Covid-19 briefing

Powered by

Download GlobalData’s Covid-19 Executive Briefing report

- ECONOMIC IMPACT -

Latest update:17 March

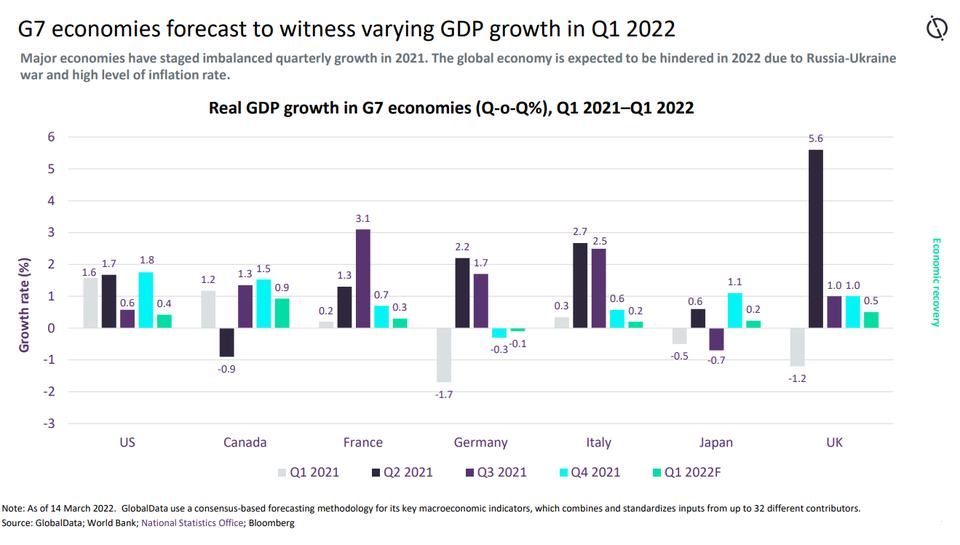

The US economic growth forecast for 2022 has been revised downward by Goldman Sachs to 1.75% from its earlier projection of 2%, as of 11 March.

The European Central Bank forecasts Eurozone GDP to grow by 3.7% in 2022 and by 2.8% in 2023, which is a downward revision from its earlier projection of 4.2% and 2.9% respectively, as of 10 March.

12

The Pfizer/BioNTech vaccine has received approval in the world’s 15 leading economies, with just three top economies not yet implementing the drug

350,000

France has the world’s highest number of total confirmed cases per million people, with close to 350,000 in the two weeks to 27 February

Projected covid-19 recovery around the world

- SECTOR IMPACT: MINING -

Latest update: 4 March

BASE METALS

After passing $10,000/t in October, the copper price declined marginally over the remainder of the year, but still averaged over 50% higher in 2021 compared with 2020.

A drop in inventories has helped copper prices, which have been under pressure due to declining demand in China, with the country’s power supply crisis leading to factories being closed, thereby impacting demand, with surpluses expected.

IRON ORE

The global iron ore price fell steeply in November due to steel production curbs by China as the country looked to reduce pollution and power use.

However, while port stocks continued to climb, there followed an improvement in the price in December, peaking at $113.6/t. For 2021, the average iron ore price was 52% higher than in 2020.

PALLADIUM AND PLATINUM

After reaching a six-year high of $1,325/troy oz in February, the price of platinum fell to a low of $925/troy oz in December, before recovering marginally by the end of the year.

The average price of platinum was still significantly higher in 2021, compared with the prior year, at $1,098/oz, an increase of 23%.

COAL

Rising demand as the northern hemisphere entered the winter months, coupled with increasing natural gas prices and supply constraints, led to a surge in thermal coal prices in September and October.

After peaking at $269.50/t on 5 October, an intervention by the Chinese Government, ordering its major miners to cut prices and increase output, led to thermal coal price dropping to $140.90/t in early November, before it recovered to $166/t in December.

PRECIOUS METALS

The gold price has fluctuated around the $1,800/oz mark for the last few months, with an increase in November due to rising inflation followed by a dip, related to the spread of the latest Covid-19 variant in December