Ukraine crisis briefing

Powered by

Download GlobalData’s Ukraine Crisis Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 8 June

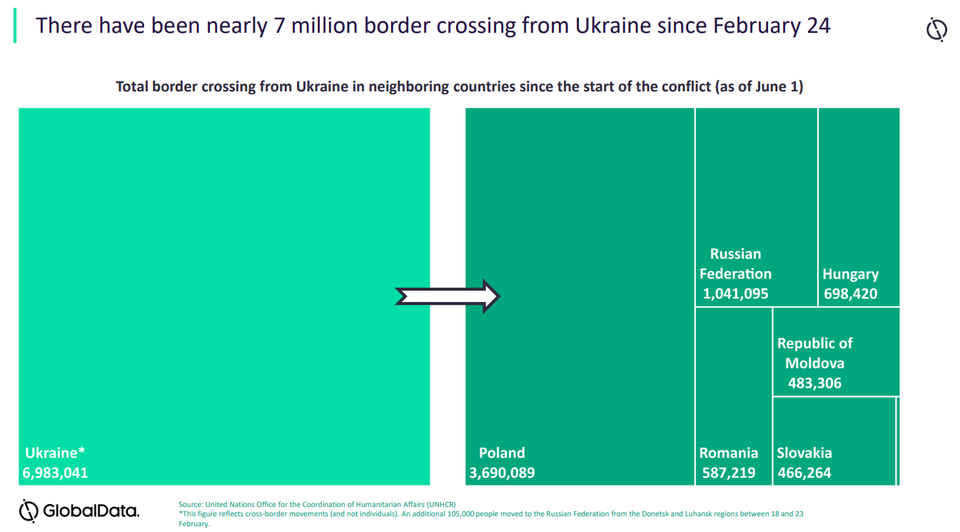

Data from the United Nations’ Refugee Agency indicates that around seven million people have crossed the Ukrainian border as of 1 June, while 2.1 million have returned.

After a period of easing, prices of grains and oilseeds have begun to escalate again as several other exporting countries have introduced schemes to limit exports and preserve domestic supplies.

2.9%

The World Bank lowered its global growth forecast from 4.1% to 2.9%, with a warning that many countries may see recessions.

7%

According to the World Bank, the global inflation rate is projected to rise to 7% in 2022 from 3.5% in the previous year.

- SECTOR IMPACT: MINING -

Latest update: 8 June

SUPPLY CHAINS

There has been a significant impact on the mining industry’s supply chain, as Russia is among the top three producers of diamond, gold, platinum group metals and nickel. It is also a key supplier of seaborne and met coal (to European markets), iron ore, steel and aluminium.

Meanwhile Ukraine, is principally a supplier of coal, iron ore and uranium, though in each case its share of global production is small. Faced by sanctions, Severstal, one of Russia' largest steelmakers, is reported to be redirecting product to other markets such as Asia, the Middle East and South America.

OPERATIONS AND MAINTENANCE

Aside from the operational impacts within the Ukraine, production from some Russian mines is being affected. While Nornickel has stated that operations are continuing and Polymetal reported on 9 March that all its operations in Russia and Kazakhstan continue undisrupted, Canadian miner Kinross announced that it was suspending all activities in Russia, including its Udinsk development project in Khabarovsk Krai, and operations at its Kupol gold mine.

Further to that it has agreed to sell its operations to Highland Gold Mining, one of the larger gold producers in Russia, for $680m, including $400m for Kupol and $280m for Udinsk.