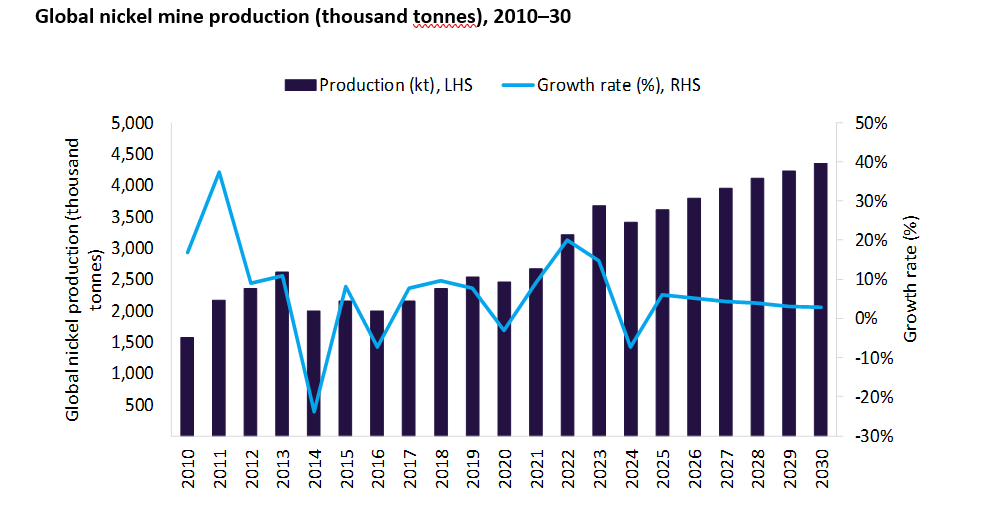

Global nickel production is anticipated to fall by a significant 7.4% to 3.4 million tonnes in 2024 as most of the major producers have reduced their output for 2024, linked mainly to (mt) declining prices and operational disruptions.

Major declines are expected from Indonesia, the Philippines, and New Caledonia. Output from these three countries is expected to decline from a collective 2.44mt in 2023 to an estimated 2.29mt in 2024 - a 6.1% decline. In addition, production will also fall from other key producers such as Russia (-6.5%) and Australia (-12.8%). However, these declines will be partially offset by increases in output from Canada (3.8%) and China (3.1%), albeit only a marginal offset.

Indonesia’s nickel supply for the year 2024 is expected to decline due to lower output from key operating mines.

Meanwhile, Indonesia’s nickel supply for the year 2024 is expected to decline due to lower output from key operating mines such as the Weda Bay, Gag Island, Pakal Island, Pomalaa, and Tapunopaka, in response to anticipated delays in obtaining Rencana Kerja dan Anggaran Biaya (RKAB) approvals.

In 2023, Indonesia, the world’s largest producer, introduced significant changes to the RKAB regulations, extending the validity period from one year to three years. These changes have had varying impacts on different mining companies, depending on their specific circumstances and the nature of their operations. Some companies have been able to adapt quickly to the new regulations while others have faced more significant challenges.

Meanwhile, the Philippine nickel industry has seen fluctuations in production over the same period due to global market conditions, regulatory changes, and operational challenges.

Global nickel production over the forecast period is expected to grow at a compound annual growth rate of 4.2% to over 4.3mt in 2030. Indonesia and the Philippines are expected to be key drivers for this growth. Upcoming projects that have a high likelihood of starting operations through the end of this decade include the Weda Bay expansion (Indonesia, 2026), Onaping Depth (Canada, 2027), and Nickel West (Australia, 2027).

Caption. Credit: