Metals and mining industry merger and acquisition (M&A) deals announced globally in Q1 2022 totalled $7.8bn, led by China Fangda’s $1.7bn acquisition of Anyang Iron and Steel, according to GlobalData’s deals database.

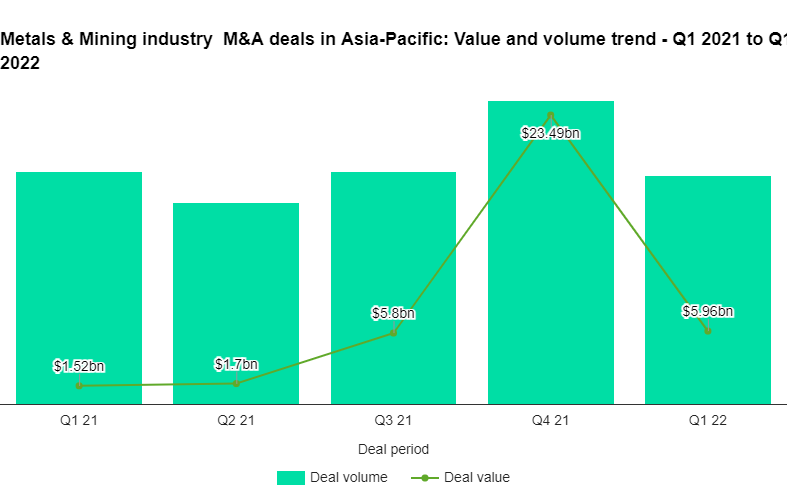

The value marked a decrease of 78.7% over the previous quarter of $36.38bn and a drop of 47.4% when compared with the last four-quarter average, which stood at $14.73bn.

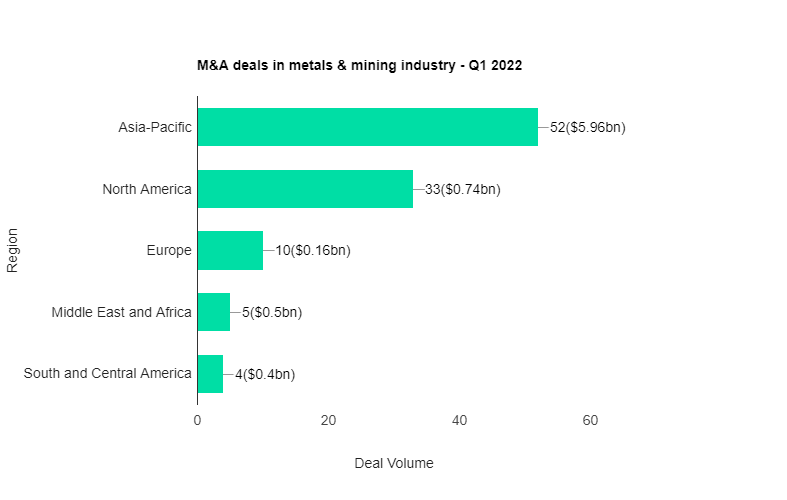

Comparing M&A deals value in different regions of the globe, Asia-Pacific held the top position, with total announced deals in the period worth $5.96bn. At the country level, China topped the list in terms of deal value at $3.96bn.

In terms of volumes, Asia-Pacific emerged as the top region for metals & mining industry M&A deals globally, followed by North America and then Europe.

The top country in terms of M&A deals activity in Q1 2022 was Canada with 19 deals, followed by China with 16 and Australia with 14.

In 2022, at the end of Q1, M&A deals worth $7.75bn were announced globally in metals & mining industry, marking a decrease of 1.2% year on year.

Top deals in Q1 2022

The top five M&A deals in metals and mining industry accounted for 1.2% of the overall value during Q1 2022. The combined value of the top deals stood at $5.27bn, against the overall value of $7.8bn recorded for the quarter.

The top five metals & mining industry metals and mining deals of Q1 2022 tracked by GlobalData were:

1) China Fangda’s $1.7bn acquisition of an 80% stake in Anyang Iron & Steel

2) Tata Steel Long Product’s $1.61bn acquisition of a 93.7% stake in Neelachal Ispat Nigam

3) Shanxi Coking Coal’s $1.04bn acquisition of a 51% stake in Huajin Coking Coal

4) Zhejian Flat Mirror Glass’s $525.78m acquisition of Anhui Dahua Oriental Mining and Anhui Sanli Mining

5) Newmont’s $400m acquisition of Minera Yanacocha