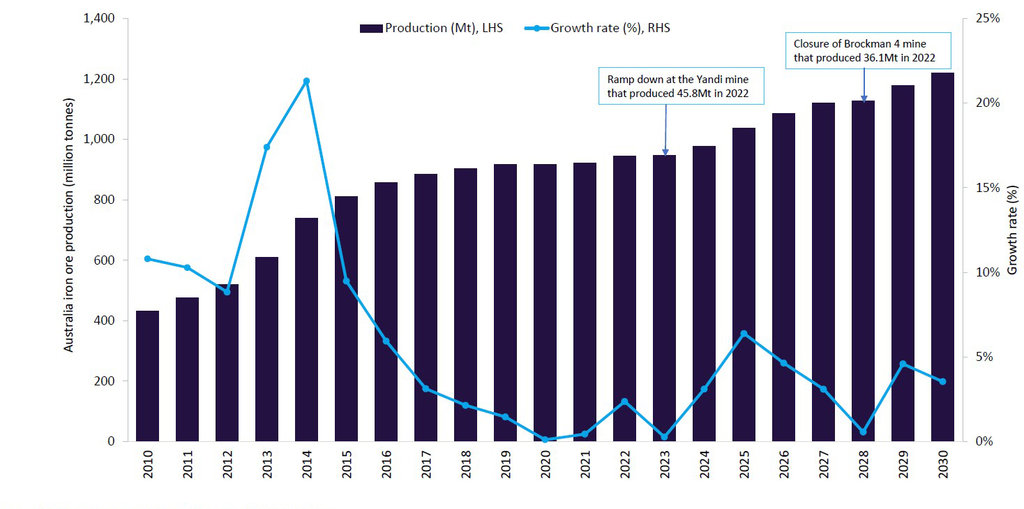

Australia is the world’s largest iron ore producer with output reaching 944.1Mt in 2022. Western Australia accounts for the majority of Australia's total iron ore production, with 98.9% of iron ore production coming from the state.

GlobalData, in its latest report on iron ore in Australia, estimates production to have remained flat in 2023, with just 0.3% year-on-year (YoY) growth rate, and forecasts an increase by 3.1% in 2024.

Flat output in 2023 was primarily due to the ramp down at the BHP’s Yandi mine, which is set to close in 2024. The Yandi mine produced 45.8Mt of iron ore in 2022, accounting for 4.9% of total iron ore production in Australia. Difficulties at BHP's Yandicoogina mine related to materials handling and plant reliability in Q1 2023 also contributed to flat growth.

These factors were partially offset by the ongoing ramp-up of BHP's South Flank and Rio Tinto's Gudai Darri operations, as well as the start of operations at the Iron Bridge (North Star Magnetite) project in May 2023.

Overall, Australia’s iron ore production is expected to grow at a compound annual growth rate (CAGR) of 3.8% to reach 1,220.2Mt by 2030. Along with the commencement of new projects such as Onslow project (2024), Jimblebar Expansion project (2024), and Western Range (2025), the expected higher production from Iron Bridge (North Star Magnetite), Gudai Darri and South Flank projects will further boost production through the forecast period.

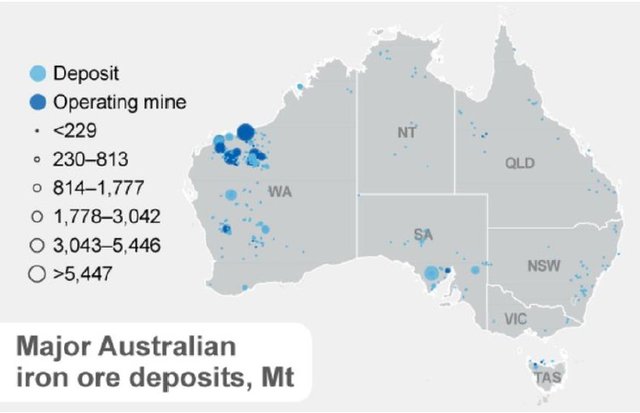

Australia’s iron ore reserves and production

Australia has the world’s largest crude ore reserves and iron content. The country had 51 billion tonnes (Bt) of crude ore reserves, accounting for 28.3% of the global total as of January 2023. Almost all of Australia’s iron ore reserves are located in Western Australia.

Western Australia is the country's largest iron ore producing state, with an estimated 45.2Bt of economically demonstrated iron ore resource in 2021-22 and reserves with an average iron content of 53%, and can sustain production for another 56 years at 2021-22 production rates The state sent A$649m ($1,058m) on iron ore exploration in 2022, a 23% increase from the previous year.

Major Australian iron ore deposits. Source: GlobalData

Australian iron ore deposits have an average cut-off grade of 59.6% Fe content. These are used as direct feed to smelters, both as a raw lump or fines and in processed forms as sinter or pellets.

Hematite ore, also known as direct shipping ore, has Fe content in the range of 56-62%, and processing of this type of ore is relatively simple. Australia has a large, high quality hematite resource capable of producing low cost, direct shipping ore.

The future outlook for iron ore mining in Australia is bright, thanks to the country’s strong resource base and competitive advantage in transportation costs.

Iron ore production in Australia, 2010-2030. Source: GlobalData

Major iron ore development projects in Australia

Onslow project, Western Australia

Mineral Resources’ Onslow project is one of the largest iron ore developments undertaken in Western Australia, which is currently under construction. It has an annual saleable iron ore production capacity of 35kt and is set to commence operations in June 2024 with an expected mine life of more than 30 years. To reduce carbon emissions from the project, the developer intends to convert all its 170 autonomous road trains from diesel to electric. In July 2023, the company also entered into an agreement with Hexagon to deploy a fleet of 120 fully autonomous triple road trains, which will each carry 330 tonnes of iron ore along a 150km route.

Marillana Iron Ore Project, Western Australia

Brockman Mining and Mineral Resources jointly own the Marillana Iron Ore Project, which is currently undergoing feasibility studies. The project is expected to commence operations in 2025 with an annual saleable production capacity of 20Mt.

Western Range, Western Australia

Rio Tinto (54%) and China Baowu Steel Group (46%) own Western Range, which will allow Rio Tinto's existing Paraburdoo hub to continue producing the Pilbara Blend. Construction at Western Range began in early 2023 and production is expected to begin in 2025 with an annual capacity of 25Mt of iron ore. In June 2023 both partners in the Western Range mine issued contracts totalling A$1bn ($667.4m) to local businesses to advance the project's construction.

Key companies in Australian iron ore mining

Rio Tinto, BHP, Fortescue Metals Group and Mineral Resources are among the key iron ore producing companies in Australia, together accounting for 770.4Mt, or 81.6%, of total iron ore production in the country in 2022.

In 2022, the most significant decline was observed from Fortescue Metals Group (-7.6%). In contrast, Rio Tinto (+2.4%), BHP (+2.5%) and Mineral Resources (+4.4%) increased production.

Combined iron ore production from the top four companies remained flat in the first half of 2023 with a combined growth rate of 0.8% YoY.

While production at BHP and Mineral Resources remained flat, Rio Tinto experienced rapid growth, supported by the ongoing ramp up of its Gudai Darri operations. Fortescue’s production fell by 7% primarily due to a shift in mining operations from the central to north-east pit at Wonmunna, combined with the impact of Cyclone Ilsa in April 2023.

This article is based on information from GlobalData’s report ‘Australian iron ore mining to 2030’. The full report includes a forecast to 2030, detailed breakdowns of Australia’s iron ore reserves and production, price trends and exports, details of key assets and development projects, the competitive landscape as well as the country’s fiscal regime, taxes and royalties. You can buy the full report here.