DATA

Deals analysis: metals & mining industry M&A deals total $6.9bn in Canada in Q4 2021

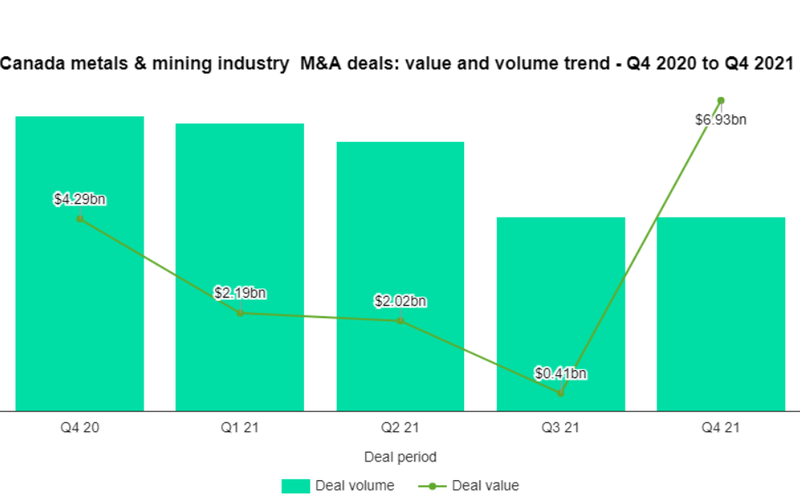

Total metals & mining industry M&A deals worth $6.9bn were announced in the Canada in Q4 2021, led by Newcrest Mining’ $2.8bn acquisition of Pretium Resources, according to GlobalData’s deals database.

The value marked an increase of 1607.7% over the previous quarter and a rise of 210.8% when compared with the last four-quarter average of $2.23bn. Canada held a 19.59% share of the global metals & mining industry mergers and acquisition (M&A) deal value that totalled $35.38bn in Q4 2021.

In terms of deal activity, the Canada recorded 31 M&A deals during Q4 2021, marking a flat growth over the previous quarter and a drop of 25.75% over the last four-quarter average.

The combined value of the top five metals & mining M&A deals stood at $5.97bn, against the overall value of $6.9bn recorded for the quarter.

The top five metals & mining industry M&A deals of Q4 2021 tracked by GlobalData were:

Newcrest Mining’s $2.8bn acquisition deal with Pretium Resources

Kinross Gold’s $1.42bn acquisition of Great Bear Resources

Zijin Mining Group’s $763.83m acquisition deal with Neo Lithium

Chijin Internationa’s $501.95m acquisition of Golden Star Resources

Lundin Mining’s $484.7m acquisition deal with Josemaria Resources