DEALS ANALYSIS

Deals activity: Asia-Pacific leads in YoY growth; gold continues sector growth

Powered by

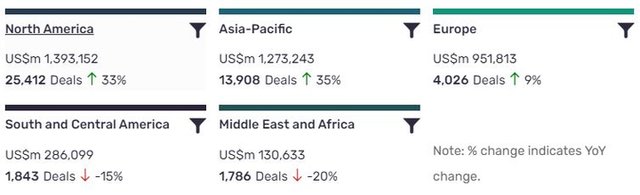

Deals activity by geography

Mining industry deals, as captured by GlobalData’s Mining Intelligence Centre, are largely up year-on-year (YoY) across all regions.

North America is leading in terms of deal value, ($1,393,152m) but has been bested in YoY growth by Asia-Pacific (35%). Europe has also managed to maintain a positive growth, with an increase of 9%.

The volume of deals recorded by GlobalData decreased YoY however in Middle East and Africa and South and Central America, with the former seeing a decline of 20% and the latter one of 15%.

Deals activity by type

| Deal type | Total deal value (US$m) | Total deal count | YoY change (volume) |

| Equity Offering | 437843 | 22680 | -21 |

| Asset Transaction | 527747 | 10152 | 6 |

| Acquisition | 2034302 | 8732 | -31 |

| Debt Offering | 779863 | 2419 | 3 |

| Partnership | 3404 | 1365 | -88 |

| Private Equity | 60281 | 600 | 72 |

| Venture Financing | 1354 | 210 | -84 |

| Merger | 52469 | 194 | -45 |

A breakdown of deals by type and volume shows a general downtrend, with acquisitions down -31% YoY, mergers down -45%, partnerships down -88%; asset transactions are up 6% however. Financing deals have seen a similar downturn, with venture financing down -84% YoY and equity offerings down -21%, although debt offerings saw slight growth of 3%. Private equity has seen surprisingly good growth, with a 72% increase.

Deals activity by sector

The most notable development apparent in GlobalData’s analysis of mining industry deals by sector is the strength of gold's growth. While all sectors have seen some growth, though admittedly only slightly in sectors such as uranium and zinc, gold has continued to rise, with deals increasing by around 1,000 YTD.

Note: All numbers as of 10 November 2020. Deals captured by GlobalData cover M&As, strategic alliances, various types of financing and contract service agreements.

For more insight and data, visit GlobalData's Mining Intelligence Centre.

Latest deals in brief

Pilbara Minerals to acquire Altura’s lithium operations for $175m

Pilbara Minerals has signed an agreement with Altura Mining to buy shares in Altura Lithium Operations (ALO) for $175m. ALO is the owner of Altura’s Pilgangoora lithium project in Western Australia. The project is located approximately 123km south of Port Hedland, Pilbara.

Nickel Mines to buy 70% stake in Indonesian nickel project for $490m

Australian firm Nickel Mines has signed an agreement with partner Shanghai Decent Investment to buy a 70% interest in the Angel Nickel project in Indonesia for a consideration of $490m.

The project is located within the Indonesia Weda Bay Industrial Park (IWIP).

South32 to divest Western Australian mineral royalties to Elemental

South32 has signed an agreement to sell a package of mineral royalties located in Western Australia to Canadian gold-focused royalty company Elemental Royalties.

The royalty package comprises three gold royalties. It also consists of one non-gold royalty.

Thor Mining to acquire interest Australian in copper-gold project

UK-headquartered resources company Thor Mining is set to acquire an interest of up to 80% in the Alford East copper-gold project, located in the Yorke Peninsula, South Australia.

The company announced that it had executed a binding term sheet for Thor Mining to acquire an interest in the mineral rights from Spencer Metals. The agreement grants Thor Mining the right to explore for minerals on agreed portions of Spencer’s exploration licences and to conduct feasibility and development activities in relation to those licences. Thor can earn an interest of up to 80% over two stages via funding expenditure on these activities.

Endeavour agrees to buy Teranga Gold in all-share deal

West Africa-focused miner Endeavour Mining has signed a definitive agreement to buy all the ‘issued and outstanding securities’ of Teranga Gold.

The combination of both the companies is expected to create a London-listed ‘top ten gold producer’. The combined company will produce over 1.5 million ounces (Moz) of gold per annum.

Rhizen signs oncology drug development deal with Curon

Swiss biopharma company Rhizen Pharmaceuticals has signed an exclusive licensing agreement with Curon Biopharmaceutical to develop and commercialise Tenalisib for oncology in the Greater China region. Tenalisib, a highly selective dual PI3K delta and gamma inhibitor, is currently in Phase II clinical development for haematological malignancies. The US FDA granted fast track and orphan drug designations for the drug candidate Tenalisib as a treatment for relapsed/refractory peripheral T-cell lymphoma and cutaneous T-cell lymphoma.