Shutterstock

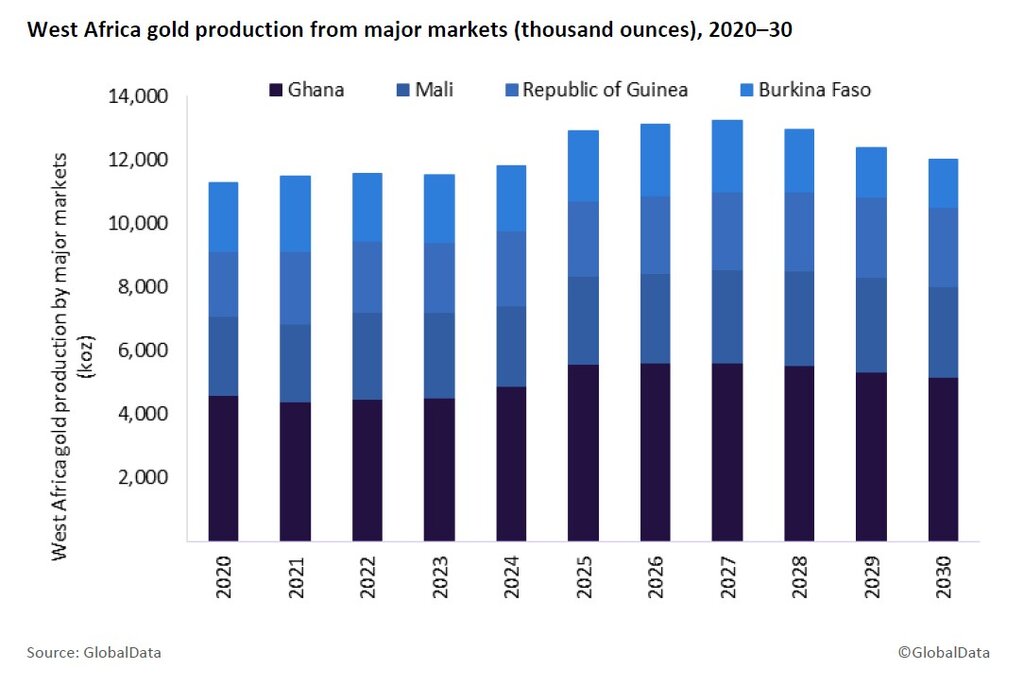

Gold production from West Africa’s larger producers - Ghana, Mali, Burkina Faso and the Republic of Guinea - is projected to reach 11.83 million ounces (moz) in 2024, a 2.6% increase from 2023. Ghana will be the largest contributor, with output rising by 8.5% to 4.9 moz. Increased production from the Ahafo mine, Bibiani and Obuasi is expected to drive this growth.

Ghana is recovering from recent economic troubles preceding the pandemic, with inflation rates coming down to near to 40% from over 50% in 2023, and the steeply depreciating value of its domestic currency. However, gold mining is expected to remain unaffected relative to the non-extractive industries, mainly due to new mines and the continued activities of the small-scale miners.

The Republic of Guinea will also see a significant rise in gold production, contributing to the overall growth alongside Ghana, however, production in Mali and Burkina Faso is expected to decline by 5.5% collectively in 2024 due to factors such as lower ore grades, planned reduction and temporary suspension of operating activities.

Credit:

Rich gold reserves, particularly in emerging markets, are attracting investment despite concerns such as political unrest, economic instability, security risks, and illegal mining. Many emerging countries are formalizing their mining sectors to capitalize on the rising demand for gold.

Collective gold production from the emerging markets of the Ivory Coast, Niger, Liberia, Senegal, and Sierra Leone is expected to grow by 6.2% to 4.67moz in 2024, after an estimated 0.9% growth in 2023. While gold mining in these countries is still nascent, some, such as the Ivory Coast and Niger, have reached a point where they are expected to maintain steady output in the coming years.

Looking ahead, gold production from the four major markets to 2030 is expected to grow marginally at a CAGR of 0.2% to nearly 12.0moz, linked to scheduled closures, mainly in Burkina Faso. In contrast, production from the emerging markets is expected to increase at a CAGR of 3.2% to 5.65moz with key contributions from the Ivory Coast and Niger.

Overall, political instability and unregulated illegal mining are some of the key barriers that are expected to impair West Africa’s gold mining in the coming years.