Fuel and power costs rising most for miners, with 45% looking for other suppliers

Nearly 50% of respondents in a survey of more than 100 miners cited a fuel and power price increase of more than 30%.

While rising inflation is affecting all aspects of mining operations, it is fuel and power costs that are rising the most, according to a survey of more than 100 miners conducted by GlobalData in August and September.

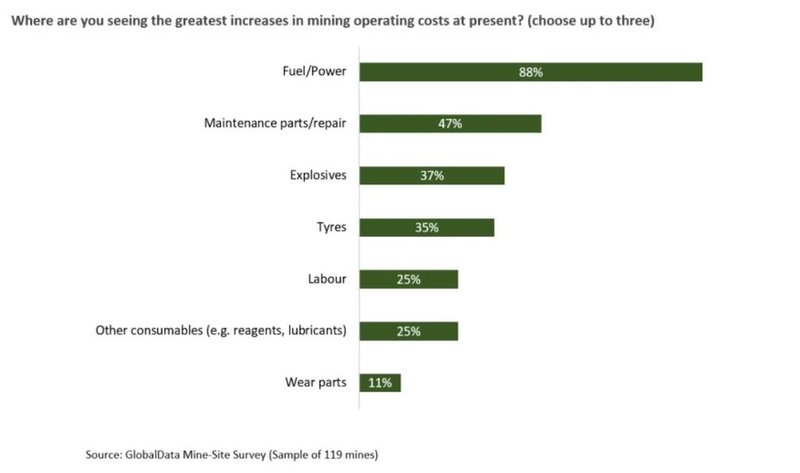

When asked where they were seeing the greatest increase in mining operating costs at present, 88% selected fuel and power as one of the top three areas, followed by maintenance parts and repair (47% of respondents) and explosives (37%).

The increases being experienced in fuel and power costs were also substantial, relative to the 12 months earlier. Some 89% of respondents have experienced fuel and power price increases of 11% or more, with 48% citing an increase of more than 30%. Meanwhile, price increases of over 30% were experienced by 29% of respondents when it came to explosives, which is to be expected given the rising cost of its raw materials.

For other consumables and maintenance parts and repair, 28% of respondents had experienced price increases of 21% or more, while elsewhere increases were not so severe; the most common price increase for wear parts and tyres was 11%-20%, whilst for labour, it was 6%-10%.

Price increases have also encouraged miners to seek out new suppliers more than before. Overall, 30% strongly agreed and 45% agreed with the statement: “we have looked for alternative suppliers more this year than before because of higher prices”.

Similarly, 45% confirmed they had specifically looked for a new supplier for fuel or power, with even higher shares of 70% for wear parts and 75% for other consumables, such as reagents and lubricants.

// Main image: Excavator at a mine. Credit: Fotowerkstatt-KS via Shutterstock

COMMENT