DATA

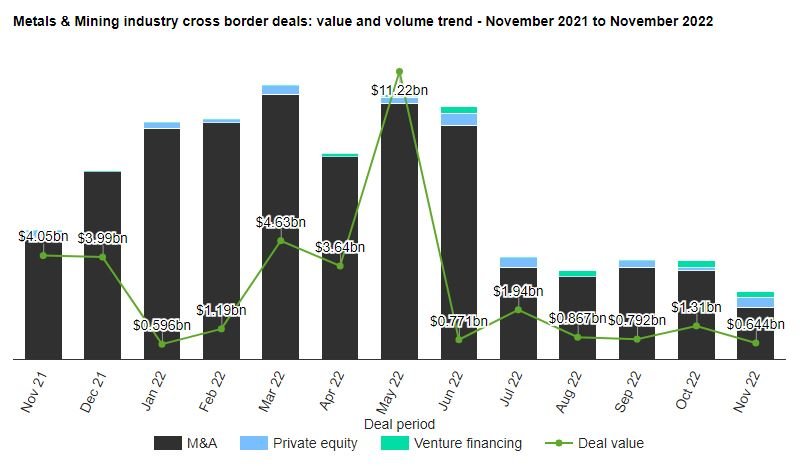

Metals and mining industry cross-border deals total $643.9m globally in November 2022

The sector saw a drop of 62.71% in total cross-border deals, with 22 deals in November 2022 when compared to the last 12-month average of 59 deals.

Powered by

In November 2022, the metals and mining industry reported cross-border deals worth $643.9m around the world, with Jinshan’s $565m acquisition of Zhaojin Mining being the sector’s biggest investment, according to GlobalData’s deals database.

The value marked a decrease of 50.9% over the previous month of $1.31bn and a drop of 78% when compared with the last 12-month average of $2.92bn.

In value terms, Asia-Pacific led the activity with cross border deals worth $568m in November 2022.

The top five cross border deals accounted for 99.2% of the overall value during November 2022. The combined value of the top five cross border deals stood at $638.4m, against the overall value of $643.9m recorded for the month.

The top five metals & mining industry cross border deals of November 2022 tracked by GlobalData were:

- Jinshan (Hong Kong) International Mining’s $565.04m acquisition deal for 20% stake in Zhaojin Mining.

- The $50m private equity acquisition of Torngat Metals by Cerberus Capital Management, Greentech Minerals Holdings and Hegemon Capital

- Breakthrough Energy Ventures’s $12.4m venture financing deal with I-ROX

- The $7.9m private equity acquisition of SouthGobi Resources by Land Grand International Holding

- Lind Global Fund II and SBC Global Investment Fund’s $3m private equity deal with Australian Mines