COMPANY INSIGHT

Sponsored by Aspect Environmental

Making ESG Reporting Robust and Purposeful

Appreciation of the effect of changing regulations enables mine operators to proactively assess and respond to their relative exposure. A proactive response enables the operator to retain control of change processes in advance of a regulatory direction enforcing the change, the resource demand and the timeframe.

By way of example, Aspect Environmental looks at the requirements of the NSW Mining Amendment (Standard Conditions of Mining Leases – Rehabilitation) Regulation 2020 and how operators can respond and retain process control.

T

he first paper in this series discussed how the Infrastructure Sustainability Council (ISC) Rating Scheme facilitates the implementation of ESG principles to enhance corporate sustainability reporting capabilities. This paper compares the application of the ISC rating scheme and alternative sustainability frameworks/methodologies to mining associated infrastructure assets and operations to achieve sustainability reporting outcomes.

Applying the IS Process to ESG Principles

Adopting the IS framework and methodology as a complementary component to ESG reporting gives investors and asset owners a comprehensive understanding of a company’s risk profile and future growth potential, as well as assurance that relevant sustainability criteria are being met.

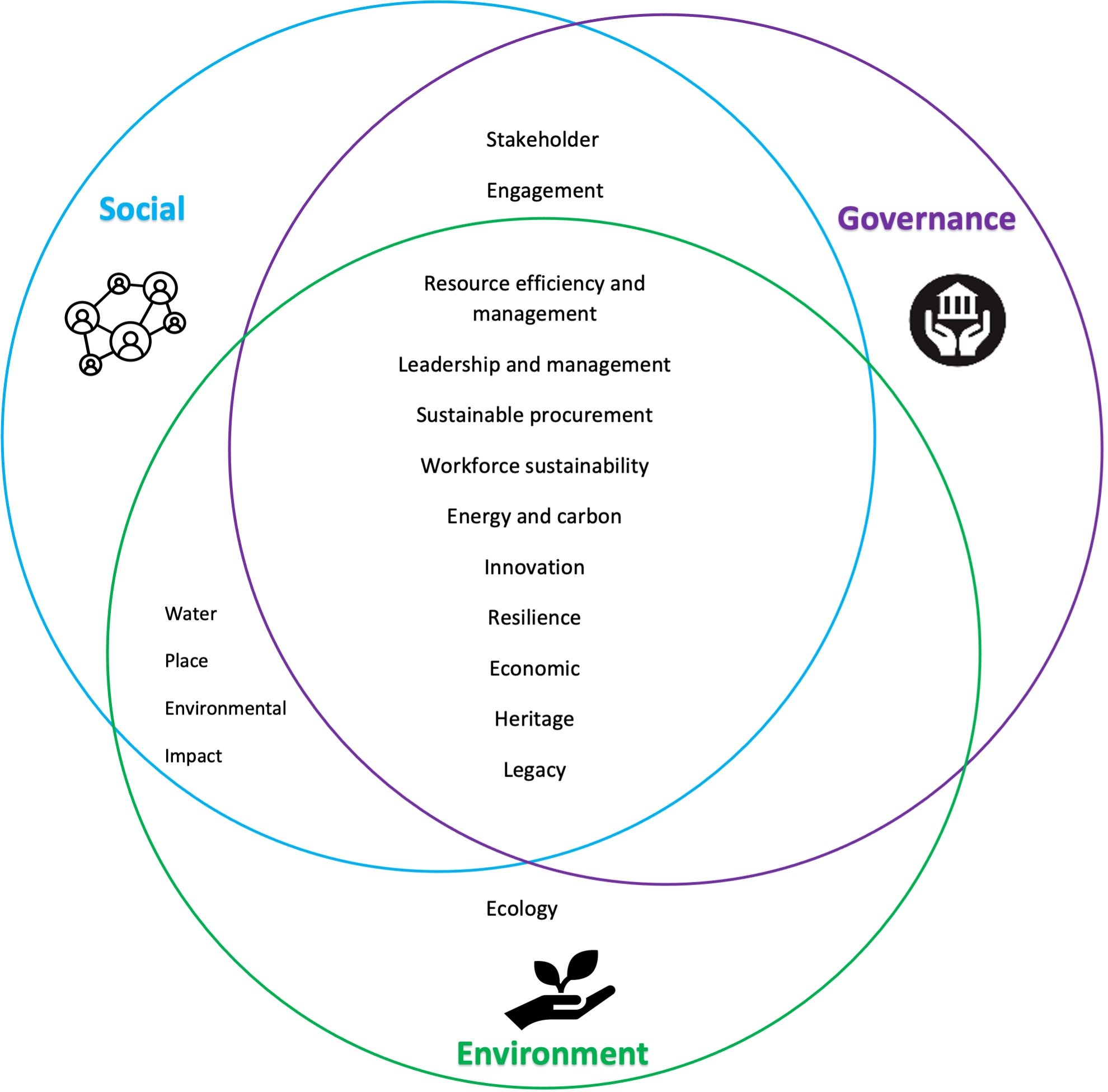

Core ESG principles of environmental, social and governance, correlate with the ISC Rating Scheme’s four themes of governance, economic, environmental and social.

