Feature

Australasia’s investment in mining technology – survey

Australasia is a leader in mine communication and management systems, drones, autonomous vehicles and safety-related tech. Candiece Cyrus reports.

Main image: As AI further enhances the appeal for digital technologies, GlobalData’s survey suggests that Australasian miners will continue to invest considerably across most tech areas over the coming years. Photo by Anton Petrus via Getty Images

The Australasian mining industry has ploughed funds into numerous technologies over the past two decades, from communication and management systems to drones and autonomous vehicles. According to the Minerals Council of Australia, the Australian mining industry directed $30bn into tech development and research between 2005 and 2022.

The Global Mine-Site Technology Adoption Survey, 2025, conducted by MINE’s parent company GlobalData, reveals that Australasian respondents are embracing a wide array of technologies designed to improve productivity, safety and cost-efficiency, especially in remote locations.

As AI further enhances the appeal for digital technologies, GlobalData’s survey suggests that Australasian miners will continue to invest considerably across most tech areas over the coming years.

Trends in Australasian mining tech investments

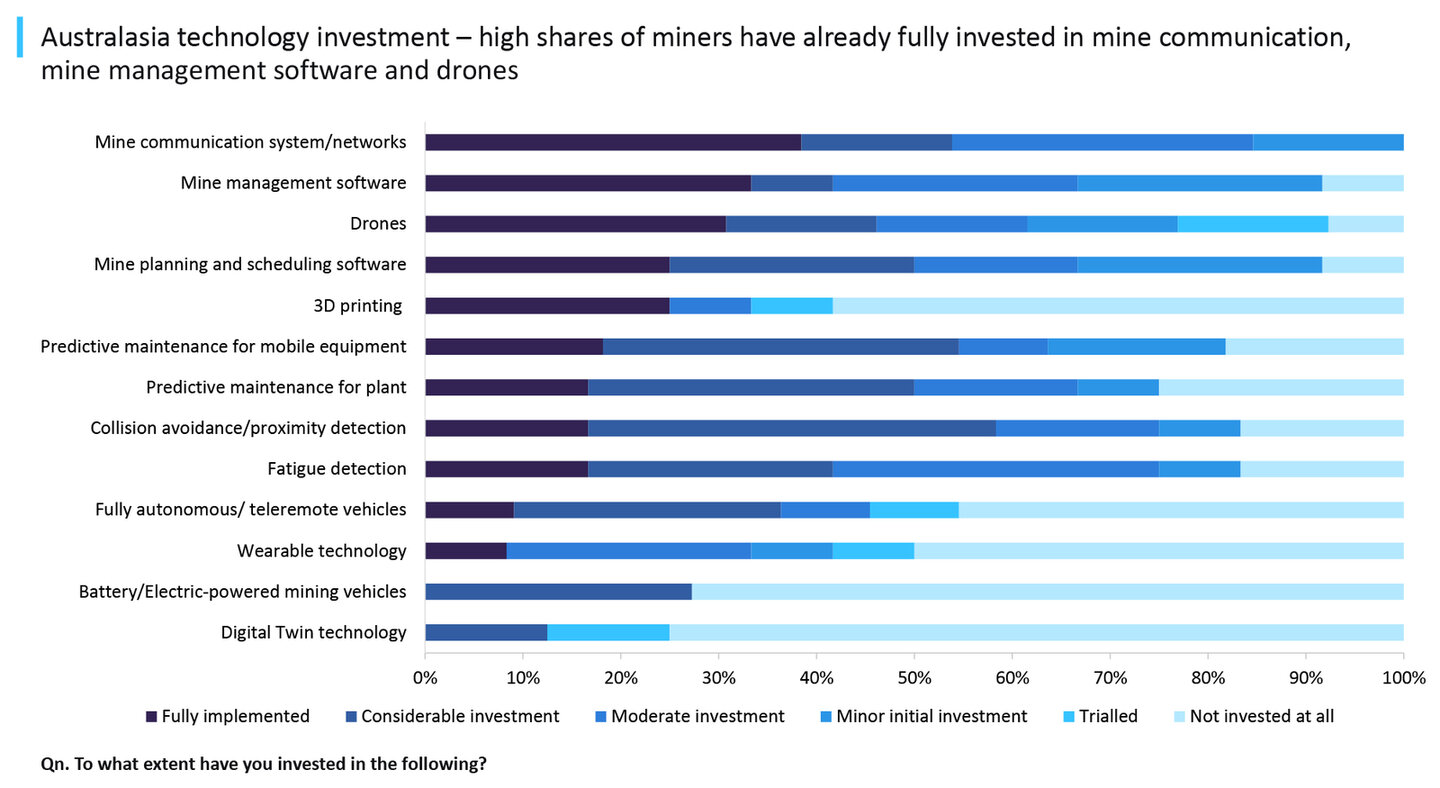

A large share of respondents said they have already “fully implemented” mine communication systems, mine management software and drones, equating to 38.5%, 33.3% and 30.8% of respondents, respectively. According to Dave Kurtz, global head of mining research at GlobalData, this reflects a wider trend of Australasians being “among the highest adopters of productivity and safety-related technologies” globally.

Source: GlobalData, Mine Site Technology Adoption Survey: 2025

Communication networks are the nexus for a range of smart technologies, including robotics and drones, enabling users to optimise an array of activities such as drilling, blasting and hauling to boost production. They also reduce the need for human intervention, which in turn minimises safety risks.

The introduction of 5G Internet of Things (IoT) networks have further enhanced the role of mine communication systems. Integrating IoT and satellite technologies, for instance, has enabled miners to connect larger numbers of machines and networks to run from the headquarters thousands of miles away.

If a communication network is the web connecting all technologies together, a mining management system is the brain of the operation organising and leading all processes, from improving forecasting to ensuring compliance and automating instructions for robots.

Mine communication and management systems are essential for productivity because they provide the potential to fully upgrade a mining site rather than simply integrate new technologies into legacy systems, Kurtz explains.

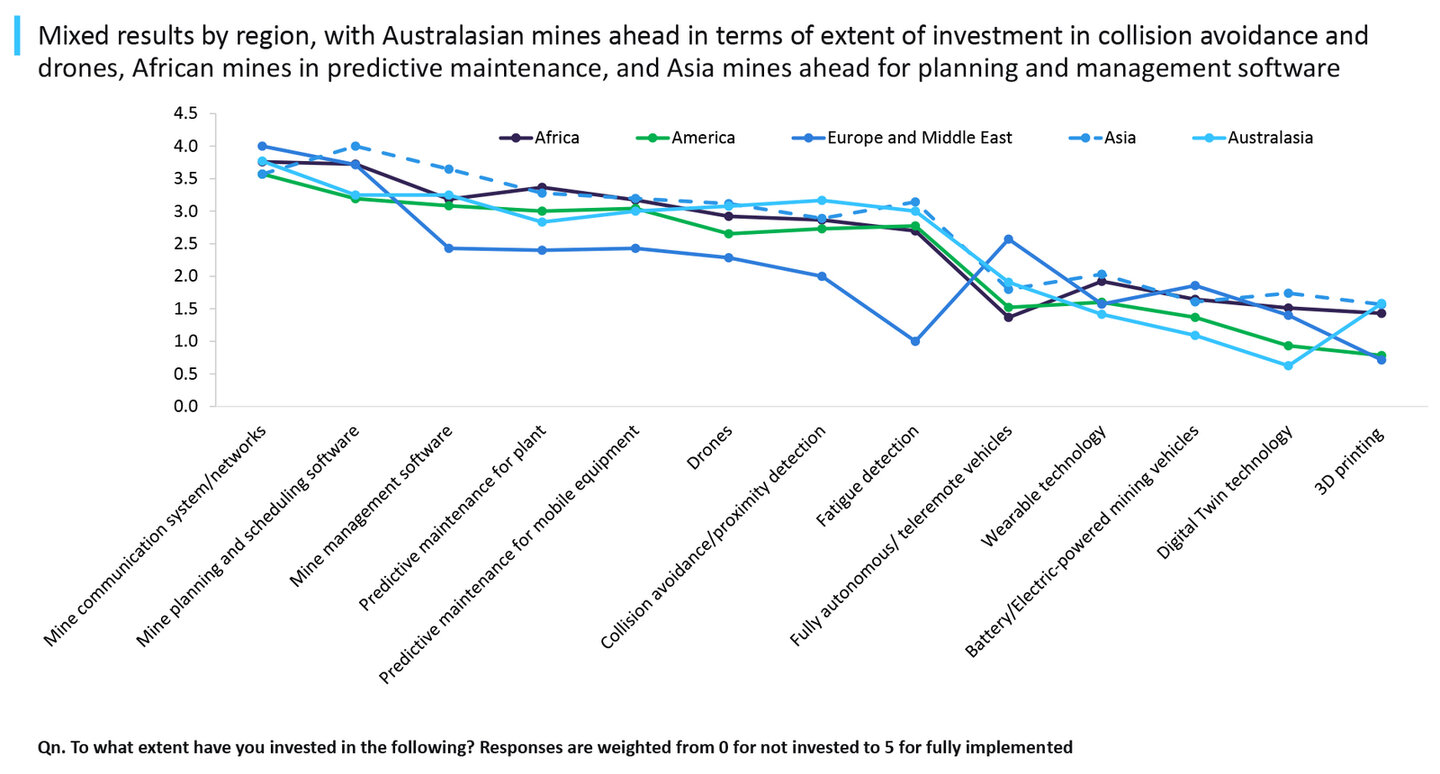

Meanwhile, drones are becoming a “necessity” for both productivity and safety as miners move into deeper and more remote terrain, says GlobalData strategic intelligence analyst Aidan Knight. With 95,000 historic and active mineral extraction sites, most of which are in remote areas, Australia is actively investing in drones to optimise mining operations. Among many other applications, drones can conduct site surveys far more cost-efficiently than humans and reduce safety risks by detecting gas and managing ventilation control systems, which all contribute to reducing safety risk. Australasian miners respondents mostly responded as only having considerably or moderately invested in, rather than fully implemented, collision avoidance, proximity detection and fatigue detection – technologies critical to improving safety. However, when compared with the global rate of investment, the region still leads in these areas.

Source: GlobalData, Mine Site Technology Adoption Survey: 2025

Australia is an early adopter of fatigue detection technology, with reports showing the country has developed, and used it for over 20 years. This again represents the region’s focus on mining safety, also reflected in their relatively stricter and more progressive safety regulations compared to many other regions. Notably, Australia updated over 60 mining safety standards for 2025, increasing the number of related regulatory requirements by 15%.

Although most Australasian respondents said they have put little to no investment into autonomous vehicles, this does not reflect their level of adoption. Industry experts widely view autonomous vehicles as a necessity to boost productivity by enabling deeper extractions in hard-to-reach places. Australia has led in this area for years, which explains the current lack of investment compared to other tech areas. In 2016, Rio Tinto’s Yandicoogina and Nammildi mines in Western Australia (WA) became the first in the world to use driverless trucks to transport all their ore.

“Australia was an early adopter of autonomous haul trucks, led by BHP, Rio Tinto and Fortescue, and now has over 1,000 autonomous or autonomous-ready surface mining trucks – the second highest globally after China,” says Kurtz.

Expected Australasian tech investments

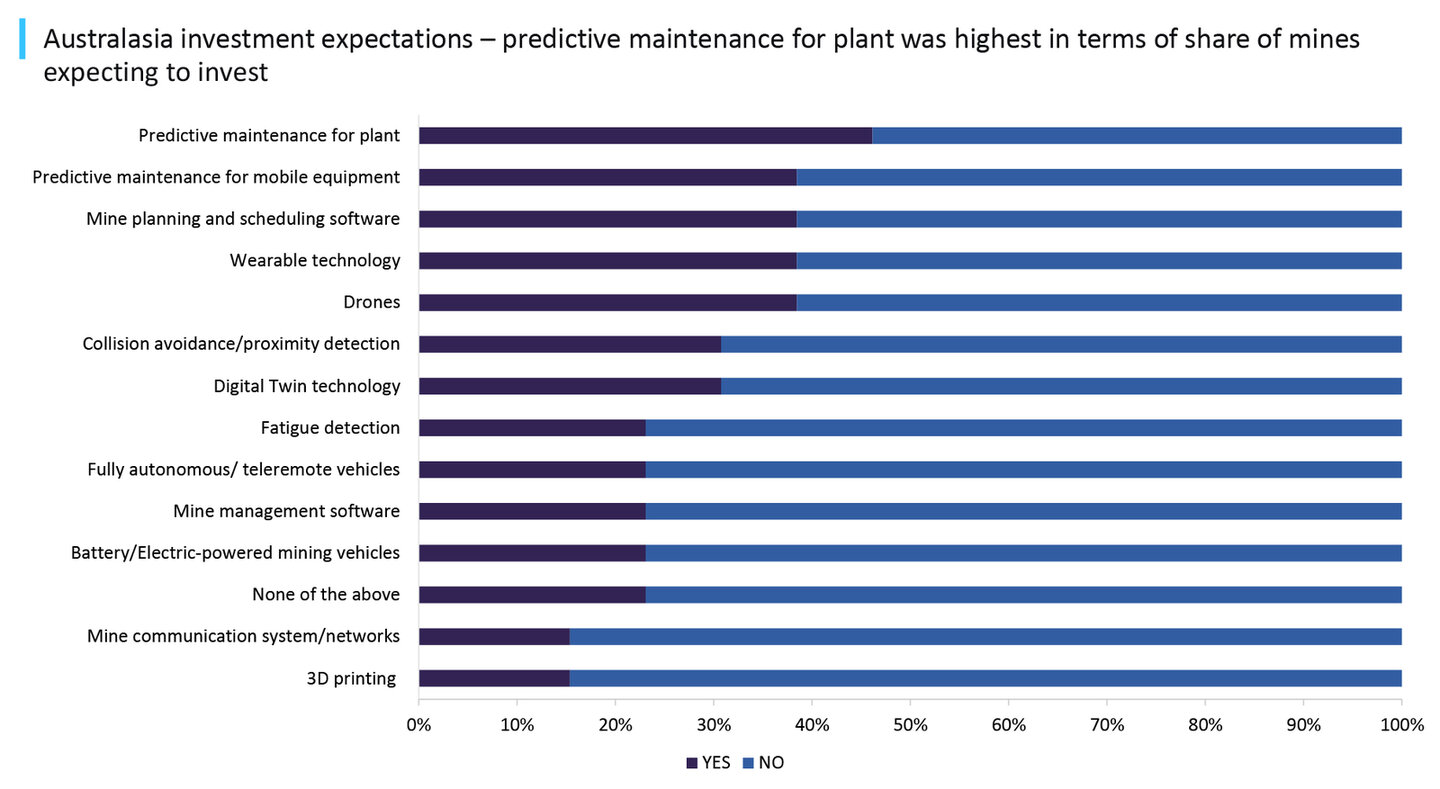

Looking ahead over the next two years the Australasian miners surveyed are prioritising predictive maintenance for future investment.

Source: GlobalData, Mine Site Technology Adoption Survey: 2025

Predictive maintenance helps mines improve safety and reduce downtime, addressing issues like dirty power. The introduction of AI in predictive maintenance over the last decade has only helped to increase its advanced analytics capabilities and attract investment as Australia welcomes its fourth industrial revolution.

“Investment in predictive maintenance has been strong but is expected to grow even more due to the huge costs associated with downtime in the mining industry, which the technology can help minimise,” says Kurtz. The survey followed a string of Australian mines recently halting operations due to downtime. This includes Glencore closing its Mount Isa copper mines in July mainly due to high operating costs and depleting ore reserves. Oaky Creek also suspended operations from April to July, following water leaks that resulted in an evacuation, and BHP has suspended its nickel operations into 2027 due to financing issues and market shifts.

