- ECONOMIC IMPACT -

Latest update: 20 April

Many economists have cut their GDP forecasts. The 2020 consensus forecast for GDP growth is currently negative and many predict a recession.

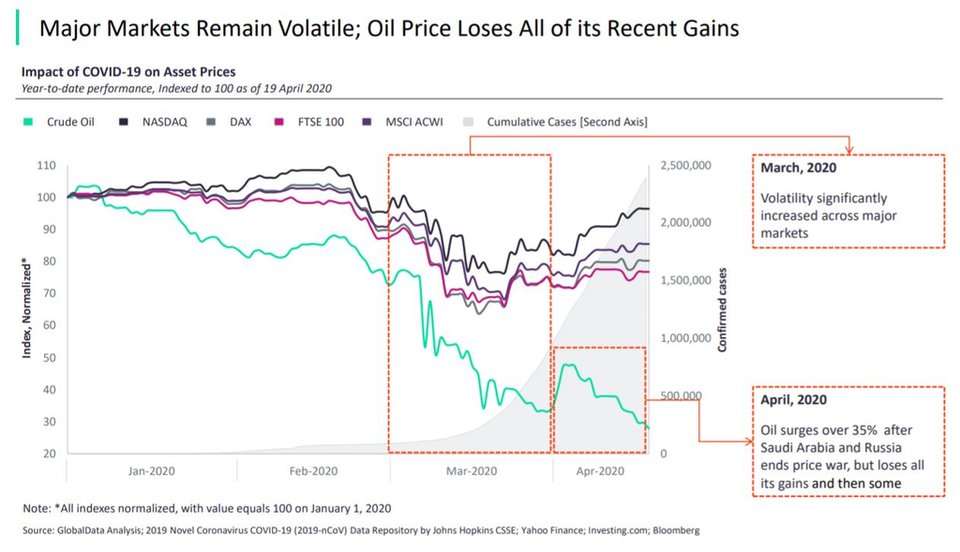

Major markets remained volatile during April as oil prices lost all recent gains.

3%

The IMF has forecast the global economy will contract by 3% in 2020 as lockdowns cause a dramatic drop in economic activity.

$2-$3 trillion

Expected reduction in investments in the commodity-rich exporting nations, according to UNCTAD

Impact of Covid-19 on asset prices

- SECTOR IMPACT: mining -

Latest update: 20 April

GlobalData analyst view:

"Lockdowns and closure of non-essential businesses and operations is particularly impacting platinum, copper, silver and gold, with only coal mines largely exempt."

Some countries, such as Argentina, have declared mining an essential service, and brought an end to suspensions. Whilst the lockdown in Zimbabwe was extended to 3 May, it too has allowed mines to open.

On the demand side, a slowdown in construction activity, initially in China and now increasingly across the rest of the world, is particularly impacting demand for copper, iron ore and aluminium, with the latter also impacted by reduced automotive manufacturing.

Lower automotive manufacturing will also impact demand for platinum and palladium, which are used in autocatalysts.

impact on financing and operations