The potential to boost efficiency and optimise production is expected to drive a large share of miners to invest in predictive maintenance for mobile equipment and mine-management software in the next two years.

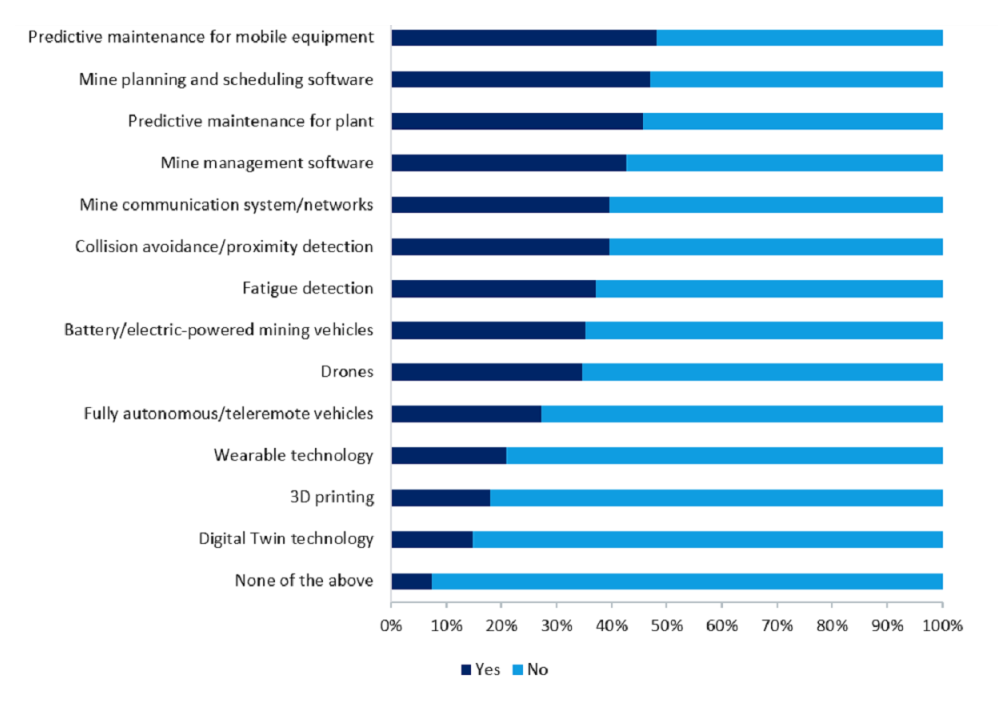

Leading data and analytics company GlobalData’s latest mine-site survey, conducted between February and May 2024, revealed that while more than 66% had made at least moderate investments into predictive maintenance for mobile equipment globally, 48% of miners surveyed expected to either invest in the technology for the first time or invest further in the coming two years.

This was marginally ahead of those expecting to invest in mine management software (47%), and investment expectations were considerably higher for small- and mid-tier miners (62%) compared with majors (47%), with the former currently lagging behind the latter in terms of the degree to which they have invested in predictive maintenance for mobile equipment so far.

Almost half of respondents expect to invest in predictive maintenance for mobile equipment within the next two years. Source: Global Mine-Site Technology Adoption Survey, 2024. Credit: GlobalData

Comparing the different regions, a high share of South African respondents (66.7%) expect to invest in predictive maintenance for mobile equipment in the coming two years, followed by 62.5% of respondents from Canada, and 42% of respondents from both Peru and the US.

At present, the South African respondents also considered themselves to have progressed the most with regards to their investment with 16.7% saying they had fully implemented the technology, 50% saying they had made considerable investment, and 5.6% moderate investment.

This collective 72.3% compares with the 67% from the 2020 survey who considered themselves to have made at least moderate investment in predictive maintenance for mobile equipment at that time.

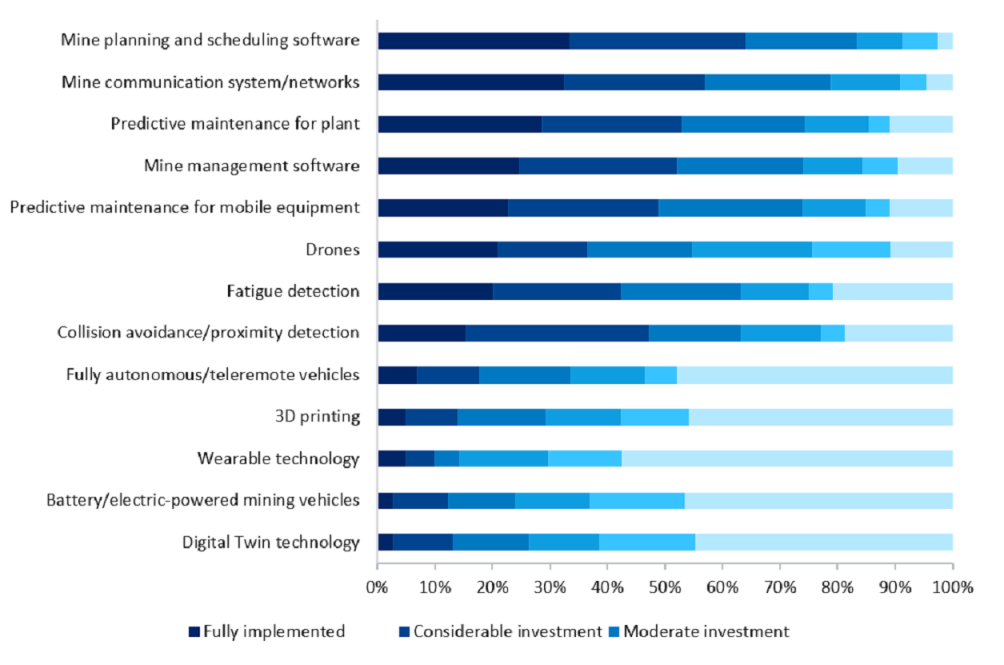

Overall, the areas where miners had invested to the greatest extent were mining planning and management software, mine communications systems, and predictive maintenance for plants.

Mining planning and management software was found to be one of the top areas of investment by miners. Source: Global Mine-Site Technology Adoption Survey, 2024. Credit: GlobalData

A total of 162 mines were surveyed, with the respondents including mine managers, general managers, and mine-site IT managers, amongst others.

Of the respondents, 33% were from Africa; 28% from the Americas; 17% from Asia; 14% from Oceania, and 8% from Europe and the Middle East.