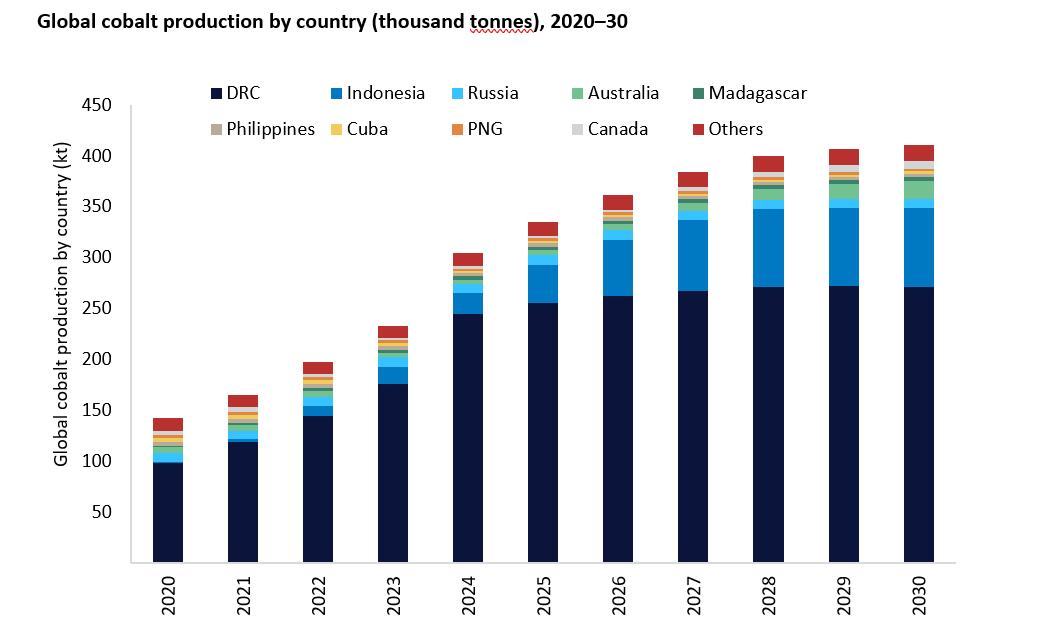

Global cobalt production has surged in recent years, exceeding 200 kilotonnes (kt) in 2023 and, despite price volatility, is estimated to have surpassed 300kt in 2024, a substantial 30.7% growth.

The Democratic Republic of Congo (DRC) remains the dominant player, accounting for over 80% of global output in 2024, followed by Indonesia.

In 2024, the DRC's production is projected to reach 244kt, a 38.9% increase, driven by the ramp-up of operations at the Kisanfu mine and Tenke Fungurume mine.

This dominance stems from the DRC's abundant mineral resources and strong partnerships with Chinese companies. The DRC's dominance in production and China's near monopoly on cobalt processing and refining concentrates a significant portion of global supply, creating vulnerabilities to geopolitical instability.

Indonesia has emerged as a significant player in the global cobalt market, experiencing a remarkable transformation in recent years. Cobalt production surged from a mere 1.3kt in 2015 to an estimated 20.5kt in 2024, representing a 22% increase from the previous year.

This rapid growth is a direct consequence of the Indonesian government's strategic initiative to develop a robust domestic electric vehicle (EV) supply chain. The 2020 export ban proved to be a pivotal catalyst, attracting substantial foreign investment, primarily from Chinese companies, into the country's nickel and cobalt processing industries.

Australia and Canada emerge as key players, while Russia faces setbacks

While the DRC and Indonesia dominate the market, other countries are also gaining prominence. Australia and Canada are rapidly emerging as key players, with production expected to increase significantly in the coming years.

New projects such as Australia's Broken Hill Cobalt and Canada's Copper Cliff mine, are poised to bolster their market shares. By 2030, their combined market share is projected to reach 6%.

Russia, despite possessing substantial cobalt reserves and currently the second-largest producer, faces significant challenges. The ongoing geopolitical tensions and the resulting sanctions have severely impacted its ability to reliably supply the global market. Consequently, Russian cobalt production is expected to stagnate in the coming years.

The global cobalt outlook to 2030

Looking ahead, the global cobalt market is poised for continued growth.

Over the forecast period (2024-2030), global cobalt production is projected to exhibit a 5.1% compound annual growth rate (CAGR), reaching an estimated 410.9kt by 2030.

The emergence of cobalt-free battery technologies, such as lithium-iron-phosphate batteries, poses a long-term threat to cobalt demand. While the transition to cobalt-free batteries is gradual, it could eventually reduce cobalt demand. However, in the short term, the market may experience oversupply due to the emergence of new cobalt mining projects. This oversupply could be mitigated by robust growth in EV market demand.

Credit: GlobalData