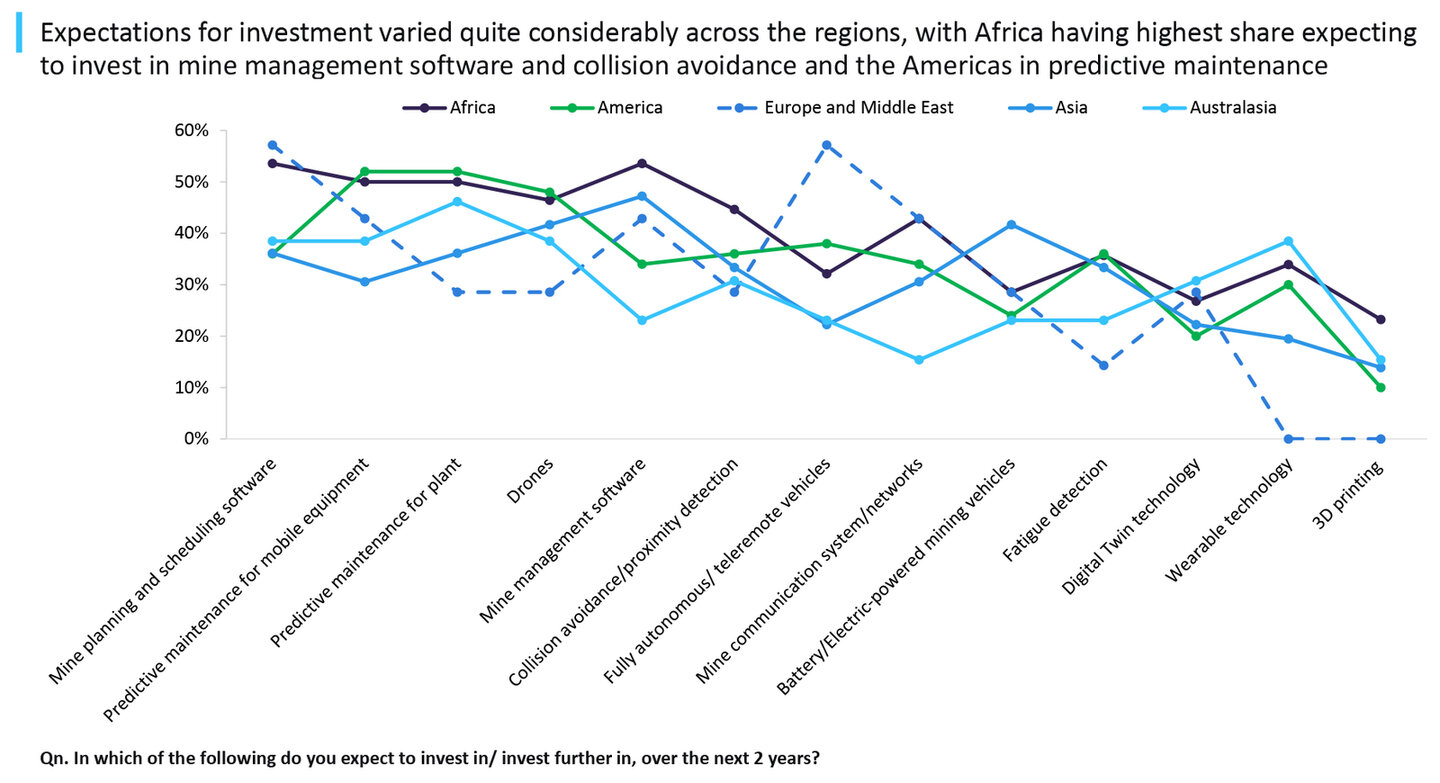

Investment in wearable tech, which Australasian miners said currently lacks, will begin to pick up momentum in the coming years. Wearables such as wristbands, smart watches and little box devices can detect various signs of a safety risk, such as increased heart rate or worrying changes in body posture. Similarly, while Australasian respondents said they’d invested the least in digital twin technology compared to respondents from other regions, Australasians are expected to invest the most going forward.

Source: GlobalData, Mine Site Technology Adoption Survey: 2025

Digital twin technology has grown in prominence over the last decade, helping mining companies test scenarios and assess risk before deciding whether to make changes in reality.

While only the big players in Australasia, such as Rio Tinto and BHP, are currently in the game (explaining the limited uptake by respondents) increasingly more miners are looking to invest in the technology as bigger companies demonstrate its potential.

This is evident across all technology types, according to Kurtz: “While spending was dominated by the major miners, and at the largest mines, we are seeing mid-size and smaller miners increasingly closing the gap on the majors in terms of technology adoption, although adoption of autonomous equipment will remain primarily amongst the larger mines due to barriers such as high capital costs.”

Australasian respondents said they expect to moderately invest in autonomous and battery electric-powered vehicles.

