Deals in brief

Powered by

Metals & mining industry M&A deals in August 2019 total $1.86bn globally

Total metals & mining industry M&A deals in August 2019 worth $1.86bn were announced globally, according to GlobalData’s deals database. The value marked a decrease of 36.5% over the previous month and a drop of 65.9% when compared with the last 12-month average, which stood at $5.47bn.

Comparing deals value in different regions of the globe, Asia-Pacific held the top position, with total announced deals in the period worth $928.87m. At the country level, Australia topped the list in terms of deal value at $639.04m.

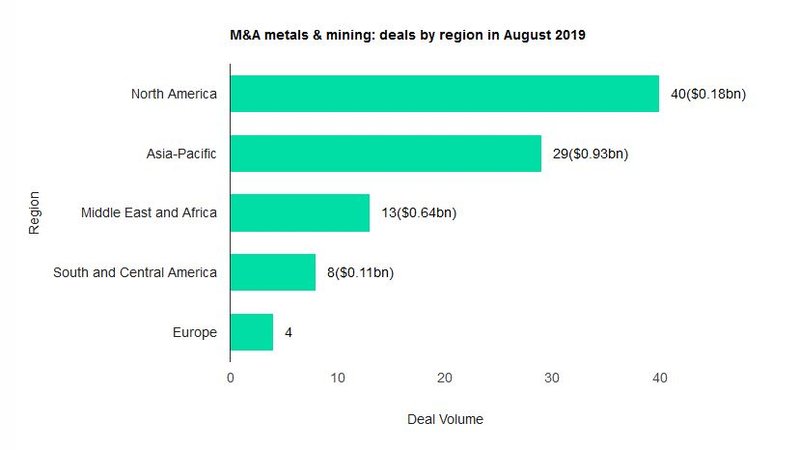

In terms of volumes, North America emerged as the top region for metals & mining industry M&A deals globally, followed by Asia-Pacific and then the Middle East and Africa.

The top country in terms of M&A deals activity in August 2019 was Canada with 26 deals, followed by Australia with 24 and the US with 12.

In 2019, as of the end of August 2019, metals & mining M&A deals worth $34.22bn were announced globally, marking a decrease of 47.6% year on year.

Metals & mining industry M&A deals in August 2019: Top deals

The top five metals & mining industry M&A deals accounted for 67.3% of the overall value during August 2019. The combined value of the top five metals & mining M&A deals stood at $1.26bn, against the overall value of $1.86bn recorded for the month.

The top five metals & mining industry deals of August 2019 tracked by GlobalData were:

1) Al Ezz Dekheila Steel’s $423.78m acquisition of Al Ezz Flat Steel

2) The $299.47m acquisition of Stanmore Coal by Winfield Group Investments

3) Jiangsu Fuda Enterprise InvestmentLimited’s $277m acquisition of Haicheng Haiming MiningLimited

4) The $130.09m acquisition of Echo Resources by Northern Star Resources

5) Al Ezz Dekheila Steel’s acquisition of Al Ezz Rolling Mills for $124.85m.

More in-depth reports and analysis on all reported deals are available for subscribers to GlobalData’s deals database.

Indonesia’s Inalum to acquire 20% stake in Vale Indonesia

Vale subsidiary PT Vale Indonesia, along with its shareholders Vale Canada and Sumitomo Metal Mining has signed a heads of agreement with PT Indonesia Asahan Aluminium, also known as Inalum. As part of the agreement, Inalum intends to acquire PT Vale’s 20% divested shares to fulfil the latter’s divestment obligation. The two companies did not disclose the value of the deal.

Glencore signs five-year cobalt supply deal with China’s GEM

Glencore has signed a five-year deal with Chinese company GEM to supply a minimum of 61,200 tonnes of cobalt per year starting from 2020. The fee for the deal was not disclosed by either party.

Canada’s metals & mining industry sees a drop of 35% in deal activity in August 2019

Canada’s metals & mining industry saw a drop of 35% in overall deal activity during August 2019, when compared with the last 12-month average, according to GlobalData’s deals database. A total of 26 deals worth $173.57m were announced in August 2019, compared to the 12-month average of 40 deals. M&A accounted for 100% of all deals in the month in terms of volume with 26 deals and value of $173.57m.

Sirius Minerals pulls out of $500m bond issue

UK-based mining company Sirius Minerals has been forced to cancel a $500m bond issue after the UK government refused to back its potash mine in the North Yorkshire Moors. Sirius will now look for a partner in the private sector to fund the project, naming sovereign wealth funds such as EuroChem or a major mining group like BHP as possible investors.

CATL to buy stake in Pilbara Minerals in Australia for A$55m

Chinese battery company Contemporary Amperex Technology (CATL) has announced it will buy an 8.5% stake in Australian lithium mining company Pilbara Minerals for around $37.5m (A$55m). CATL will pay A$0.30 each for over 183 million shares in the company, which the Financial Times notes was 14% less than Pilbara’s share price at the close of trading on 5 September.

North America’s metals & mining industry sees a drop of 5.3% in deal activity in Q2 2019

North America’s metals & mining industry saw a drop of 5.3% in overall deal activity during Q2 2019, when compared to the four-quarter average, according to GlobalData’s deals database. A total of 160 deals worth $2.94bn were announced for the region during Q2 2019, against the last four-quarter average of 169 deals.