Legislation

What’s in the Inflation Reduction Act for miners?

Matthew Farmer investigates the US’s ground-breaking bill, and how it incentives mining energy transition minerals.

O

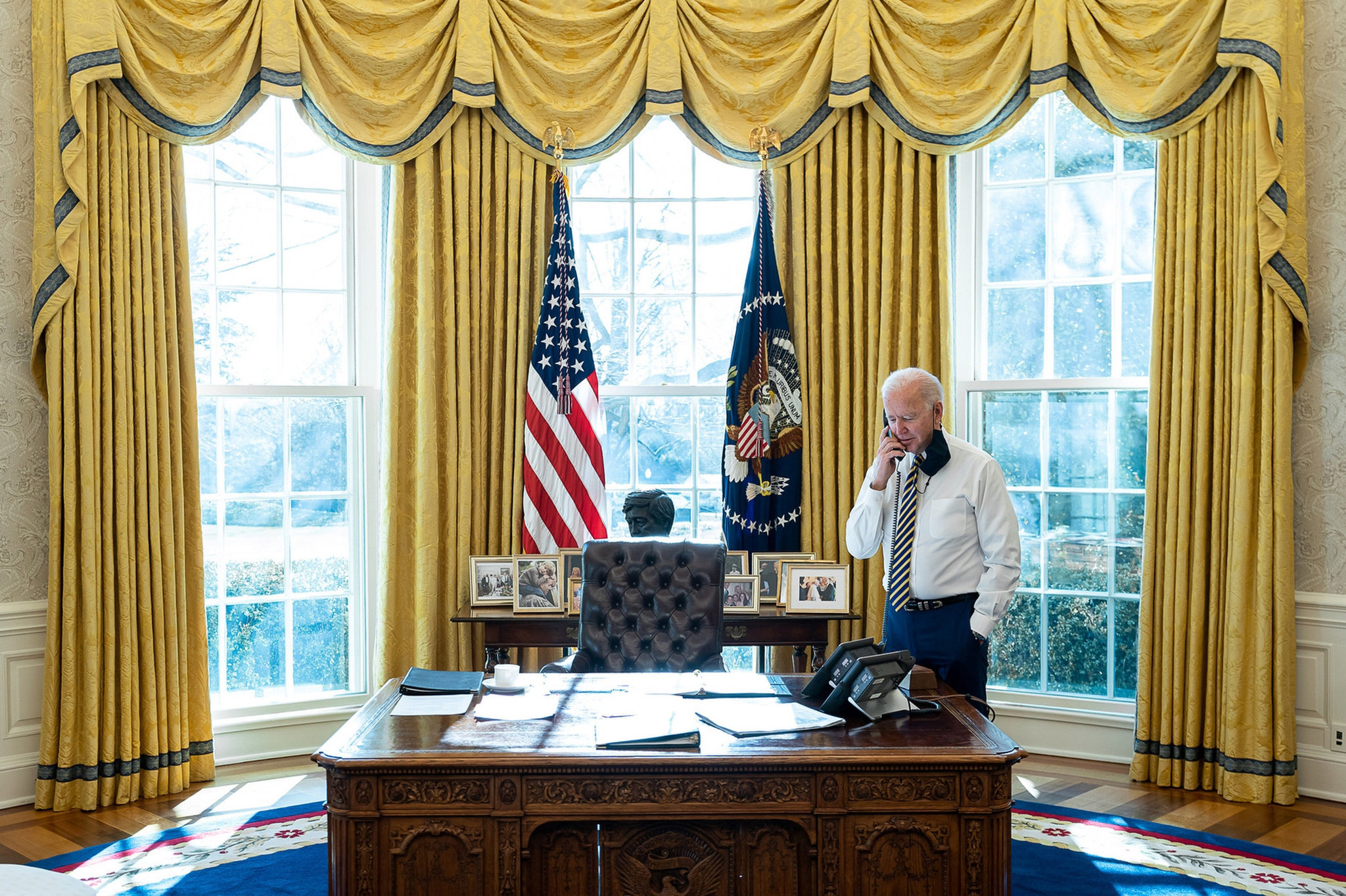

n 17 August, US president Joe Biden signed the Inflation Reduction Act of 2022 into law. This bill, boasting the largest dollar value of in US history, faced several revisions to make it more agreeable to the US senate. After more conservative voices within Biden’s party negotiated down specific payments, the bill passed the senate in a tie-broken 51-50 vote.

