Vale remains the world's leading iron ore producer. The company's production increased by 4.4% in 2023, reaching 321.2 million tonnes (Mt), supported by improved output at several mine complexes, including Vargem Grande, Itabira, Minas Centrais and Mariana.

Rio Tinto, the world's second-largest iron ore producer, is aiming for a significant production increase in 2024. The company's guidance for 2024 is between 328-338Mt, which represents an increase of 11.3% to 16.5% from 2023 production levels.

Rio Tinto's production climbed by 2.5% in 2023, reaching 290.2Mt, due to a focus on enhanced output and a 5Mt boost from the adoption of a safe production system. The ramp-up of Gudai-Darri to its nameplate capacity of 43Mt during Q2 2023, also contributed to the growth.

NMDC, the largest iron ore producer in India, also delivered a strong performance in 2023. The company's output increased by 13% to 46.1Mt, exceeding its target of producing more than 46Mt.

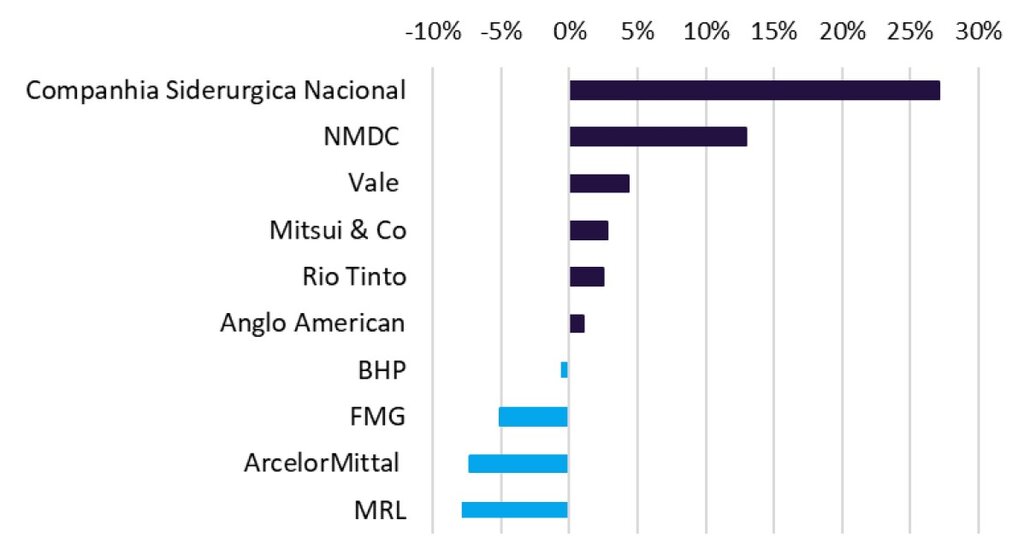

Iron ore production by company (% change), 2023 vs 2022. Source: GlobalData

Several companies, including BHP, FMG, ArcelorMittal, and MRL, experienced production declines in 2023 due to operational challenges.

BHP's production was impacted by ongoing ramp up and maintenance activities at its Central Pilbara hub. FMG's output was affected by bad weather and plant rectification works at its Iron Bridge mine, while a rail bridge failure at ArcelorMittal's Liberia mine in early November 2023 contributed to their decline in output.

MRL's production fall can be attributed to bad weather, extensive pre-stripping activities in the Yilgarn Hub which hosts the Koolyanobbing, Parker Range and Carina mines, and a wall failure at the Iron Valley mine in in late November.

For in-depth analysis of the global iron ore market to 2030, purchase GlobalData’s latest report.