Data

Global energy investment: leaders, losers and Covid-19 disruption

Powered by

GlobalData’s analysis of global energy investment from 2019 to 2020 highlights how different power sectors were affected by the Covid-19 pandemic and by policy changes.

Solar power: China takes the lead, Vietnam sees solar boom

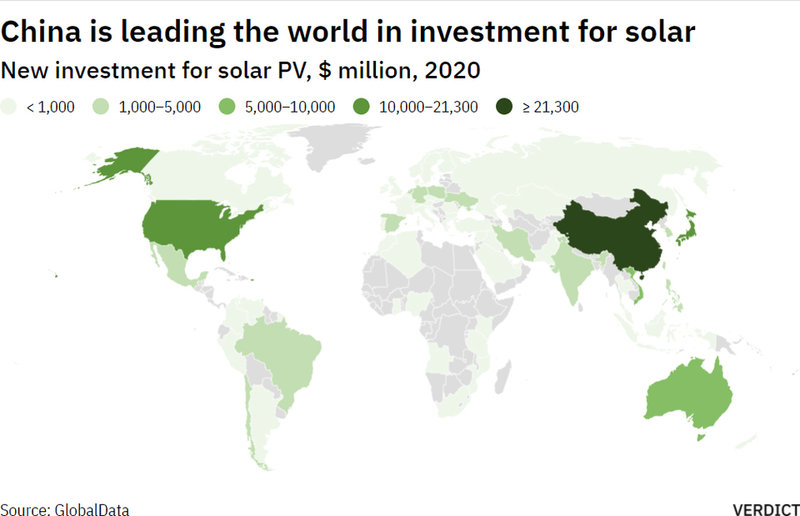

China, the US and Australia were the top three countries for investment in solar PV in 2020.

Two factors contributing to China’s leading position are the government’s ambitious target to build more than 1,200GW of solar and wind power by 2030, and the dropping prices of solar power in the country.

One country that stands out aside from the major investing countries is Vietnam, which is seeing a solar power boom supported by strong public demand for clean energy and generous feed-in tariffs. Vietnam’s solar PV capacity increased from 86MW in 2018 to 4,750MW in 2019, making it the country with the highest installed capacity of solar power in Southeast Asia.

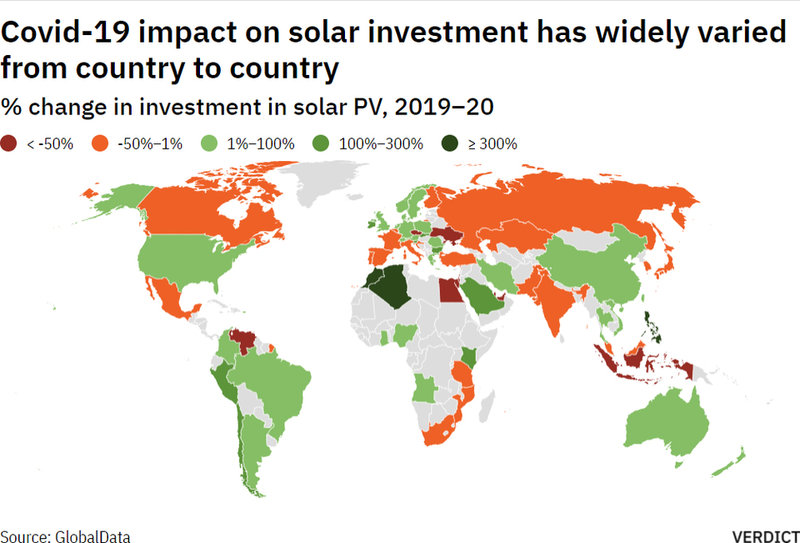

GlobalData’s analysis of changes in solar PV investment between 2019 and 2020 shows significant differences between countries and regions. Significant decline in investment was recorded in Russia, Canada, Mexico and parts of Europe and Asia, while the US, China, Australia, large parts of South America and some parts of Europe and Africa saw an increase in solar PV investment.

