Feature

Saudi Arabia's mining revolution

Saudi Arabia has experience with natural resources, and now eyes moving into mining. Giles Crosse looks at the growing green industry in the country, and its development of internal mineral demand.

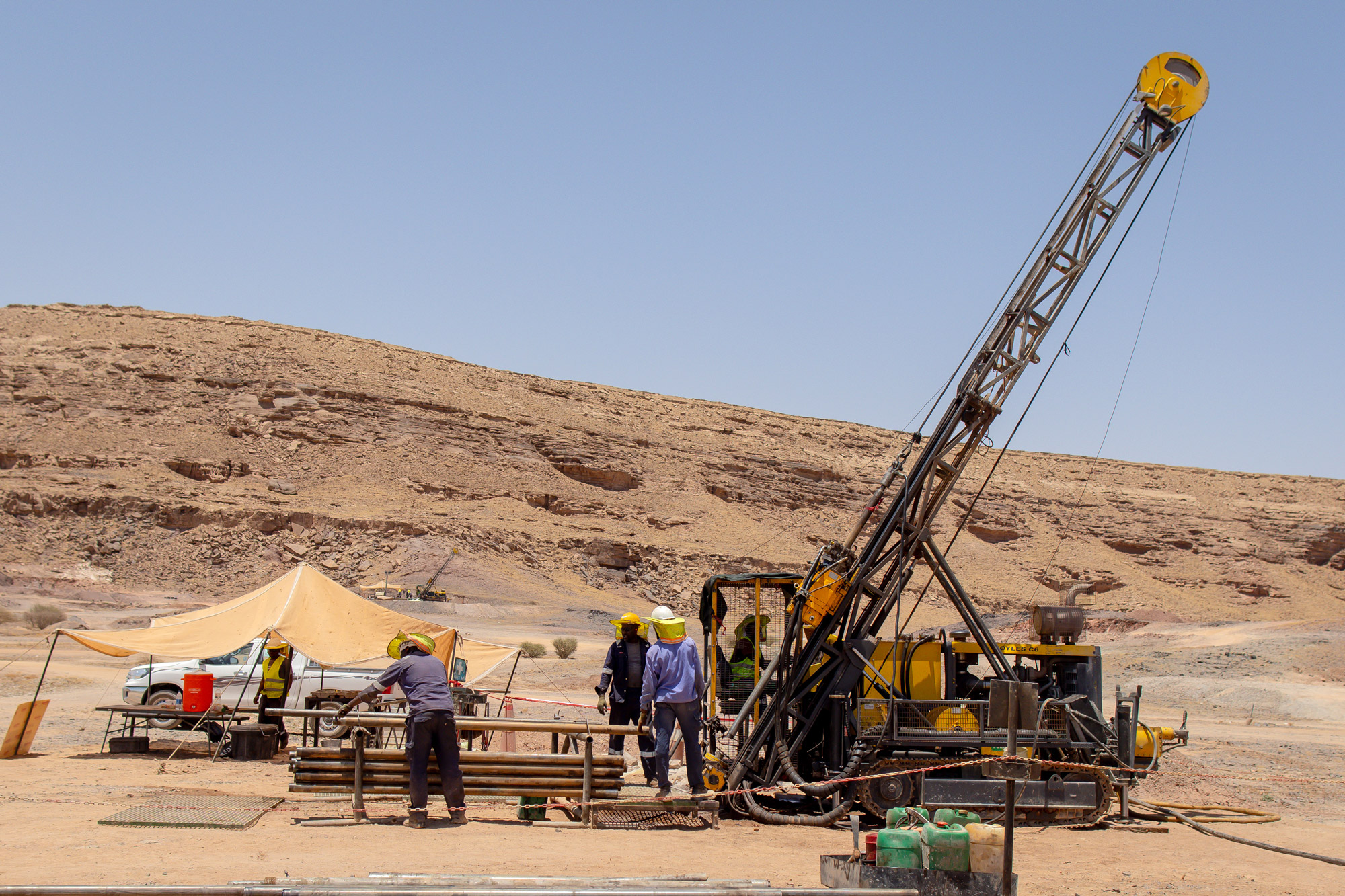

Saudi Arabia seeks to move into mining. Credit: Giuseppe Cacace/AFP

In recent months, it has become increasingly clear that Saudi Arabia wants a chunk of the global transition to EV metals and minerals, and the Crown Prince is the man driving the change.

By no means has the country given up the importance of its fossil resource. The Organisation of Petroleum Exporting Countries (OPEC) estimates that it possesses around 17% of the world’s proven petroleum reserves. However, the Kingdom does seem to have recognised that the world is altering, and that capital, both financial and environmental, lies in grabbing onto some of that trend.

The question now is whether Saudi has the legs and the resources to challenge existing Chinese producers at scale, and the ability to hasten the global low carbon transition while making some sizeable cash.

The background

Saudi's Ministry of Industry and Mineral Resources says that the Arabian Shield, an area within Saudi Arabia spanning 600,000km², is a major source of precious and base minerals. To date, the Ministry asserts that over 48 minerals have been identified, with at least 15 that are commercially viable.

