Some miners are ramping up spending; others are taking a more cautious approach.

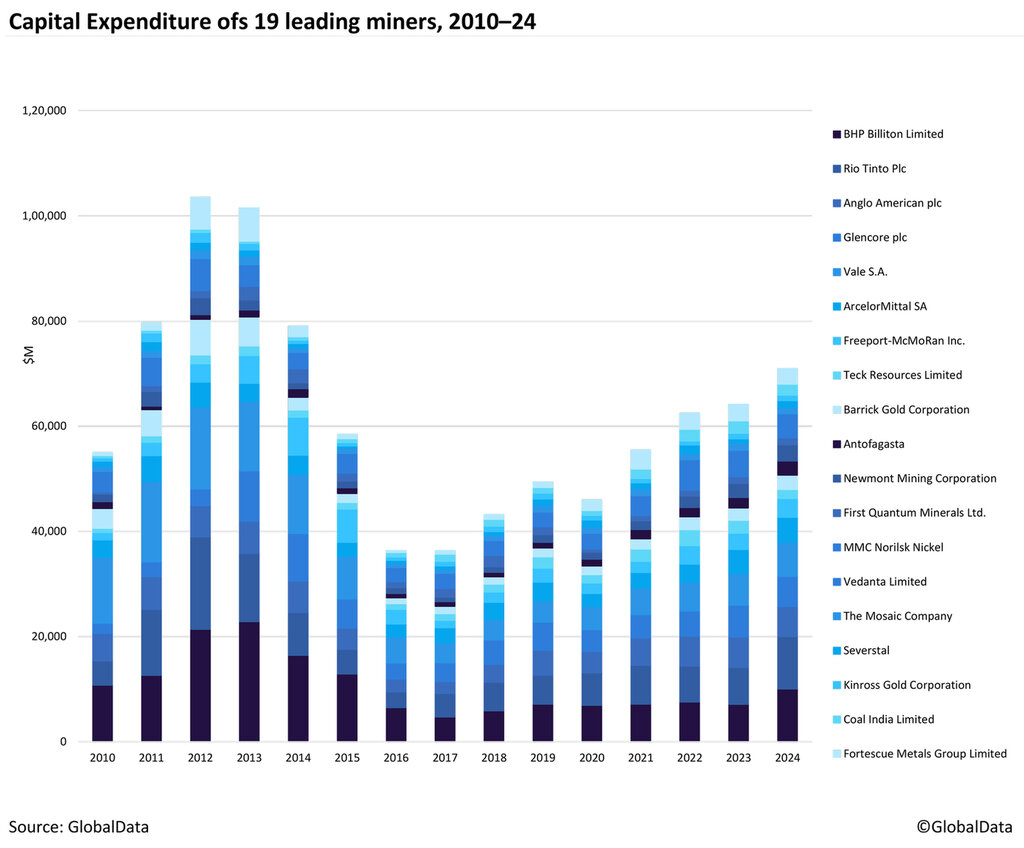

The combined capex of the top 19 mining companies is expected to reach $71bn in 2024, a rise of 10.6% compared with 2023. The two largest spenders are expected to be Rio Tinto and BHP, each planning to invest $10bn this year.

BHP plans to use these funds to enhance productivity, decarbonise existing assets, and develop projects in copper, potash, and iron ore. The majority of the $10bn will be used to upgrade and expand the Jansen Potash, Copper South Australia and Pilbara projects.

Meanwhile, Rio Tinto is focusing on critical minerals such as copper, aluminium, and lithium. Its estimated annual capex of $10bn from 2024 to 2026 includes up to $3bn specifically for growth projects. The company’s board has also approved the Simandou iron-ore project, with Rio Tinto’s share of this development being $6.2bn.

Several other mining companies are also planning major investments.

Severstal is planning the largest annual increase with a projected 64.6% rise, allocating funds towards maintaining existing capacities, development projects, and advancements in technology, safety, and environmental protection.

Meanwhile, Antofagasta is planning a 35% increase to fund projects such as the Centinela Second Concentrator, while Vale expects a moderate rise to $6.5bn in 2024 from $6.0bn in 2023 and Freeport-McMoRan is forecasting a capex increase from $3.1bn in 2023 to $3.6bn in 2024, and then $3.8bn in 2025.

ArcelorMittal plans to maintain a steady capex around $4.8bn, allocating $300-$600m for strategic growth and decarbonisation initiatives. MMC Norilsk Nickel anticipates a 2% increase after a 29.3% reduction during 2023 due to exchange rate fluctuations.

Global silver production trends from 2010-2030. Source: GlobalData

While some miners are ramping up spending, others are taking a more cautious approach. For example, Teck Resources expects a significant decline due to the near-completion of the QB2 development project. The Mosaic Company plans to trim its capex by $200m to $1.2bnin 2024 to focus on shareholder returns.

Anglo American reduced its initial 2023 capex target and plans further reductions until 2026 to navigate economic and geopolitical uncertainties. After a net capex outflow of $5.6bn in 2023, 22% up on 2022, Glencore anticipates spending $5.7bn annually through 2024 to 2026, with around 50% on copper projects. Coal India plans to maintain its capex at $2.1bn, while Newmont, Barrick, and First Quantum Minerals are expected to increase spending to support their growth projects.