Offshore wind: Brazil explore its wind potential

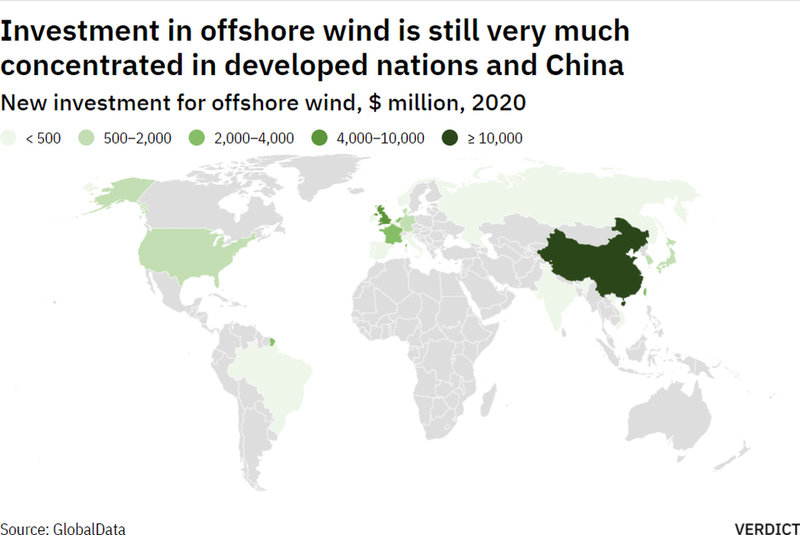

The leading countries for investment in offshore wind in 2020 were China, the US and parts of Europe – most notably, the UK, France, the Netherlands and Germany. China’s lead in offshore wind investment is driven by the country’s ambitious renewable energy targets, which have also given a boost to solar PV investment.

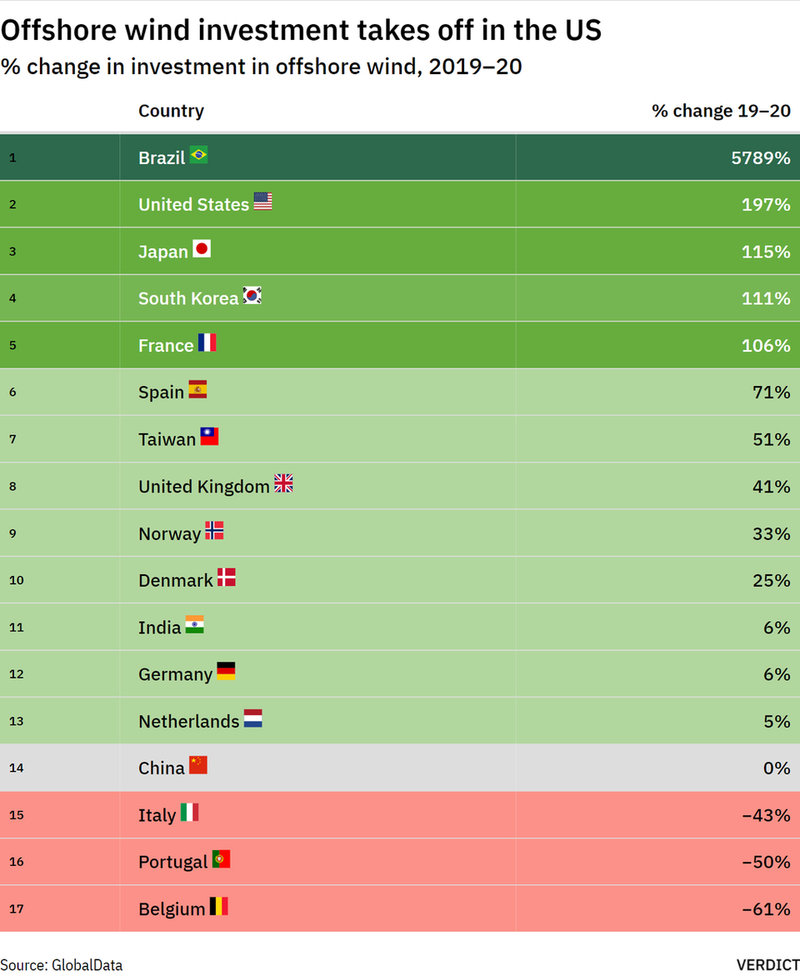

When comparing changes in offshore wind investment from 2019 to 2020, Brazil stands out as a clear leader with an 5789% increase in investment. The country has huge potential for offshore wind but is only beginning to develop its offshore wind sector, with consultations underway to assess the potential impact of offshore wind projects.

