Comment

Australia and Brazil to play key role in global iron ore output growth through 2030

Australia, Brazil, China, India and Russia account for more than 80% of the world’s total iron ore output, according to analysis by GlobalData.

Port Hedland (pictured) is Australia’s largest iron ore loading port and one of the largest in the world. Credit: ambient_pix via Shutterstock.

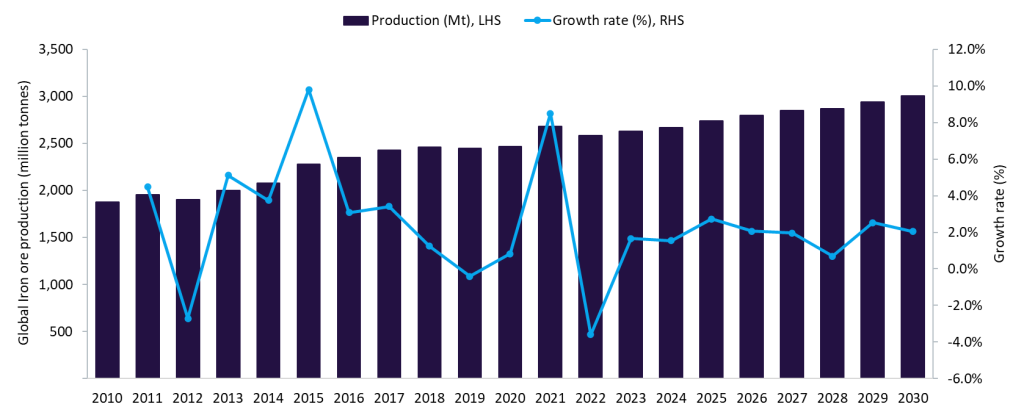

Global iron ore production is expected to increase to 2,398.3 million tonnes (Mt) in 2023, a growth of 1.1% over 2022, with Brazil, China, Russia, India and Australia all contributing to the growth. Combined output from these countries is expected to increase from 2,084Mt in 2022 to 2,114.4Mt in 2023—a 1.5% increase.

Australia, Brazil, China, India and Russia are the top five countries, together accounting for more than 80% of the total world’s output.

Brazilian iron ore production will be the primary contributor to global iron ore production in 2023. This will be primarily due to aggressive expansion commitments by the country’s largest iron producer, Vale, which aims to produce between 340 and 360Mt in 2026, rising to more than 360Mt in 2030.

Looking ahead, global iron ore production is expected to grow at a 1.9% compound annual growth rate over the forecast period, reaching 3,002.8Mt in 2030. Australia and Brazil will be major contributors to this expansion. Along with the start-up of new projects, such as the Onslow project (2024), the Jimblebar Expansion project (2024), and the Western Range project (2025), higher production from the Iron Bridge (North Star Magnetite), Gudai-Darri and South Flank projects is expected to boost Australia’s iron ore production over the forecast period.

Vale, Rio Tinto, BHP, Fortescue Metals Group, Anglo American plc, NMDC, Mitsui & Co, Companhia Siderurgica Nacional, ArcelorMittal and Mineral Resources are the top ten iron ore-producing companies in the world, together accounting for 1,293.9Mt, or 50.1%, of the global iron ore production in 2022.