Covid-19: economic & sector impact

Powered by

- ECONOMIC IMPACT -

Latest update: 16 June

After months of decline, GDP estimates for many countries have turned positive.

Polls show that concern over the spread of Covid-19 remains volatile, so does business optimism.

6.1%

Consensus forecast for world GDP growth in 2021.

0.8%

Real GDP growth in the G20 area in Q1 2021 compared to the last quarter.

The World Bank revised India’s 2021-22 economic growth forecast to 8.3% from its earlier projection of 11.2%.

The unemployment rate in OECD nations stood at 6.6% in April 2021, up from 6.5% in March 2021.

2.3%

The UK’s real GDP grew by 2.3% in April 2021, the fastest since July 2020.

10%

Global trade grew by 10% YoY in Q1 2021, primarily driven by booming exports from East Asia, as per UN estimates.

- SECTOR IMPACT: MINING -

Rising investment in infrastructure construction is expected to drive up demand for commodities. Since the start of 2021, the price of copper has increased, whilst the iron ore price rebounded in March, passing $170/t.

While supply interruptions due to Covid-19, which helped prices in 2020, should gradually fade as vaccines are rolled out, for most commodities the rise in supply will be met by rising demand.

COAL

ICE thermal coal prices improved significantly over May, reaching $118.9/t by the end of the month, compared with $90.75/t at the end of April and $61.75/t at the start of November 2020, helped by rising demand from China. China's aversion to buying coal from Australia is also leading to high price increases for lower quality coal from markets such as Indonesia.

PRECIOUS METALS

After falling to a low point of $1,678 in March 2021, the gold price has steadily improved, passing $1,900/oz at the end of May and returning to levels seen in January 2021. An improving economic outlook had dampened prospects for a rise in the gold price, although they are being supported by continued low interest rates in 2021 and rising US inflation.

BASE METALS

After reaching a high of $9,614.50/t in late February off the back of increasing demand and depleting inventories across the exchanges, the price of copper fell to $8,788.5/t by 30 March. However, the copper price rose over April and May, passing $10,000/t, and peaking at $10,725/t on 10 May.

IRON ORE

Iron ore prices passed $200/t at the start of June as requirements for production cuts at Chinese mills are being eased. China is aiming to reduce its carbon footprint, with reduced steel output in 2021 to support this. However, to date, steel production has improved with output of 97.9mt in April 2021, a YoY increase of 13.4%.

PALLADIUM & PLATINUM

Growth in industrial demand helped push the price of platinum prices to a six-year high of $1,325/troy oz in February. Although it has subsequently fallen, it averaged close to $1,200/troy oz from March to May. In 2021, prices will be supported by improved demand from the auto and industrial sectors, although this will be balanced by significant growth in supply after the 2020 challenges.

- SECTOR IMPACT: POWER -

Sustained recovery in electricity demand for most countries has brought the demand close to 2019 levels.

Renewable energy capacity addition is estimated to be 4% higher in 2020 compared to 2019.

GAS

The combination of continued lower prices and rapid growth in economies across Asia and the Middle East should drive growth of 3% in gas demand in 2021. As a result, global natural gas demand in 2021 is projected to rise 1.3% above 2019 levels.

COAL

In 2020, coal demand dropped by 220 million tonnes of coal equivalent, or 4%. In 2021, coal demand has rebounded strongly, reversing the declines in 2020, though with major geographic variations.

OIL

In 2021, oil demand is expected to rebound by 6%, faster than all other fuels. The last time oil demand increased this rapidly was in 1976. Despite the strong rebound, oil demand remains 3% below 2019 levels.

WIND

Generation from wind and solar PV is set to grow by 17% in 2021, up from 16% in 2020. Two years of rapid growth means that the share of renewables in total electricity generation will reach almost 30% in 2021, up from less than 27% in 2019.

SOLAR

Renewables usage grew by 3% in 2020, largely due to an increase in electricity generation from solar PV and wind of 330TWh.

- SECTOR IMPACT: OIL & GAS -

Oil majors had a profitable quarter following the realignment of business objectives and the recent uptick in oil prices.

The development of stranded hydrocarbon resources may take a backseat, which could weigh on their long-term prospects.

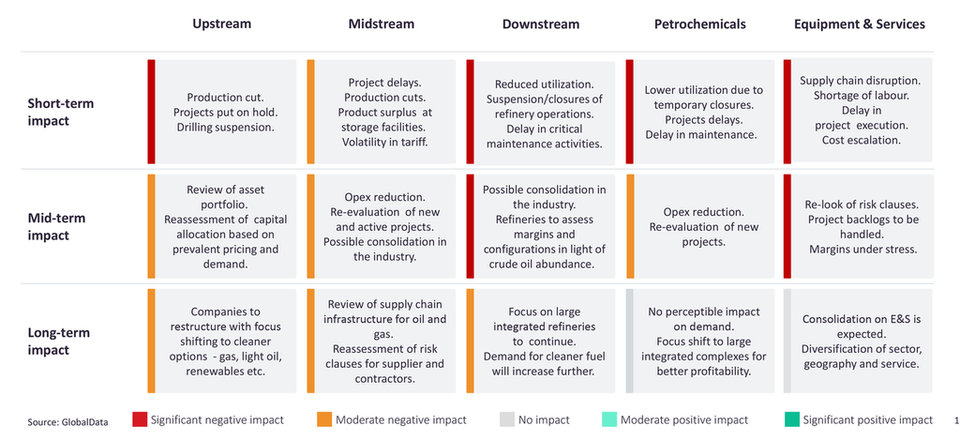

Oil & gas value chain impact