DEALS ANALYSIS

Deals activity: Asia-Pacific leads in YoY growth; gold continues sector growth

Powered by

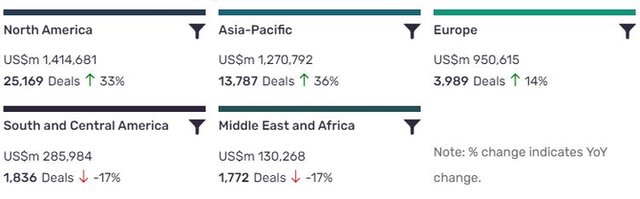

Deals activity by geography

Mining industry deals, as captured by GlobalData’s Mining Intelligence Centre, are largely up year-on-year (YoY) across all regions.

North America is leading in terms of deal value, ($1,414,681m) but has been bested in YoY growth by Asia-Pacific (36%). Europe has also managed to maintain a positive growth, with an increase of 14%.

The volume of deals recorded by GlobalData decreased YoY however in Middle East and Africa and South and Central America, with both regions seeinga decline of 17%.

Deals activity by type

| Deal type | Total deal value (US$m) | Total deal count | YoY change (volume) |

| Equity Offering | 435230 | 22420 | -21 |

| Asset Transaction | 523410 | 10074 | 36 |

| Acquisition | 2065863 | 8686 | -19 |

| Debt Offering | 772458 | 2410 | 7 |

| Partnership | 3404 | 1359 | -88 |

| Private Equity | 60261 | 594 | 65 |

| Venture Financing | 1330 | 205 | -90 |

| Merger | 52469 | 194 | -46 |

A breakdown of deals by type and volume shows a general downtrend, with acquisitions down -19% YoY, mergers down -46%, partnerships down -88%; asset transactions are up 36% however. Financing deals have seen a similar downturn, with venture financing down -90% YoY and equity offerings down -21%, although debt offerings saw slight growth of 7%. Private equity has seen surprisingly good growth, with a 65% increase.

Deals activity by sector

The most notable development apparent in GlobalData’s analysis of mining industry deals by sector is the strength of gold's growth. While all sectors have seen some growth, though admittedly only slightly in sectors such as uranium and zinc, gold has continued to rise, with deals increasing by around 700 YTD.

Note: All numbers as of 10 November 2020. Deals captured by GlobalData cover M&As, strategic alliances, various types of financing and contract service agreements.

For more insight and data, visit GlobalData's Mining Intelligence Centre.

Latest deals in brief

BHP collaborates with Chinese steel producer to address climate change

Multinational commodities giant BHP has signed a memorandum of understanding (MoU) with steel producer China Baowu to focus on reducing greenhouse gas (GHG) emissions in the steel industry. As part of the MoU, the two firms have launched a five-year partnership to invest $35m in developing low carbon technologies.

Canterra Minerals to acquire Teton Opportunities

Canterra Minerals Corporation, a Canadian resource company specializing in diamond exploration within the Northwest Territories, has entered into a binding share exchange agreement to acquire all of the issued and outstanding securities of Teton Opportunities Inc., a private, arm’s-length British Columbia company that holds an option with a subsidiary of Altius Minerals Corp. to acquire the Wilding Lake Project located in central Newfoundland, Canada.

JX Nippon to buy out Caserones copper mine in Chile

Japanese firm JX Nippon Mining & Metals has signed an agreement to buy out the stake in the Caserones copper mine owned by its partners Mitsui & Co and Mitsui Mining and Smelting for an undisclosed consideration.

The mine is located in northern Chile, close to the border with Argentina.

Cross River Ventures to acquire Northern Dominion Metals

Cross River Ventures Corp, a gold and silver exploration company, has agreed to acquire all of the outstanding shares of Northern Dominion Metals Corporation, a mineral exploration company which holds rights to acquire interests in a series of gold exploration projects, from Gravel Ridge Resources Ltd, Bounty Gold Corp, and Perry English.

Melior Resources to acquire 100% stake in Ranchero Gold

Melior Resources Inc. a Canada-based company invests in mining, metallurgical, and mineral companies, has announced plans to acquire 100% stake in Ranchero Gold Corp., a Mexico-based company that holds gold exploration property.

Rhizen signs oncology drug development deal with Curon

Swiss biopharma company Rhizen Pharmaceuticals has signed an exclusive licensing agreement with Curon Biopharmaceutical to develop and commercialise Tenalisib for oncology in the Greater China region. Tenalisib, a highly selective dual PI3K delta and gamma inhibitor, is currently in Phase II clinical development for haematological malignancies. The US FDA granted fast track and orphan drug designations for the drug candidate Tenalisib as a treatment for relapsed/refractory peripheral T-cell lymphoma and cutaneous T-cell lymphoma.