DATA

Mergers and acquisition deals in mining total $6.2bn in Asia-Pacific in Q3 2022

With a 23.54% share of all deals and agreements valued at $2.34bn, China completed the most deals in the third quarter of 2022.

Powered by

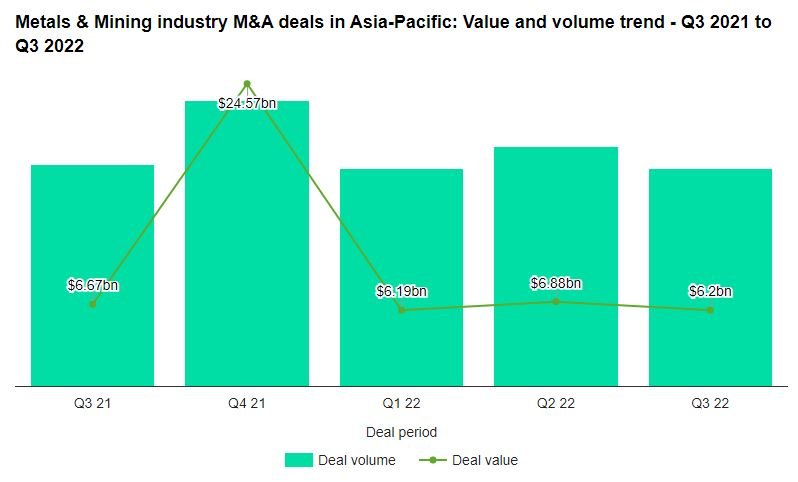

Total metals and mining merger and acquisition (M&A) deals worth $6.2bn were announced in Asia-Pacific in Q3 2022, led by Aluminum of China’s $986.4m acquisition of a 19% stake in Yunnan Aluminium, according to GlobalData’s deals database. The value marked a decrease of 9.9% over the previous quarter and a drop of 44% when compared with the last four-quarter average of $11.1bn.

In terms of deal activity, Asia-Pacific recorded 99 deals during Q3 2022, marking a decrease of 9.2% over the previous quarter and a drop of 9.8% over the last four-quarter average. Australia recorded 48 deals during the quarter.

Top deals

The top five mining M&A deals accounted for 49.1% of the overall value during Q3 2022.The combined value of the top five M&A deals stood at $3bn, against the overall value of $6.2bn recorded for the quarter.

The top five metals & mining industry deals of Q3 2022 tracked by GlobalData were:

- Aluminum of China’s $986.35m acquisition deal for a 19% stake in Yunnan Aluminium

- The $629.57m acquisition of a 51% stake in Xinyu Iron and Steel by the China Baowu Steel Group

- The $501.77m merger signed between Tata Steel and Tata Steel Long Products

- The $471m acquisition of PTT Mining by PT Astrindo Nusantara Infrastruktur

- The $452.77m merger of Tata Steel and Tin Plate of India