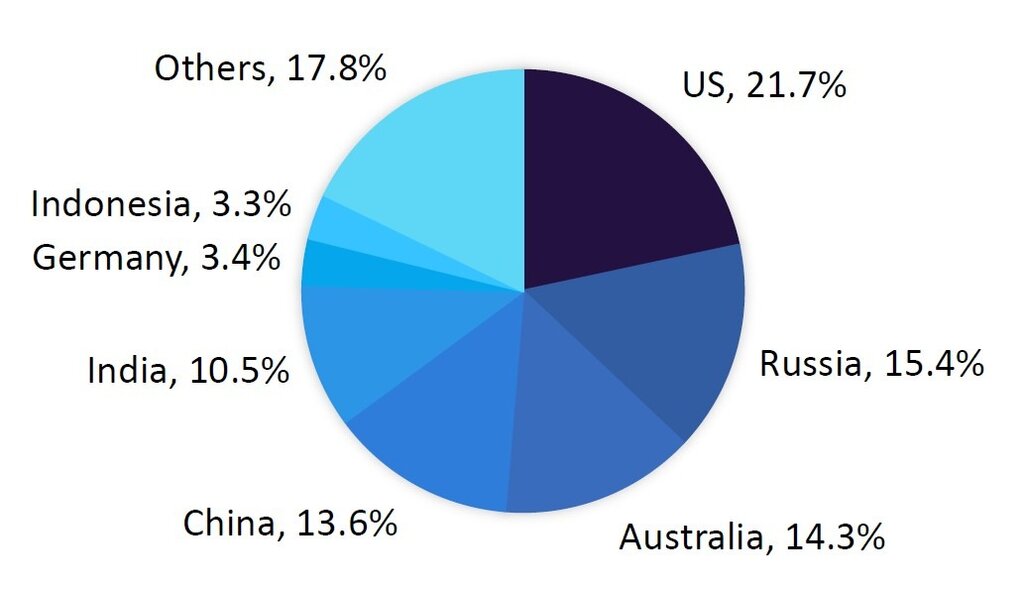

The US, Russia, Australia, China, and India have the world’s largest coal reserves. Together, they account for over 75% of the global total reserves, which stood at 1,053.7 billion tonnes (Bt) as of December 2021, according to the US Energy Information Administration (IEA).

Coal reserves by country. Source: GlobalData, US EIA

According to the EIA’s figures, the US ranked first in terms of global proven reserves of coal, with 228.3Bt at the end of 2021, accounting for 21.7% of the global total. Russia had 162.2Bt of proven coal reserves, accounting for 15.4% of the global total.

Australia has the third-largest coal reserves in the world with proven coal reserves of 150.3Bt. China is in fourth place with a total of 143.2Bt, followed by India with 111.1Bt, or 10.5% of the world’s total reserves.

Leaders in global coal production

Global coal production was forecast to increase to 8,917.3Mt in 2023, a growth of 1.9% over 2022, with China, India, Russia, Indonesia and India contributing to the growth. Combined output from these countries was expected to increase 2.7% from 2022, to reach 7,203.2Mt in 2023.

GlobalData expects global coal production to remain flat at a CAGR of 0.7% over the forecast period (2024-2030) to reach 9,369.9Mt in 2030.

Global coal production, 2010-2030. Source: GlobalData, US EIA

China

China is the largest coal-producing country and accounted for about 50% of the world’s total coal production in 2022. In 2023, GlobalData forecast that coal production in China would increase by 2.2% to 4,583.5Mt, marking lower growth than in 2022 due to the tightened safety measures resulting from accidents at mine sites, which have hampered production.

Production in China is expected to remain flat during the forecast period at a CAGR of 0.2%, reaching 4,666.7Mt in 2030. Several factors pose challenges to China's coal production, including competition from renewable sources, as well as issues with China's lower-quality coal reserves, which will lead to rising production costs.

India

India’s coal production was expected to remain robust in 2023 with 6.2% growth to 947.4Mt, helped by the government’s push to reduce dependency on imports. Consistent output from major mines such as Gevra, Kusmunda and Dipka is a key contributing factor towards this growth. Most of India’s coal mines have an annual coal production of up to 10Mt.

Over the forecast period, India’s coal production is expected to post a CAGR of 4.9% to reach over 1.3Bt by 2030. The increase in output can be attributed to the government's strategy of auctioning coal blocks to private companies for mining purposes.

Indonesia

Indonesia is the world’s third-largest coal producer. In 2023 coal production was expected to grow by 1.8% to 700.1Mt, helped by higher coal prices, coupled with the government’s intention for coal output to satisfy both domestic and export demand. Over the forecast period, Indonesia’s coal production is expected to grow at a CAGR of 0.1% to reach 708.2Mt by the end of 2030.