The $750bn bill primarily addresses healthcare and tax reforms, but could have critical influence over the future of US climate commitments. Supporters have hailed this as the US’s first true climate bill, pointing to its legal requirement for the country to reduce greenhouse gas emissions by 40% between 2005 and 2030.

“With this law, the American people won and the special interests lost,” declared Biden on the signing of the bill. But with more than half a million people employed in mining in the US, it remains to be seen how the new law will affect this critical sector.

Rare earth mining receives tax break

The act names 50 “applicable critical minerals” for the energy transition in section 45X(c)(6). Most of these will hold few surprises for miners; the list includes battery metals cobalt and lithium, as well as several other s-block metals such as caesium and beryllium. The list also specifies almost all rare earths metals, including neodymium, which is used in powerful turbine magnets.

Aluminium, tin, nickel, graphite, and chromium also make the cut, with the US apparently eager to enshrine its new mineral priorities into law.

Mining companies excavating these metals will be able to seek production credit equal to 10% of production costs. The extracted minerals must meet defined purity thresholds to qualify for the credit, as laid out in the act.

The bill aims to build electric vehicle supply chains within the US, responding to the growth of China’s EV industry.

The bill also aims to build electric vehicle (EV) supply chains within the US, responding to the growth of China’s EV industry. While stoking fears of Chinese dominance of critical minerals will do little to ease tensions between the US and China, this approach has played a key part in gathering enough support for the bill within Biden’s own party.

The last holdout in Biden’s party, West Virginia senator Joe Manchin, was won round by clauses supporting the US mining industry. He said: "Our persistent and increasing dependence on foreign energy and supply chains from countries who hate America represents a clear and present danger and it must end.”

As a result, resource nationalism will likely play a role in any future legislation concerning EV mineral extraction.

Electric vehicle tax breaks “present a challenge”

Manufacturers of EVs will be able to apply for a tax credit if their vehicles meet minimum amounts of US-manufactured components. For miners, this indirectly creates a market for battery metals from US-allied countries.

Page 386 of the act specifies the minimum thresholds of minerals contained in US-manufactured EV batteries to qualify for the tax credit. After passage of the act, at least 40% of critical minerals in US-made EV batteries must come US miners or recycling plants, or mines in countries with free trade deals with the US.

This requirement will then rise by 10% each calendar year, to a maximum of 80% in 2027.

The act also sets minimum percentages for the value of battery components sourced from North America required for a project to receive tax credits.

The act also sets minimum percentages for the value of battery components sourced from North America required for a project to receive tax credits. Before 2024, at least 50% of the value of a US-made battery’s components must come from North America. This rises to 60% in 2024 and 2025, 70% in 2026, and then 10% more each year until reaching 100% in 2029.

Representatives of the car manufacturing industry have criticised the credit for its high thresholds. After the bill passes, only 21 models of the electric vehicle will qualify for the subsidy, out of 72 available EV models. When criteria increase at the end of 2022, some of these will likely become ineligible, and while the impacts on the automotive industry more broadly are unclear, this rising threshold could push domestic mines to increase production in the short-term.

The Inflation Reduction Act and the electric future

Lithium miner Albemarle, based in North Carolina, US, told S&P Global that the act represents a “positive step forward” for its business. However, a company statement said that “[the act’s] conditions and timeline for the credit on EVs is challenging given the battery industry largely operates in Asia and the domestic supply chain is in early development.”

If EVs cannot qualify for government subsidies, then the market will likely remain closed to the average consumer. Practically, this would mean little increase in demand for EVs, and resultingly slower growth in battery minerals.

If EVs cannot qualify for government subsidies, then the market will likely remain closed to the average consumer.

However, this slower growth may be by design, and could give US companies time to build up supply chains to meet the transition.

In a note on the act, Simon Moores, chief executive of lithium market analyst Benchmark said that it would be “almost impossible” for any countries in the US’s Fair Trade Alliance to fully replace China’s role in EV raw materials imports before 2024. Instead, he commented that establishing a new US-based supply chain would take “the best part of a decade”.

// Main image: President Biden. Credit: Marlin360 via Shutterstock