Deals in brief

Powered by

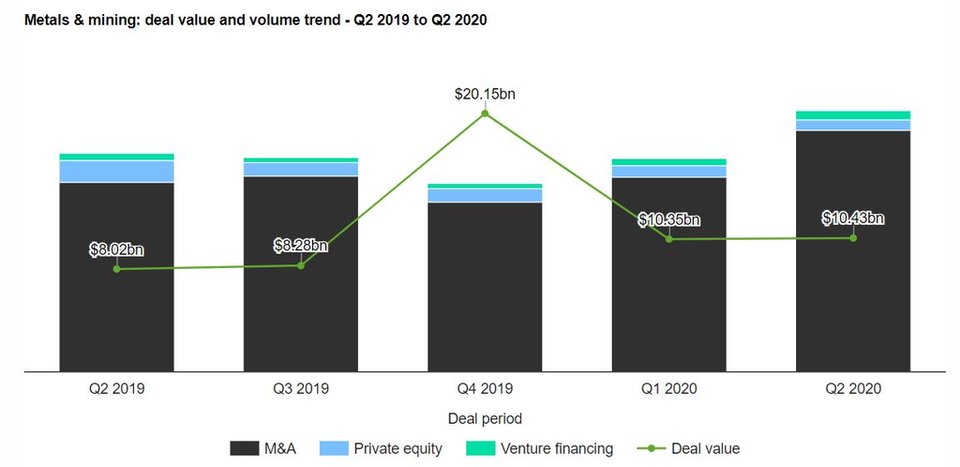

Metals & mining industry deals in Q2 2020 total $10.43bn globally

Total metals & mining industry deals for Q2 2020 worth $10.43bn were announced globally, according to GlobalData’s deals database.

The value marked an increase of 18.6% over the previous quarter and a drop of 10.8% when compared with the last four-quarter average of $11.7bn.

In terms of number of deals, the sector saw a rise of 25.2% over the last four-quarter average with 408 deals against the average of 326 deals.

In value terms, Asia-Pacific led the activity with deals worth $4.76bn.

Metals & mining industry deals in Q2 2020: Top deals

The top five metals & mining deals accounted for 57% of the overall value during Q2 2020.

The combined value of the top five metals & mining deals stood at $5.94bn, against the overall value of $10.43bn recorded for the month.

The top five metals & mining industry deals of Q2 2020 tracked by GlobalData were:

1) Vedanta Resources’ $2.15bn acquisition of Vedanta

2) The merger of Alacer Gold and SSR Mining for $1.78bn

3) Templar Investments’ $1bn private equity deal with Jindal Shadeed Iron & Steel

4) The $548m acquisition of Tibet Julong Copper Industry by Tibet Zijin Industrial

5) Newcrest Mining’s asset transaction with Blackstone Tactical Opportunities Fund, Lundin Gold and Orion Resource Partners (USA) for $460m

Rio Tinto Exploration to explore Sipa’s Paterson North project

Gold and base metals explorer Sipa Resources has signed a A$12m ($8.54m) farm-in and joint venture agreement with Rio Tinto’s exploration unit RTX.

The agreement is related to Sipa’s Paterson North copper-gold project in Western Australia (WA).

Auryn to acquire Canadian explorer Eastmain and spin out Peruvian projects

Vancouver-based Auryn Resources and Canadian explorer Eastmain Resources have signed a definitive agreement, pursuant to which the former will acquire all of the shares of the latter.

The combination of these two companies will create new Canadian gold developer, Fury Gold Mines.

Middle East and Africa’s metals & mining industry sees a rise of 16.7% in deal activity in Q2 2020

A total of 28 deals worth $1.44bn were announced for the region during Q2 2020, against the last four-quarter average of 24 deals.

Of all the deal types, M&A saw most activity in Q2 2020 with 26, representing a 92.9% share for the region.

Vale and Progress Rail develop first 100% battery-powered locomotive

Brazilian mining major Vale, in partnership with Caterpillar company Progress Rail, is developing a new 100% electric, battery-powered locomotive.

The latest move comes as part of the mining giant’s efforts to move toward more environmentally friendly operations by reducing greenhouse gas emissions.

India’s Runaya and Australia’s Minova partner to make mining products

Indian firm Runaya has signed a joint venture agreement with Australian firm Minova to manufacture products for the mining sector.

Minova is a wholly-owned division of Australia-based Orica, which is a provider of mining support systems and explosives.

Artemis to sell interest in Mt Clement gold project to Northern Star

Artemis Resources has signed a binding sale agreement with Northern Star Resources to sell its interest in the Mt Clement gold project in Western Australia.

Located 30km southwest of Northern Star’s Paulsen’s gold mine, the Mt Clement project has a JORC resource of 64,400 ounces of gold and 618,500 ounces of silver.