US

After registering 3.3% growth in 2022, US coal production was expected to fall by 6.9% to 504.3Mt in 2023, mainly driven by declining demand from the electricity sector. The scheduled closures of several mines such as Buckskin, Cadiz Mining Complex, Kingston No 2, Cedar Grove 2, and CCU Belmont Strip mines, which together produced 18.3Mt in 202,2 will contribute to the reduction in production.

The country’s coal output is expected to decline to 436.7Mt by the end of 2030 due to the gradual closure of five major mines – Antelope, Buckskin, Eagle Butte, Spring Creek and Colstrip – which together produced 66.7Mt in 2022.

Australia

Coal production in Australia increased around 2.3% to 532.9Mt in 2023, driven by consistent production levels from key mines such as Loy Yang, Moolarben, Mount Arthur, Yallourn and Rolleston, and the restart of operations at the Grosvenor mine in the second quarter of 2022.

Looking ahead to 2030, GlobalData expects a marginal decline of 0.6% in coal production, to 525.7Mt. This can be attributed to the closure of around 30 coal mines, a trend which reflects a broader shift away from coal as Australia tries to reduce its reliance on fossil fuels for environmental reasons.

Power and steel drives coal demand

GlobalData estimates that global coal consumption grew by 1.3% in 2023 to reach 8,176.1Mt, owing primarily to strong demand from China and India, which together account for two thirds of total global coal consumption This is partially offset by the gradual phase-down of coal use in countries such as the US.

Coal consumption in China was estimated to increase by 3.7% in 2023 to 4,479.2Mt due to warmer weather conditions driving electricity demand for cooling. Coal has traditionally been the country’s dominant source of fuel for electricity generation, but its share in the electricity mix is expected to decline to 46.8% by 2030 from a 59.6% share in 2022.

Consumption in India, the second-largest coal consumer in the world, was expected to grow by 3.1% to 1,093.6Mt in 2023. The steady rise in the domestic coal consumption can be attributed to India's continuous economic growth, which drives the need for electricity and steel for infrastructure development and industrial expansion.

In contrast, US coal consumption is expected to decline to 230.7Mt by 2030 due to declining coal-fired power generation capacity, with government regulations aiming to reduce carbon emissions by encouraging power generation from sources other than coal.

Looking ahead, global coal consumption is expected to remain relatively flat during the forecast period, with a CAGR of 1.1% to reach 8,794.8Mt by 2030, supported by steady demand growth from China, India, Russia and Indonesia. In contrast, coal consumption is expected to decline gradually in other countries such as the US, Germany, Japan, Australia, South Africa, Poland and Canada.

Power generation and steel production are the primary drivers of demand for coal.

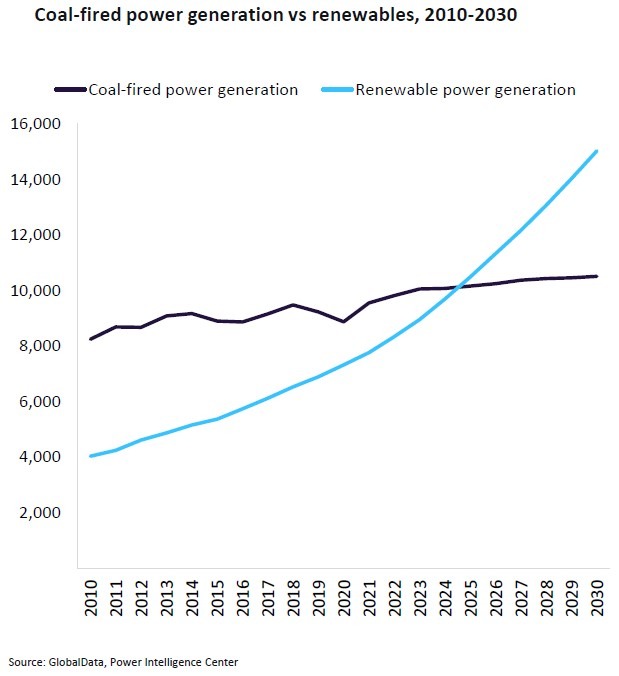

After registering 2.7% growth in 2022, global coal-fired electricity generation was estimated to grow by a further 2.4% in 2023 to 10,057.9TWh. Coal remained the dominant fuel for power generation in 2022, having a 35.2% share in the energy mix, and is expected to remain the dominant fuel over the forecast period, albeit with its share declining to 28.4% by 2030.

Credit:

The global steel industry is the second-largest coal consumer after power, and the primary consumer of metallurgical coal.

Global crude steel production was 1.885Mt in 2022, with APAC accounting for 73.9%, followed by Europe (including Ukraine) 14.1% and North America (6%). Global crude steel production declined by a marginal 0.2% to 1,256.4Mt between January and August 2023.

This article is based on information from GlobalData’s report ‘Coal mining to 2030’. The report offers coal market forecasts to 2030, including breakdowns of global coal reserves and production, price trends and exports, details of key assets and development projects and the competitive landscape. You can buy the full report here.