Analyst briefing

Mining sector prospers after short-lived Covid-19 shock

David Kurtz, director of research & analysis at GlobalData, reviews the mining sector's rapid recovery over the past year.

I

n March 2020, when the Covid-19 pandemic was beginning to sweep across the globe, it could not have been predicted that, within 12 months, commodity prices would have hit record highs.

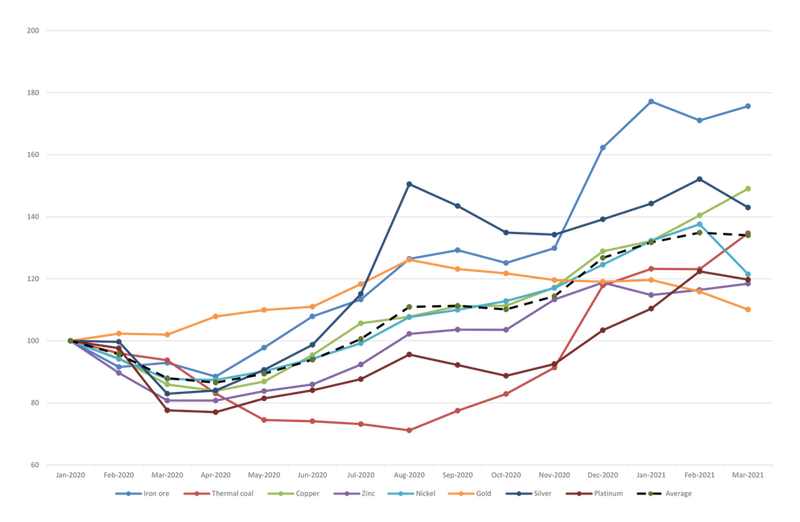

In early 2020, the spread of Covid-19 was anticipated to have major impacts on key end-user segments, such as construction and manufacturing, leading to sharp falls in commodity demand and prices. And initially it did: the prices of copper and zinc both dropped by over 25% between mid-January and late March.

Some commodities demonstrated resilience – iron ore prices fell only marginally, despite declining steel output, thanks to supply issues in Brazil, while the price of gold rose due to its position as a safe haven.

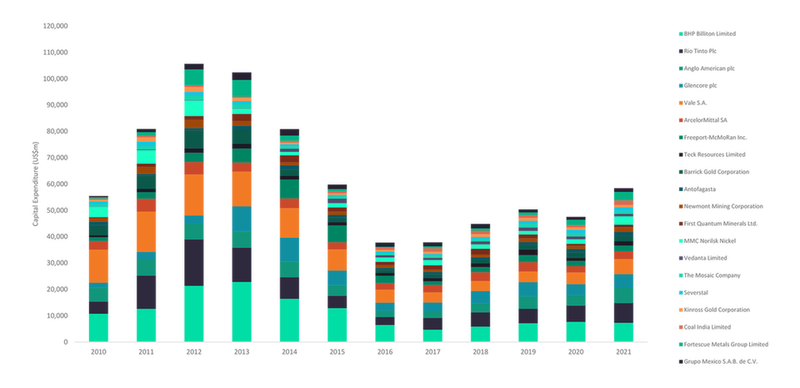

Major miners also moved to reduce spending, anticipating lower demand as well as interruptions to supply chains affecting supply of materials and labour. These included Rio Tinto, which reduced its capex guidance for 2020 to $5-6bn, down from the previous guidance of $7bn, partly due to Covid-19 and partly due to the strength of the US dollar.

Anglo American cut its 2020 capex expectations by $1bn to $4-4.5bn while Glencore reduced its from $5.5bn to $4-4.5bn, due to project deferrals, lower production and falling input costs. Further major reductions were being made by Freeport-McMoRan, which announced a cut in capex from $2.8bn to $2bn, and ArcelorMittal, which reduced its capex guidance from $3.2bn to $2.4bn.

Mine closures

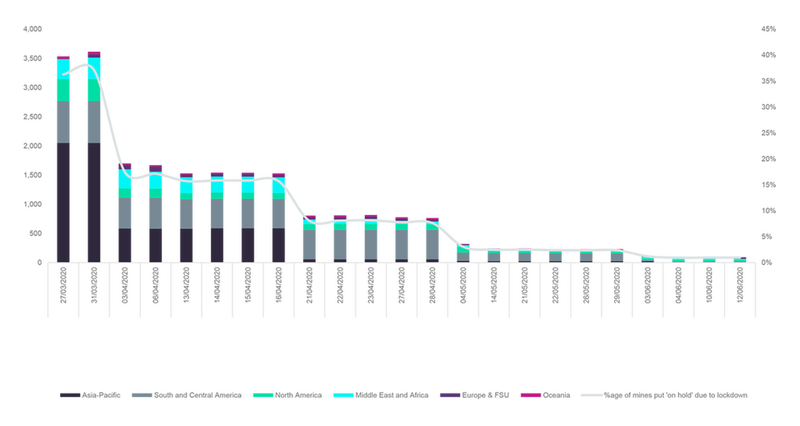

As of the end of March, operations at over 3,600 mines across the globe were put on hold for varying lengths of time as countries went into lockdown, or miners took measures into their own hands and ceased operating to protect workers and local communities.

Extensive lockdowns were put in place in North America, Peru, India and South Africa, although major producers such as Australia escaped relatively unscathed, with operations continuing after quick action from the miners and federal and state governments. By the end of April, however, this figure had fallen to below 750 mines and by June most lockdowns had ceased across the globe.

