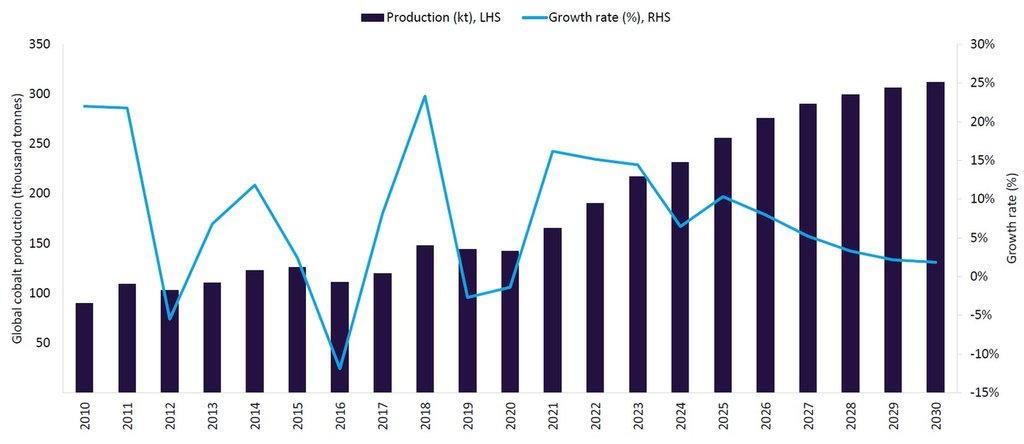

Cobalt mining has seen steady growth over the past two decades. Growing interest in cobalt, combined with government and private sector investment to meet rising demand, increased the number of countries producing cobalt from seven in 2000 to 16 in 2023.

According to GlobalData’s report ‘Global Cobalt Mining to 2030’, global cobalt production is expected to rise for the third time in a row in 2023, to 217.4 thousand tonnes (kt), marking an increase of 14.4% over 2022. This growth is driven by increased supply from the DRC and Indonesia.

By 2030, global cobalt production is expected to increase at a CAGR of 5.1% to reach 311.8kt.

Global cobalt production to 2030. Source: GlobalData, US Geological Survey

What’s driving growth of the cobalt market?

The rapid growth of the electric vehicle (EV) market is one of the key drivers behind rising demand for cobalt. Lithium, cobalt and nickel are key materials in the manufacture of EV batteries, and cobalt is expected to remain an important raw material for the entire battery supply chain in the coming years.

In 2022, around 60% of batteries demand was from lithium, followed by cobalt (30%) and nickel (10%). Although the cobalt market was impacted by weaker Chinese battery demand in 2023, this was offset by increased in demand from North America and Europe.

According to the IEA, global demand for automotive Li-ion batteries increased by 66.7% in 2022 to reach 550GWh, from 330GWh in 2021, owing to the rise in EV sales. Car battery demand is expected to rise further, reaching 3.5TWh by 2030, at a CAGR of 12.6% over the period. This will be supported by positive EV policies around the world, which have been crucial in driving the EV market in recent years.

Where are the world’s cobalt reserves located?

Global cobalt reserves stood at 8.3 million tonnes (Mt) in January 2023, up from 7.6Mt the previous year, according to the US Geological Survey (USGS).

According to the USGS, the DRC had the world’s largest cobalt metal reserves, with 4Mt as of January 2023, a 14.3% increase over the previous year. All these reserves are located in Katanga. The Tenke Fungurume, Sicomines Copper Cobalt and Deziwa mines are the largest, with 822.6kt, 604.5kt and 420.kt of metal reserves, respectively.

Australia has the second-largest cobalt metal reserves, at 1.5Mt and accounts 18.1% of the global total as of January 2023. Cobalt in Australia is produced as a by-product of copper and nickel mining. The Nova Bollinger and Savannah mines are the major active mines in the country in terms of metal reserves. The country’s major active projects are the Nova Bollinger and Savannah.

Indonesia ranks third with 0.6Mt of cobalt reserves, accounting for 7.2% of global reserves as of January 2023. Cobalt reserves in the country are spread mainly across the Maluku, Central Sulawesi and West Papua province and its major active mine is the Weda Bay project.