Varying reports and claims coming out of the Kingdom estimate that Saudi Arabia has some $1.3trn of mineral resources, including copper, zinc, phosphates, uranium and gold, ready for extraction. But right now, the mining industry within the Kingdom remains nascent.

Data from Reuters, quoting Mining Minster Bandar Al-Khorayef, points out that more than 145 licenses have been issued so far and the country has seen a 27% growth in its mining revenue.

We have an ambitious strategy to attract investments… This is only the beginning.

“We have an ambitious strategy to attract investments worth $32bn to the mining and mineral sector. This is only the beginning,” Al-Khorayef told Reuters.

Saudi wants outside investment to pull such riches out of the ground. The minister also said that another ten licensing opportunities had been set out in 2023 for Bir Umq, Jabal Idsas, Umm Hadid, Jabal Sahabiyah and Ar Ridaniyah, among others. These projects would aim to help the Kingdom move beyond exploration and extraction to processing and manufacturing, if they can be actualised.

“Supported by our increasing supply of competitively-priced renewable energy, our ambition is to become a leading green metal refining and processing hub,” Al-Khorayef told Reuters, adding that the country plans to invest to build a strong value chain for the rapidly growing electrical vehicles sector.

How Saudi Arabia would transition into metal refining

Saudi's approach appears multi-faceted. Firstly, Saudi's Public Investment Fund (PIF) has a world investment portfolio with a focus on sustainable investments, both domestically and internationally. The idea behind this is that the PIF aligns with the Kingdom's greener future by creating assets such as Ceer, Saudi's first EV brand.

Ceer, says the PIF, “reflects Saudi Arabia’s ambitions to support the global energy transition, future-oriented transport and infrastructure, decarbonisation and the power sector, with implications for attracting investment, talent and technology”.

Ceer aligns with Vision 2030, the Saudi reform blueprint to diversify beyond fossil fuels for long-term prosperity, through strategic sectors and the PIF’s net-zero-by-2050 emissions goal. This is an anchor investment, with targets to produce 170,000 cars per year by 2025, create 30,000 direct and indirect jobs, and inject approximately $8bn to Saudi GDP by 2034.

Ceer is an anchor investment, with targets to produce 170,000 cars per year by 2025.

The company is expected, or more precisely hoped, to attract more than $150m in foreign direct investment. In mid-July 2023, the Saudi Ministry of Industry and Mineral Resources granted an industrial license to Ceer. This was a key step toward build Ceer’s manufacturing facility; securing over 1km² in King Abdullah Economic City’s Industrial Valley. The build, of course, will take time.

Jarrah bin Mohammed Al-Jarrah, the spokesperson for the Saudi Ministry of Industry and Mineral Resources, has previously emphasised the strategic significance of the automotive industry within the context of the Kingdom’s national industrial strategy. He has further highlighted that the automotive manufacturing industry will serve as a catalyst for other priority sectors, such as minerals and chemicals.

So on one side of its mining strategy, Saudi is growing the firms that would use the homegrown minerals and resources. The government is effectively trying to create an internal demand market for internally-owned resources; creating a self-controlled supply and demand system.

A rich seam of mining licenses

In July 2023, Saudi organised site visits for international and local qualified bidders in the fourth cycle of the licensing round, to explore the sites and assess their geological potential before submitting their proposals. Then in August, the Ministry of Industry and Mineral Resources issued 71 new mining licenses, including 45 exploration licenses, 21 building materials quarry licenses, and five small mine and exploitation licenses.

This brings the total number of active mining licenses in the sector by the end of July 2023 to 2,348 licenses. Building materials quarry licenses have reached 1,453 licenses, followed by 651 exploration licenses, 182 small mine and exploitation license, 37 reconnaissance licenses, and 25 excess mineral ores licenses.

Reports say that the actual licences were then due to be issued within three months of the end of the round, which would mean announcements concerning next steps might be expected around October or November 2023, around time of publicaiton.

A reliable path into mining?

There is, of course, more going on. Wider reports hint that Saudi is offering Tesla an option on its foreign investments into metals and minerals, so long as Tesla builds a factory in the Kingdom to use the global resources the Saudis seek to buy up.

These reports argue that the massive wealth attained from fossil resources, sitting in PIF's coffers, is being leveraged in places like the Democratic Republic of Congo, for cobalt or lithium mines owned by other companies. This is necessary, one surmises, because homegrown Saudi EV mineral and metal production cannot scale up massively, at the serious pace needed to get the factories and the finance flowing.

Saudi Arabia does already have an aluminium industry. Credit: Photo by Fayez Nureldine/AFP via Getty Images

Therefore, why not use massive fossil fuel public wealth to simply buy out existing global resource capacity, ship it in and build the factories locally? Would this not scale up the homegrown extractives industry via local demand?

For now, this appears to be the path chosen by Saudi Arabia. Whilst it is risky, it also displays some holistic thinking and an awareness of demand and supply that hint at it as a route to success.

At the minute, however, the industry returns to the age-old question of chicken and egg. Which comes first, the factory to build EVs or the minerals and mines to supply it? When both come at a big investment cost, with China and the US seeking to pinion markets to their favour too, the outcomes will be intriguing.