DATA

Hiring activity in the mining industry decreased by 8% in Q4 2022

Software and web developers, programmer and tester jobs accounted for a 3% share of the global mining industry’s new job postings in Q4 2022, down 25% over the prior quarter.

Powered by

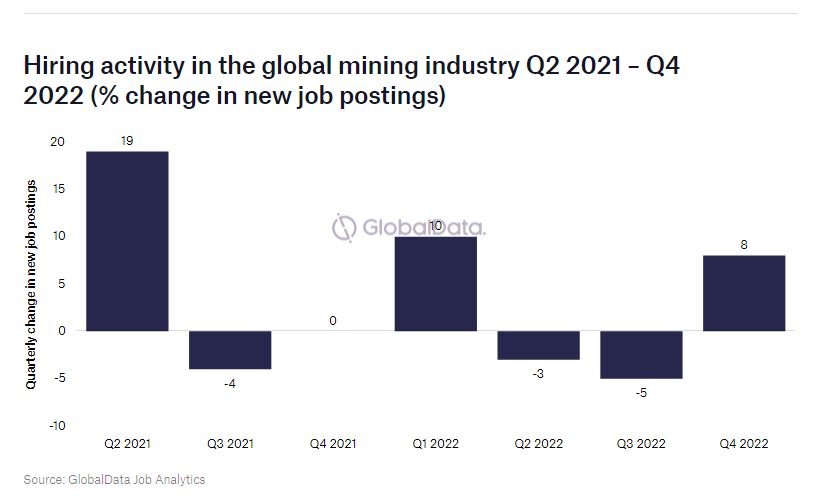

The global mining industry experienced an 8% drop in new job postings in Q4 2022 compared with the previous quarter, with Komatsu responsible for the most new job postings with 6,241, according to GlobalData’s analysis of mining company job postings.

Software and web developers, programmers and testers, with a share of 3%, were the occupations with the greatest hiring activity in the global mining industry in Q4 2022, ahead of miscellaneous engineers with a 2% share of job postings.

The other prominent roles include computer and information systems managers, marketing and sales managers and database and network administrators and architects, all of which accounted for 2% of new job postings.

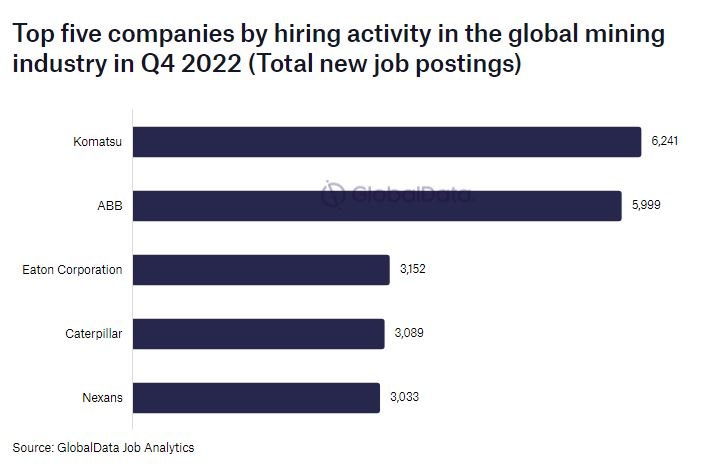

The top five companies, in terms of number of new job postings tracked by GlobalData, accounted for a combined 30% share of the overall hiring activity in the global mining industry in Q4 2022.

Komatsu posted 6,241 jobs in Q4 2022 and registered a drop of 33% over the previous quarter, followed by ABB with 5,999 jobs and a 104% growth. The Eaton Corporation with 3,152 jobs, and Caterpillar with 3,089 jobs, both saw a 21% fall in job postings, while Nexans recorded a 26% drop, with 3,033 job postings during Q4 2022.

North America held the leading share of the new job postings in the global mining industry with a 53% share, 0.6% higher over Q3 2022. The Middle East and Africa stood next, with a 23% share, ahead of Europe, which posted a share of 22%, a 9% decline over the previous quarter.

Asia-Pacific was the next-most impactful region, with an 18% share, registering a 17% decline over Q3 2022, while South and Central America accounted for a share of 13%.