Conversely, the current momentum for investment in fatigue detection and collision avoidance is set to slow down in Australaisa, as attention shifts elsewhere. Investment in mine communication networks, which Australasian respondents said they have currently implemented the most, is also expected to attract less investment over the next two years. “Communication networks are amongst the most 'fully invested' of the technologies, so more mature in terms of investment already,” explains Kurtz.

“Going forward we expect to see investment in AI-related technology, such as digital twins, predictive maintenance and drones, as miners strive to further enhance productivity,” Kurtz summarises.

AI in Australasian mining

AI is a key element of the technological transformation in mining. GlobalData estimates that mining companies’ spending on AI will grow from $2.7bn in 2024 to $13.1bn by 2029.

AI’s impact on Australasian mining is clear, with industry heavyweights such as Rio Tinto making huge strides in its adoption. This includes AI applications at its Gudai-Darri mine in Pilbara, Australia, where the company is creating a 3D model of the mine, using AI-powered digital twin technology to monitor and respond to in real time as well as plan their work, access related documents and data and carry out interactive training. Rio Tinto has also harnessed AI in biodiversity efforts at its Weipa mine in Australia, where researchers developed a machine-learning pipeline to detect, monitor and conserve palm cockatoos in the area.

Caterpillar has found the use of AI in autonomous trucks to reduce instances of safety compromises by 50% and mine costs by 20% at Jimblebar, a BHP-owned mine in Pilbara. AI-powered collision avoidance systems also reduced the number of accidents that take place between vehicles and personnel.

Australian mining major Fortescue has also seen great success in applying AI for autonomous drilling and large autonomous fleets. The company said AI implementation has led to an increase in productivity of close to 30%.