Although Brazil currently has no operating offshore wind farms, a few projects are in the application stages. The government sees potential to develop 16GW of offshore wind capacity by 2050. This would require huge investment in associated infrastructure, making Brazil a potentially attractive market for offshore wind in the future.

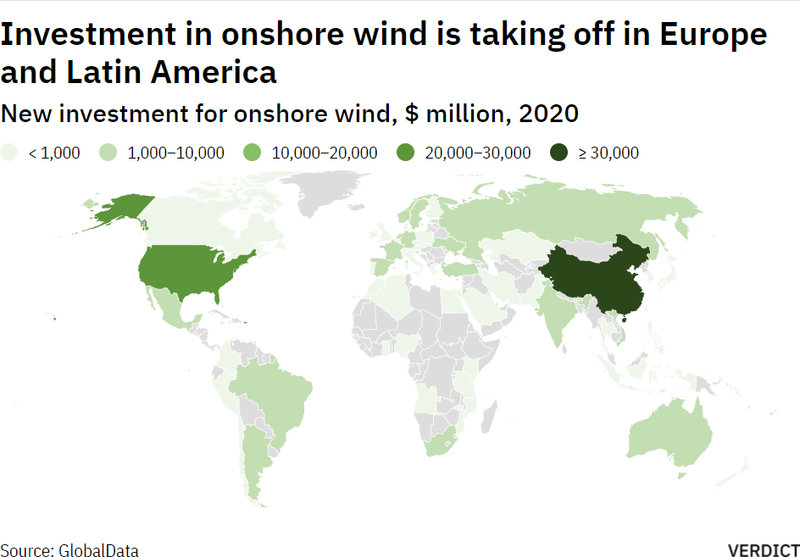

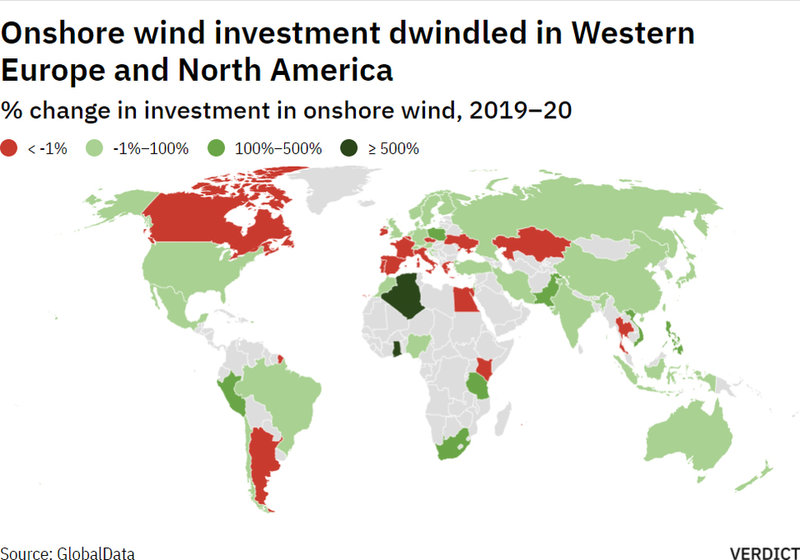

Onshore wind: investment drops in Europe due to Covid-19

Although investment in onshore wind was strong in many parts of the world in 2020, when compared with 2019 investment levels a significant drop becomes apparent in many countries –most notably, western Europe and Canada.

According to a report by Wind Europe, 14.6GW of new wind power capacity was installed in Europe in 2020, 6% less than in 2019. Onshore wind made up 80% of the new installations with 11.8GW, 22% less than the organisation’s pre-Covid-19 forecast.

The report attributes the drop to delays in commissioning new wind farms due to Covid-19-related supply chain disruptions and restrictions to the movement of people and goods.

