Last year was not a good one for commodities, with only gold and silver, among the major commodities, experiencing any sort of price rise, up by 8.1% and 7.7% respectively. This was helped by gold’s appeal as a safe haven amidst geopolitical uncertainty, a US banking crisis early in the year, and the threat of rate cuts which led to a weakening US dollar.

In contrast to these, the average prices for thermal and met coal, zinc and aluminium all feel steeply, down by 51.3%, 17.2%, 24.0% and 16.8%, respectively, while the prices of copper and iron ore fell marginally (down 3.8% and 2.2%, respectively), despite some improvement over the latter part of the year.

The price of lithium also plummeted, with Australia’s Department of Industry, Science and Resources (DISR) reporting in its December quarterly that the average spodumene price was $2,168/t as of October 2023, compared with an average $4,364/t in 2022, and the average lithium hydroxide price was just $25,327/t in October 2023, against an average of $67,279/t in 2022.

The switch from a deficit to a surplus of lithium as high prices encouraged investment, and the weaker-than-expected demand for electric vehicles were two key factors in this decline.

Although lithium prices are expected to stay low, with the DISR forecasting $2,200/t for spodumene and $30,000/t for lithium hydroxide by 2025, a significant share of respondents to a poll conducted by Mining Technology in January 2024 expect lithium prices to show the greatest improvement across a selection of commodities over this year.

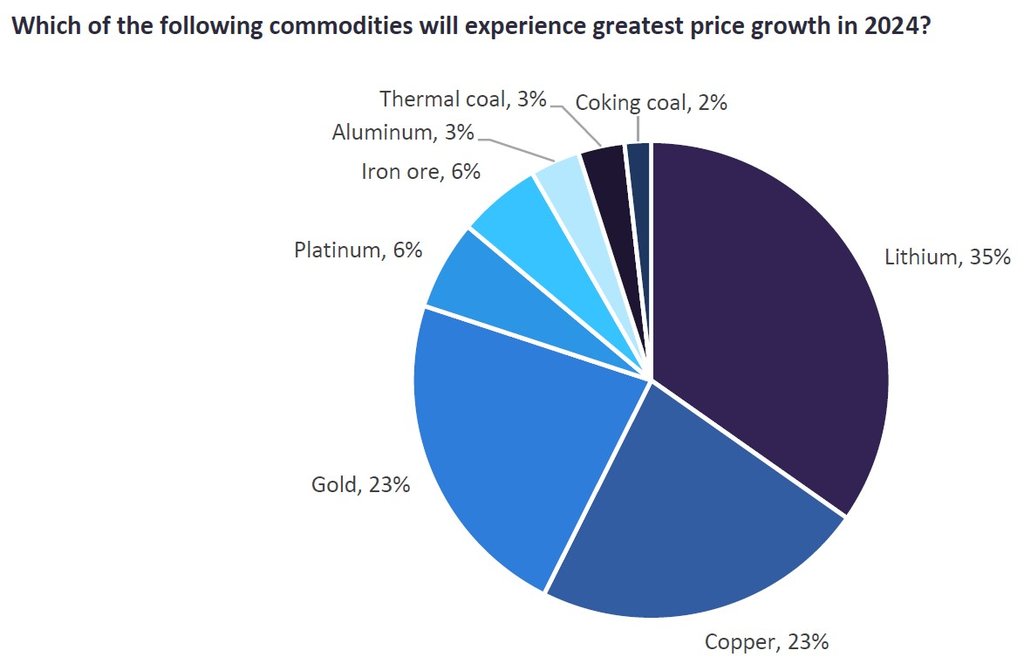

Of the 446 poll respondents, 35% expect the price of lithium to have greatest growth of those commodities listed, followed by both gold and copper with shares of 23% each. Of the remainder, iron ore and platinum were next highest with shares of just 6% each.

While almost a quarter of poll respondents were positive about copper, it is expected that the price of copper will be under pressure in 2024 due to the fragile state of the global construction industry. GlobalData forecasts growth in total global construction output of just 1.1% in real terms in 2024, compared with 3.4% in 2023, and this is expected to lead to a decline in the copper price this year.

In contrast, after hitting an all-time high in 2023, the price of gold is expected to remain high as geopolitical uncertainty and declining interest rates provide support for gold, and it is predicted to average over $1,900/oz, just as it did in 2023.

Responses to our poll show confidence in lithium. Source: GlobalData

Of the remaining commodities, the iron ore price is forecast by GlobalData to rise marginally, up by 2.5% compared with 2023, helped by government stimulus measures in China and spending on infrastructure, despite an overall weak construction sector. However, the China Metallurgical Industry Planning and Research Institute is expecting a drop in steel demand of 1.7% in China in 2024, following a 3.3% decline in 2023.

Meanwhile, the price of platinum, which rose by just under 1% in 2023 due to a sizeable deficit, is expected to drop back in 2024. In late November, the World Platinum Investment Council reported in its quarterly platinum update that it expected a record deficit of 1,071koz in 2023, with year-on-year demand growth of 26%. However, this deficit would drop to 353koz in 2024 as demand falls and supplies improve.

Very few respondents to our poll expected thermal coal, met coal or aluminium to show the greatest improvement in 2024, and this follows each of these commodities experiencing substantial declines in 2023. Declining steel demand in China will impact demand for met coal, while thermal coal demand is forecast to fall in line with the gradual phasing out of coalf-ired power in many countries, and a weak construction sector will continue to impact aluminium demand in 2024.