The share of global cobalt resources by country. Source: GlobalData, US Geological Survey

Which countries are the major producers of cobalt?

The mining of cobalt is heavily monopolised by the DRC, which accounted for 68.4% of global cobalt output in 2022. Production is expected to grow by 17.3% to reach 152.5kt in 2023, up from 130kt in 2022. This is primarily due to the restart of Kinsanfu (later named KFM) project in Q2 2023. CMOC acquired the Kisanfu mine in 2020 and is targeting to produce between 24kt and 30kt in 2023 from KFM, of which a 9.3kt was achieved in the first half of 2023.

Although the DRC will continue to dominate the world’s cobalt supply in the coming years, its share will gradually decline to 56.5% by 2030. In contrast, Indonesia's share is expected to rise from 5.3% in 2022 to 20.8% during the period.

With an output of 10kt of cobalt in 2022, Indonesia became the second-largest cobalt producer in the world, surpassing established producers including Russia, Australia, Canada, Cuba, the Philippines, Papua New Guinea and Madagascar. Major drivers of this increase in production were the ramping-up of the PT Halmahera Persada Lygend project and the commencement of the PT Huayue and PT Qmb projects in 2022. The country’s upward trend is expected to continue in 2023, with output rising by 40.7% to an estimated 14.1kt.

Countries such as Russia, Madagascar and Australia also contributed to the global growth, albeit in smaller volumes. The total cobalt production for the top ten countries is projected to increase from a collective 174.3kt in 2022 to 200.1kt in 2023, representing a 14.8% increase and accounting for 92.1% of the global total in 2023.

Major cobalt development projects in 2023

According to GlobalData, there are 17 new projects in various stages of development with high likelihood of coming online by 2030. Here are some of the key upcoming projects in the pipeline.

Mutoshi project, DRC

Dubai-based Shalina Resources wholly owns the Mutoshi project, which is currently undergoing construction. It has an annual saleable cobalt production capacity of 16kt and is set to commence operations in 2024. The capital expenditure of the project is estimated around $255m.

Musonoi project, DRC

The Musonoi project, currently under construction, is owned by Hong Kong-based Jinchuan Group (75%) and DRC-based Gecamines (25%). It is expected to commence operations in 2024 with an annual saleable production capacity of 7.4kt.

Sorowako Limonite project, Indonesia

Vale Indonesia wholly owns the Sorowako Limonite project, which is currently undergoing definitive feasibility studies and is expected to begin production in 2026. It has an annual production capacity of 8kt of cobalt.

Weda Bay dxpansion project (Sonic Bay), Indonesia

Owned by French company Eramet (51%) and German multinational BASF (49%), the Weda Bay expansion project which is currently at the final investment decision stage. It is a hydrometallurgical plant which will produce both nickel and cobalt. Operations are expected to begin in 2026 with an annual saleable production capacity of 6kt of cobalt.

Who are the leading companies in cobalt mining?

Glencore, CMOC Group, Jinchuan Group, Vale and BHP are the top five cobalt producing companies in the world, together accounting for 190kt, or 37.4%, of the global cobalt production in 2022.

During the first nine months of 2023, CMOC and BHP registered significant growth in comparison with the same period over 2022. CMOC’s cobalt output grew significantly during the same period supported by the addition of more production lines at Tenke Fungurume mine.

At the same time, Glencore, Jinchuan Group and Vale experienced declines. Glencore’s output was impacted by lower grades at Mutanda mine as a result of feed plan adjustments. This was partially offset by the improved recoveries from its Katanga mine.

Jinchuan Group’s output was affected by lower grades as well as lower cobalt recovery rate from its mines, while Vale’s output fell due to annual planned maintenance at the Long Harbour refinery at Thompson and Voisey's Bay mines.

This article is based on information from GlobalData’s report ‘Global Cobalt Mining to 2030’. The full report includes a forecast to 2030, detailed breakdowns of global cobalt reserves and production, price trends and exports, active and upcoming projects, and the competitive landscape. You can buy the full report here.