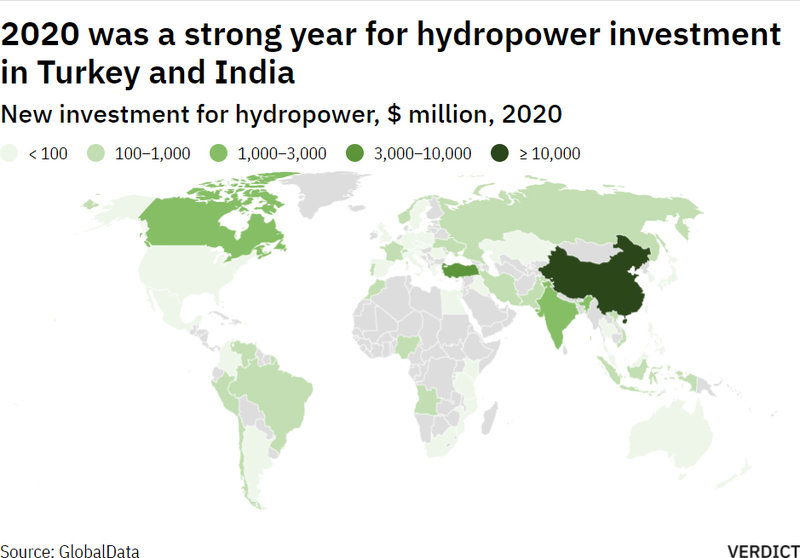

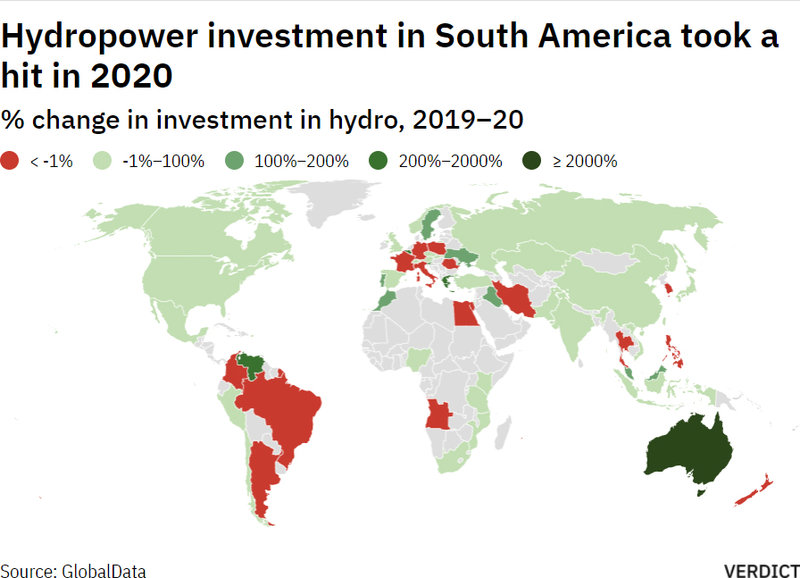

Hydropower: investment drops due to Covid-19 disruption

Hydropower investment was strong in China, Turkey, India and Canada in 2020. According to the International Hydropower Association, nearly two-thirds of global growth came from China, which saw 13.8 GW of new capacity added in 2020. Turkey was the only other country adding more than 1GW of new capacity, with 2.5GW installed.

However, a comparison between 2019 and 2020 investment shows that hydropower also suffered from the impact of Covid-19, with investment dropping in Europe and South America, as well as other parts of the world.

In a report on the immediate impact of Covid-19, the association stated: "In the short-term, widespread uncertainty, currency volatility and liquidity shortages have put financing and refinancing of many hydropower projects at risk.

Greenfield development and critical modernisation projects have also been halted due to social distancing measures and supply chain disruptions. Furthermore, proposed or existing government programmes aimed at supporting the sector have been postponed or cannot be implemented.”