Combined, they enable a comprehensive, efficient and effective measurement of a company’s performance against relevant sustainability criteria (Figure 1).

//Figure 1: Correlation between the ISC credits and ESG principles (Source: Aspect Environmental, 2021)

Applying the IS Process to the Mining Lifecycle for ESG reporting

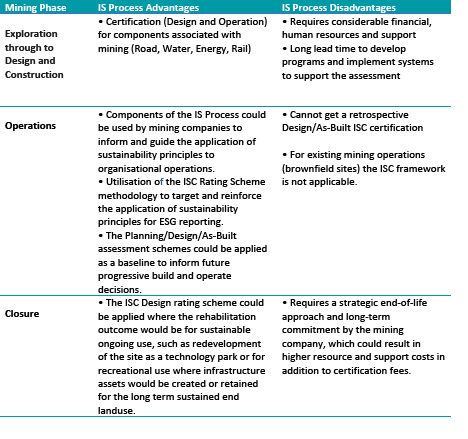

A mining lifecycle consists of three main phases: exploration/design; operation; and closure/rehabilitation.

Through assessment of typical mining activity components progressively through each mining phase against relevant credit elements, the IS Process could provide a comprehensive, flexible, and scalable methodology that can provide meaningful metrics to inform a mining organisation’s ESG reporting. However, the prescriptive nature of the ISC process requires significant capital investment and a long lead time. Additionally, the focus on infrastructure specific programs will mean that only defined “infrastructure assets” such as rail, road, power and utilities can be assessed and rated.

Whilst the ISC Rating Scheme is not directly applicable to mining infrastructure, the framework initiatives and process methodology can be adapted and applied to support corporate ESG reporting. The methodology provides an objective, recognised and robust process to collect data and facilitate transparency to the board, shareholders and other stakeholders.

The selection of an ESG reporting framework needs to adopt criteria and metrics that are directly related to both the nature of the operations and the intended beneficial corporate outcomes sought from reporting.

Why are you communicating your ESG performance?

ISC is one tool to provide shareholders with ESG metrics for a mining organisation’s performance with respect to infrastructure assets. The ISCA Rating Scheme, and other tools such Sustainability Accounting Standards Board (SASB), International Integrated Reporting Framework (IIRC), Dow Jones Sustainability Indices (DJSI), require significant investments and time for any organisation seeking to develop or enhance their ESG reporting. In order to justify the cost, organisations should have an appreciation of why they want or need to report their ESG performance.

ESG and sustainability communication may include reporting, audits, presentations, analysis or other means of information (collectively referred to as 'ESG reporting’ in this paper). ESG reporting needs to be tailored for each organisation and may utilise one or more sustainability frameworks to feed into ESG reporting. The reasons for undertaking organisational ESG reporting can be varied, and the focus for sustainability reporting will be different for smaller or larger companies. Reasons for needing (or wanting) to undertake ESG reporting may include:

- Reporting requirements to shareholders

- Community engagement

- Social responsibility

- Market leader

- Internal performance indicator, or to improve performance

- Statement to the Corporations Act

- Demonstration of good practice

- Social licence to operate

- Safety focus

- Pollution and contaminant management

- Waste management

- Sustainability performance audit

Management and mitigation measures can be provided to enhance sustainability reporting.

Integrating Sustainability Frameworks and Methodologies

Integrating the flexible and comprehensive sustainable development principles and initiatives adopted from the IS Process with other relevant sustainability frameworks, such as Towards Sustainable Management (TSM) and Enduring Value, United Nations Sustainable Development Goals, (UN SDGs), Global Reporting Initiative (GRI) sector supplements, International Council on Mining and Metals (ICMM), International Union for Conservation of Nature (IUCN), World Bank or other frameworks would enable the establishment of a robust and comprehensive approach to ESG reporting.

Each framework provides systems for quantifying and demonstrating ESG performance. This paper identifies that the ISC framework, while well suited to infrastructure assets associated with mining operations, has some shortcomings in terms of application to the phase of mining activity and its ability to be applied retrospectively to brownfield developments. Optimum ESG reporting may best be achieved by tailoring available indicators and metrics from the range of available frameworks.

A tailored ESG reporting strategy that selectively utilises operation specific metrics can increase transparency, reduce business and operational risk management requirements, and can contribute to social investment corresponding with positive outcomes to the board, shareholders, regulatory stakeholders and to the community.

The applicability of common regional and global frameworks and methodologies to ESG reporting for mining operations are further discussed in future papers.

Contact information

Aspect Environmental

Aspect Safety Group

Suite 117 / 25 Solent Circuit

Baulkham Hills

NSW 2153

Tel: 0439 455 975