Miners also undertook a wide range of actions to minimise the spread of Covid-19. They reduced the numbers of workers on sites, reduced or eliminated non-essential travel, increased screening and adjusted FIFO schedules. A survey by GlobalData of 93 mine sites in May and June 2020 showed that 48% agreed and 47% strongly agreed that ‘mining companies have taken appropriate action to safeguard mining workers in my country’.

However, whilst restrictions were being lifted, often as a result of more widespread testing, large numbers of cases were being discovered at mines, leading to more closures. On 24 May, AngloGold Ashanti announced that 164 workers had tested positive at its Mponeng mine in South Africa, which has now been temporarily closed. The company had conducted 650 tests since detecting the first case.

In early June, for example, Polish authorities announced that 12 mines would be closed for three weeks after it was found that hundreds of workers were infected with Covid-19. Similarly, the identification of 188 cases of Covid-19 at the Itabira complex in Brazil led to the owner, Vale, being forced to suspend operations there. The company reported that, by 5 June, over 75% of its workforce in Brazil had been tested for Covid-19, along with almost the entire workforce at Itabira.

Impact on commodity prices

The impact of these mine closures proved to be positive for commodity prices. In May, prices stabilised with a delicate balance between lower demand and supply, before a recovery in Chinese steel production and manufacturing supported global commodity demand and prices.

Demand for commodities such as iron ore and copper were helped by the Chinese Government investing in the infrastructure sector to stimulate the economy, whilst the price of gold continued to rise due to the economic uncertainty, hitting an all-time high of $2,067/oz on 7 August 2020.

From the end of March 2020 to the end of March 2021 the iron ore price almost doubled, up from $88/t to $167/t and the price of copper was close to the same growth, rising from $4,797/t on 31 March 2020 to $8,810/t a year later.

While some softening of prices is expected over the year, rising construction and manufacturing activity are expected to support high prices of iron ore and base metals, in turn encouraging mineral exploration and development activity.

After falling by 2.5% in 2020 (a 5.1% decline if China’s performance is excluded), the value of the global construction sector is predicted to rise by 5.2% in 2021 and 3.8% in 2022 in real terms, helped by a sharp rebound in South and South-East Asia.

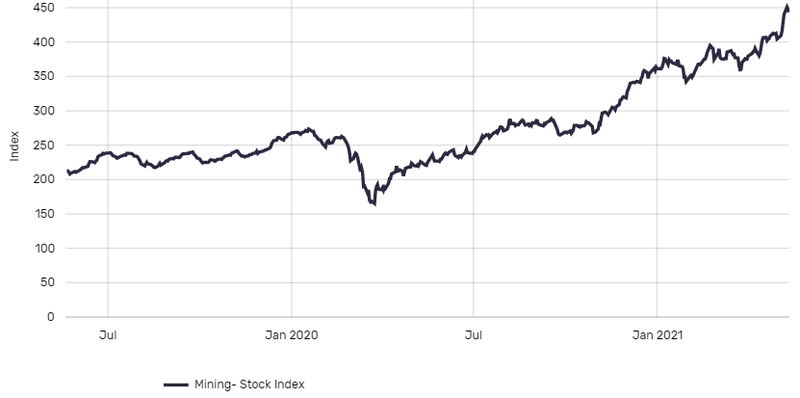

For miners, the rising commodity prices and improving economic outlook have been extremely positive. GlobalData’s index of leading mining company stock prices rose by 275% from 23 March 2020 to 12 May 2021 as commodity prices drove higher profits.

2021 outlook: good news for investment and commodities

With rising prices, commodity demand and profits, miners are committing to higher investments in 2021. After falling by an estimated 6% in 2020, the capital expenditure of 20 leading miners is expected to rise by 23% in 2021 to reach $58bn. This will be the highest point since 2015 and will be supported by both higher sustaining capex and greater development project expenditure after deferrals from 2020 due to Covid-19.

Rio Tinto and BHP will continue to be the highest spenders, with Rio Tinto’s capex expected to hit $7.5bn in both 2021 and 2022, an increase of 21% on 2020. Major developments include the continued construction of the $2.6bn Gudai-Darri iron ore mine, which is due to commence production in 2022. Significant increases in capex are expected at a number of other majors including Anglo American, Vale, Newmont, Teck Resources and Norilsk Nickel.

Meanwhile, without the operational disruptions seen in 2020, production of key commodities is forecast to grow strongly in 2021. GlobalData predicts growth of 5% in both global iron ore and mined copper production, 5.5% growth in gold output and a 21% increase in platinum in 2021. Platinum had been severely impacted by the 21-day lockdown in South Africa and an explosion at Amplats’ Anglo Converter Plant at the Waterval smelter in Rustenberg.

Over the coming years, growth in iron ore output of 3.7% per year is predicted to 2025, while copper output is forecast to rise by a CAGR of 5% as growth in construction and the sustainability agenda drive increased demand for copper.

For iron ore, major projects include the $3.6bn South Flank, which is starting production in H1 2021 and $2.6bn Gudai-Darri, due to start in 2022. For copper, new commencements in 2021 include the Spence Growth option and Kamoa Kakula, while Quellaveco and Quebrada Blanca 2 are due to start in 2022, and the El Teniente expansion, which is progressively being developed, should be completed by 2023.