ESG will be the most important theme discussed in corporate boardrooms worldwide this decade. While previous decades have witnessed environmental movements, the current wave of sustainability consciousness is unprecedented.

Each new climate-related emergency, human rights violation, or corruption scandal reinforces the public opinion that companies must take meaningful steps to address environmental, social and governance (ESG) issues.

ESG has and will continue to govern how business is conducted globally. Stakeholders are demanding greater transparency and action on a full spectrum of ESG issues, and those that take ESG seriously will be better placed to succeed in the future.

Yesterday’s business leaders focused on beating quarterly profit targets

In 1970, economist Milton Friedman proposed that the best way businesses could help society was to focus entirely on maximising profits. He suggested that successful companies created wealth that trickled down through society, benefitting everyone. The doctrine caught on, particularly in the 1980s, when politicians and CEOs followed the mantra dutifully.

Top business schools, from Harvard to Wharton, built on this theory and supercharged it. They argued that inequality, pollution, tax avoidance, financial engineering and more were necessary trade-offs for a prosperous economy.

From the 1980s to the 2000s, these schools taught armies of students that profits were paramount. Today, the brightest and best of this generation of graduates dominate the leadership positions in the world’s largest multinational companies.

Equity analysts at the big investment banks — many of whom also graduated from the same business schools — judged the performance of CEOs on their ability to hit quarterly earnings targets rather than their ability to build sustainable businesses.

Consequently, society and the environment have paid a high price for short-term profit. There are examples of corporate excess across the spectrum:

- Mining companies displace entire villages to access minerals

- Retailers purchase clothes from suppliers whose factories ignore health and safety regulations

- Banks, laden with conflicts of interest, regularly abuse their client’s trust

- Ecommerce companies aggressively avoid local taxes and implement inhumane working conditions

- Food and beverage companies generate plastic waste at a scale that endangers entire species of wildlife in our oceans

- Carmakers openly lie about the pollution caused by their diesel engines

- Internet platforms fail to protect our children from harm

The financial crisis of 2007 cast a shadow over the free-market doctrine that previously governed the corporate world.

The public began to question profiteering by big business and put pressure on regulators to tighten controls. At the same time, the consequences of climate change are evident, leading many to demand that companies are more transparent about their environmental impact.

Today, ESG strategies are not optional

Now, pressure is mounting on companies. Evidence of this came in August 2019, when the influential Business Roundtable in the US redefined the purpose of a corporation, saying that businesses should promote “an economy that serves all Americans,” including customers, employees, suppliers and communities, not just shareholders.

Large asset managers vote against the management of companies they believe are not adequately addressing ESG risks in their business strategies. Governments expect companies to publish their net-zero plans and establish quantifiable science-based targets. Companies impose rigorous social and environmental requirements for their suppliers.

The next generation of consumers has a greater sense of responsibility towards the world into which they were born. As this new generation rises through the ranks of the global workforce, they will approach business decisions with a more sustainable mindset. As consumers, they will be attracted to more sustainable products.

To survive, companies must combine their traditional profit motive with sustainable practices.

The ESG action feedback loop

For decades, the reigning philosophy of business management was the one promulgated by economist Milton Friedman, who favoured free-market principles and minimal regulation. Friedman’s view was that corporations were solely responsible to their shareholders and bore no responsibility to anyone or anything else, including the environment.

While this view was never universal, it held great sway among corporate managers even as environmental awareness grew and governments adopted environmental protections.

The financial crisis of 2007 cast a shadow over Friedman’s free-market doctrine. The public began to question profiteering by big business and put pressure on regulators to tighten controls. At the same time, the consequences of climate change became more apparent, leading many to demand that companies be more transparent about their environmental impacts.

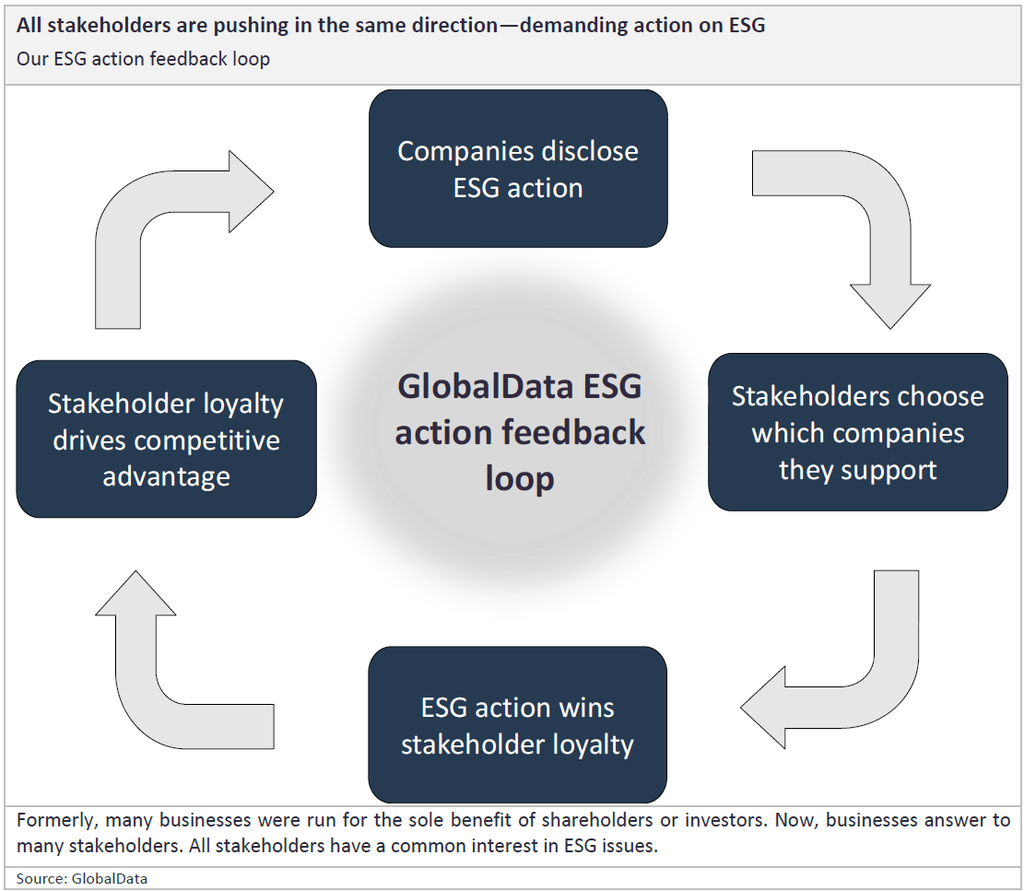

A new market mechanism is emerging that promises to drive progress, which we call the ‘ESG action feedback loop’. In short, companies act on ESG and win stakeholder support, for instance from customers, partners, employees and investors. This drives a reputational and competitive advantage, which incentivises further action and participation.

GlobalData, the leading provider of industry intelligence, provided the underlying data, research, and analysis used to produce this article.

GlobalData’s Thematic Intelligence uses proprietary data, research, and analysis to provide a forward-looking perspective on the key themes that will shape the future of the world’s largest industries and the organisations within them.