DATA

Asia-Pacific’s mining industry saw a drop of 26.32% in deal activity in November 2022

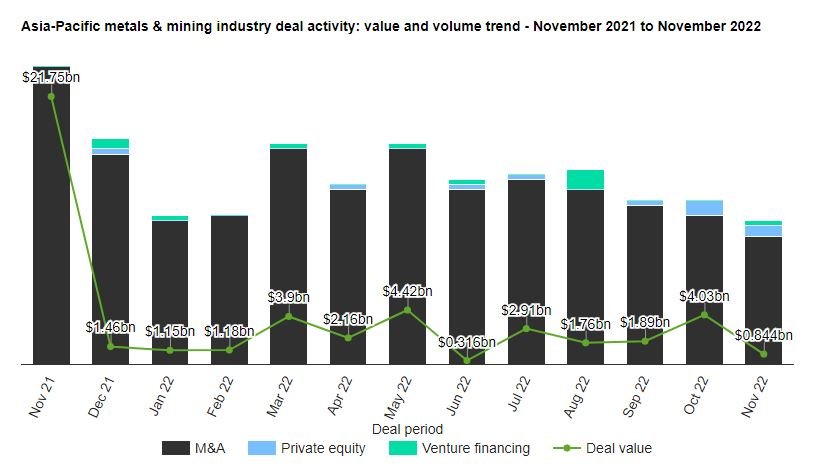

A total of 28 metals and mining industry deals worth $843.6m were announced for the region in November 2022, against the 12-month average of 38 deals.

Powered by

Asia-Pacific’s metals and mining industry saw a drop of 26.32% in deal activity during November 2022, when compared with the last 12-month average, led by Jinshan (Hong Kong) International Mining’s $565m acquisition of 20% stake in Zhaojin Mining, according to GlobalData’s deals database.

Of all the deal types, mergers and acquisitions (M&As) saw most activity in November 2022 with 25 transactions, representing an 89.3% share for the region. In second place was private equity with two deals, followed by venture financing deals with one transactions, respectively capturing a 7.1% and 3.6% share of the overall deal activity for the month.

In terms of value of deals, M&A was the leading category in Asia-Pacific’s metals & mining industry with $840.6m, followed by private equity deals totalled $3m.

The top five metals and mining deals accounted for 99.3% of the overall value during November 2022. The combined value of the top five metals and mining deals stood at $837.94m, against the overall value of $843.6m recorded for the month.

The top five metals & mining industry deals of November 2022 tracked by GlobalData were:

- Jinshan (Hong Kong) International Mining’s $565m acquisition deal for a 20% stake in Zhaojin Mining

- The $249.1m acquisition of a 49% stake in the Chongqing Iron and Steel Group by Sichuan Development Lomon

- China National Building Material Investment’s $11.1m acquisition deal for a 73.8% stake in Beijing New Building Materials

- The $9.6m acquisition of a 30% stake in Luoyang Zijin Yinhui Gold Smelting by the Zijin Mining Group

Lind Global Fund II and SBC Global Investment Fund’s $3m private equity deal with Australian Mines