Covid-19 briefing

Powered by

Download GlobalData’s Covid-19 Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 20 October

Gibraltar leads the world in total vaccination rate, with 116.3% of its population vaccinated, made possible by the fact that visitors to Gibraltar can receive vaccinations, but are not counted as part of its permanent population.

Between January and October, the number of vaccines administered in the US rose to over 375 million, driving a similar increase in GDP growth rate from around 4% to around 6% over the same period.

5.7%

The OECD expects the global economy to expand by 5.7% in 2021 and 4.5% in 2022 following the Covid-19 pandemic, while the IMF expects the global economy to grow by 5.9% this year.

40 million

The US passed 40 million confirmed cases of Covid-19 in September this year ahead of India and Brazil, with around 35 million and 20 million cases respectively.

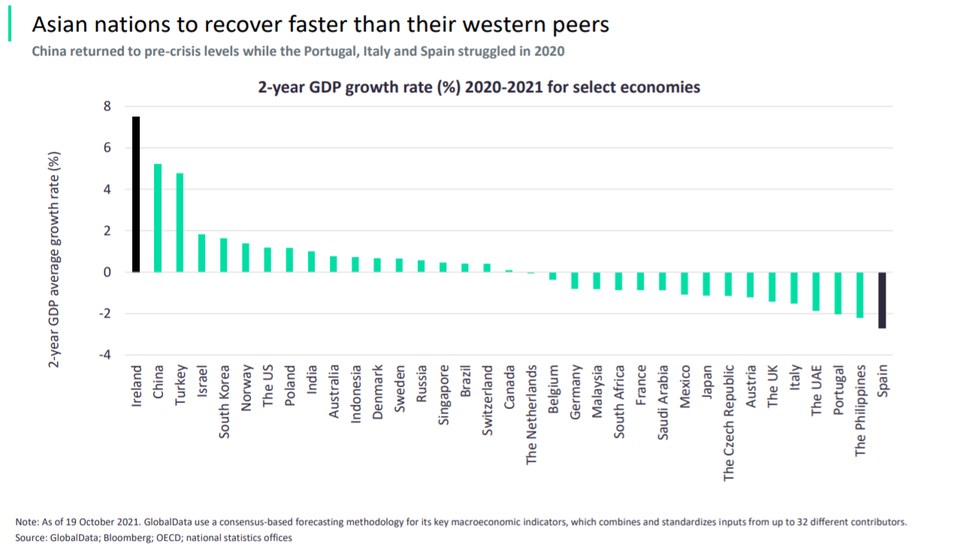

Projected covid-19 recovery around the world

- SECTOR IMPACT: MINING -

Latest update: 3 November

BASE METALS

Copper prices dipped in August and September with China’s power supply crisis leading to factories being closed and reducing demand. However, they rose again in October, peaking at $10,652/t, with a drop in inventories towards the end of the month. Meanwhile, the aluminium price reached its highest point since 2008 at $3,180/t in October, as production was restricted due to high power prices, with inventories continuing to fall.

IRON ORE

The iron ore price stabilised in October, ending the month on $121.23/t. The Chinese Government is enforcing curbs on steel production in order to reduce greenhouse gas emissions, with mills in a large number of regions to cut production based on their emissions levels as part of a winter air pollution campaign, running from October to March.

PALLADIUM & PLATINUM

After reaching a six-year high of US$1,325/troy oz in February, the price of platinum fell to a low of $930/troy oz in September, before recovering to average $1,025/oz in October. Recent semiconductor shortages are being blamed for the fall in platinum group metal prices as auto makers are closing plants and reducing their output guidance.

COAL

Rising demand as the northern hemisphere enters the winter months coupled with increasing natural gas prices, as well as supply constraints, have led to a surge in thermal coal prices. After peaking at $269.50/t on 5 October, the price dropped to $223.45/t at the end of the month, with the average 27.9% higher in October compared with September.

PRECIOUS METALS

The price of gold recovered towards the end of October, but the average monthly price was down by 0.3% on September. An improving economic outlook has dampened prospects for a rise in the gold price in 2021, along with a strengthening US dollar, with the Federal Reserve indicating that it may begin withdrawing stimulus this year as the economy rebounds.