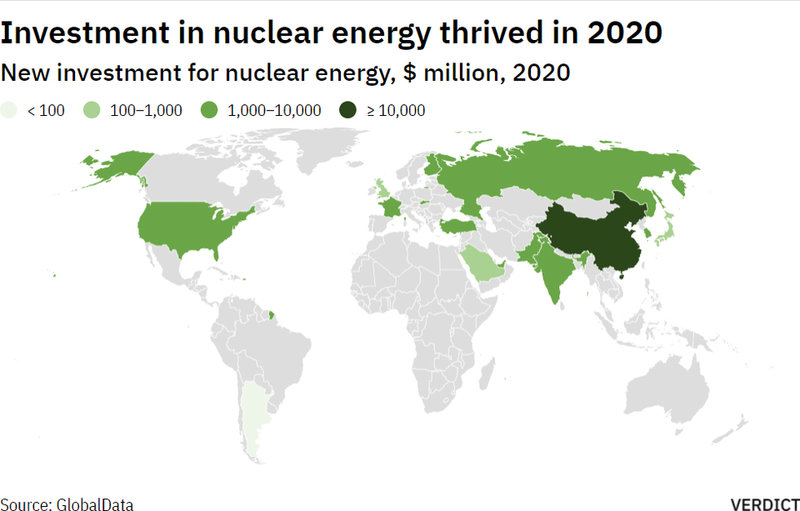

Nuclear power: investment strong in 2020

Investment in nuclear power in 2020 was strong, led by China, the US, Russia, India, Pakistan, Turkey and France. However, the impact of Covid-19 on the nuclear industry and regulators is substantial and expected to continue into 2021-2022, according to the World Nuclear Industry Status Report 2020.

“Refueling and maintenance outages were postponed, testing of key components delayed, physical inspections by safety authorities halted altogether,” the report states. “Some fear shortages in nuclear fuel supply due to logistical disruptions. These delays could lead to situations when outages need to be carried out in times of high demand.”

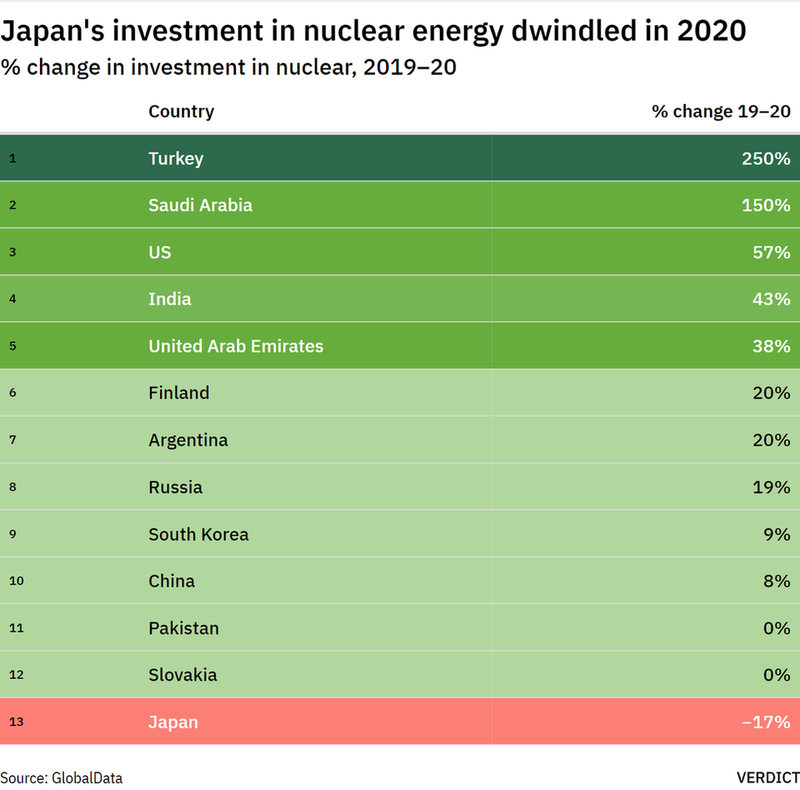

In a comparison of nuclear power investment in 2019 and 2020, a significant decrease of investment in Japan becomes apparent. It is evidence of Japan’s ongoing struggle with nuclear power following the 2011 Fukushima incident, which has led to a decline in nuclear power generation in the years since.

Although nuclear power features strongly in Japan’s recent climate pledge for 2030, the safety requirements that need to be met for the country to restart all its nuclear reactors remain a significant hurdle for the nuclear power sector.