Feature

Leading companies in remote tunnel monitoring systems

Internet of Things applications are helping to improve the efficiency, productivity and safety of underground mining operations.

Credit: Shutterstock

The mining industry continues to be a hotbed of innovation, with activity driven by improved computing power and connected sensors to control and monitor the mining environment. By adding internet connectivity and sensors to vehicles, machinery, and people, mining companies can increase efficiency, improve productivity and safety, and reduce costs on the mine site.

Examples of this include autonomous drilling, driverless haul trucks, and predictive maintenance. In addition, IoT sensors can monitor air quality for potential dangers, such as convergence or toxicity, in real time.

Devices such as drones, wearables, proximity detection sensors on moving machinery and vehicles, and scanners to identify different ore grades, can all yield small but cumulative gains in productivity. In the last three years alone, there have been over 48,000 patents filed and granted in the mining industry, according to a report by parent company GlobalData.

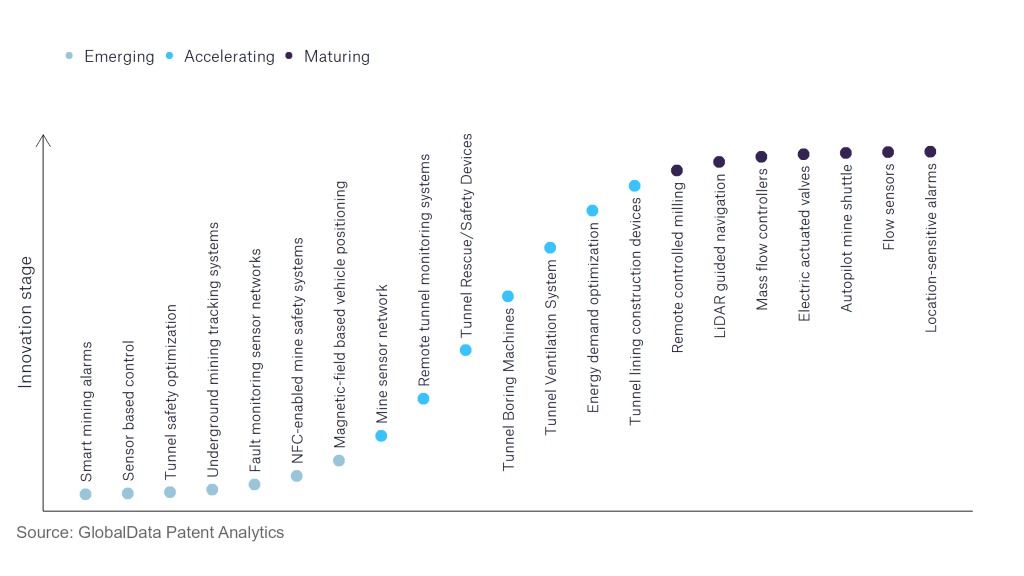

However, not all innovations are equal, nor do they all follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilising and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

150+ innovations will shape the mining industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the mining industry using innovation intensity models built on over 350,000 patents, there are 150+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, magnetic-field based vehicle positioning, tunnel safety optimisation, and smart mining alarms are disruptive technologies that are in the early stages of application and should be tracked closely.

Tunnel lining construction devices, tunnel boring machines, and mine sensor network are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are LiDAR-guided navigation and location-sensitive alarms, which are now well established in the industry.

Innovation S-curve for Internet of Things in the mining industry

Mine sensor networks are a key innovation area in Internet of Things

A mine sensor network is a network of connected sensors to monitor mines and enhance operational safety and efficiency, and optimise mine productivity. Sensors are devices that detect and respond to changes in their surrounding environment. Inputs can come from a variety of sources such as light, temperature, motion, and pressure. The most common sensor types are temperature sensors, pressure sensors, proximity sensors, optical sensors, accelerometers, and gyroscopes.

As the IoT grows, sensors will pop up everywhere, resulting in a massive increase in the amount of data collected. Advances in efficiency and productivity will in turn help reduce carbon emissions.

Mine sites have various checks and controls to ensure the site is operational and safe. Automating these manual checks helps save time and money and allows real-time monitoring of assets.

For example, Russian diamond mining giant Alrosa developed an autonomous wireless monitoring system (AWMS) for its water works division.

The AWMS consists of sensors located at the existing meters on the tailings plant, which monitors 33 thermometric and 31 piezometric wells and measures the tailing dump and storage pond levels. It also monitors water levels, soil temperature, and hydraulic system status in real-time. Digitalising these vital checks saves time and provides a constant view of these key metrics.

Similarly, about 100,000 machinery sensors and approximately 40 billion records from across Newcrest’s international mine sites are coupled with Insight’s analytics and industrial internet software sensors to predict ore levels in the crushed bins when the hardware sensors fail. By coupling AI and IoT, Newcrest can now continuously predict the level of ore in the bin with 85% accuracy.

Key players in mine sensor networks – a disruptive innovation in the mining industry

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 10+ companies, spanning technology vendors, established mining companies, and up-and-coming start-ups engaged in the development and application of mine sensor network.

In the above graph, ‘application diversity’ measures the number of different applications identified for each relevant patent and broadly splits companies into either ‘niche’ or ‘diversified’ innovators. ‘Geographic reach’ refers to the number of different countries each relevant patent is registered in and reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Leaders in mine sensor network include Strata Worldwide, whose systems detect and prevent collision of machine-to-machine and machine-to-person in surface and underground mines. It promotes safety, while enhancing productivity and efficiency in mine operations. These systems are equipped with accident prevention safety functions such as alerting through audio and visual alarms and equipment interlocking.

Sandvik is another leading innovator in the area. Its automated system installed in its loaders and trucks enables machine learning from the first time they enter an operating space such as an underground tunnel. The vehicle’s intelligent system, guided by a set of lasers, maps out and records a path. Then the company’s patented algorithms, together with sensors and gyroscopes, ensure the vehicle knows the travel path, even where the GPS is inaccessible.

GlobalData, the leading provider of industry intelligence, provided the underlying data, research, and analysis used to produce this article. GlobalData’s Patent Analytics tracks patent filings and grants from official offices around the world. Textual analysis and official patent classifications are used to group patents into key thematic areas and link them to specific companies across the world’s largest industries.