Miners need to transform - but will complacency and short termism win out?

The global mining industry is pulling in two directions. Several companies are showing signs of much-needed innovation but high commodity and share prices may lull others into complacency. Peter Bryant, board chair of the Development Partner Institute and a managing partner at Clareo, explores the need for transformation.

Peter Bryant, board chair of DPI and managing partner at Clareo.

Image: Peter Bryant

Positive signs from several mining companies show the materialisation of much-needed innovation, including recent, bold announcements on emissions reductions from the likes of BHP and Anglo American. This comes at a time when the sector is currently experiencing robust prices in many commodities, despite the Covid-19 crisis. At the time of writing, iron ore is close to a six-year high, gold is at an all-time high, and copper is close to a five-year high.

On the other hand, high commodity and share prices may lull companies into complacency and a continued focus on incrementalism. Additionally, the industry faces significant headwinds, amplified by Covid-19 and including anti-mining and environmental, social, and corporate governance (ESG) activism (despite some forward progress on social and environmental issues), with a steady erosion of the vital trust triangle between miners, communities, and government.

Iron ore is close to a six-year high, gold is at an all-time high, and copper is close to a five-year high.

TheJuukan Gorge incident with Rio Tinto, along with the widespread backlash, reminds us how far the industry still needs to go to reach an acceptable level of ESG performance. These pressing issues are all an innovation challenge at their core, and miners must adopt a new mindset, a new approach, new business models and higher levels of true collaboration.

As stated previously, some mining leaders are adopting a more progressive mindset to embrace this reality. Several of them have moved ahead aggressively with their innovation efforts, with companies like Anglo American (FutureSmart), BHP, Newcrest, Resolute, and Teck (Race21) explicitly outlining this in their strategies and the establishment of innovation organisations to lead these efforts, although these remain largely underfunded.

The path of digital transformation

Digital transformation opens a path for mining companies to further thrive, much like retail and manufacturing. It offers three areas of opportunity for mining companies:

- Deliver efficiency and productivity improvements to current methods and create a better experience for the workforce, customers, and suppliers – these tend to be short to medium term in nature.

- Deliver new or transformational approaches to operating – these tend to be, but not always, three plus years out and include a fully automated mine-to-customer digital platform

- Resolve societal, investor, and activist pressures around climate change and other environmental & social issues – these would span all time horizons and may need investment with no apparent immediate financial return when measured by net present value

The challenge though, as it is for many incumbent companies, is that the mere ownership of new 21st century digital technology is not enough. If companies persist in applying the old 20th century processes, approaches, and mindset, then failure to deliver meaningful value is almost certain.

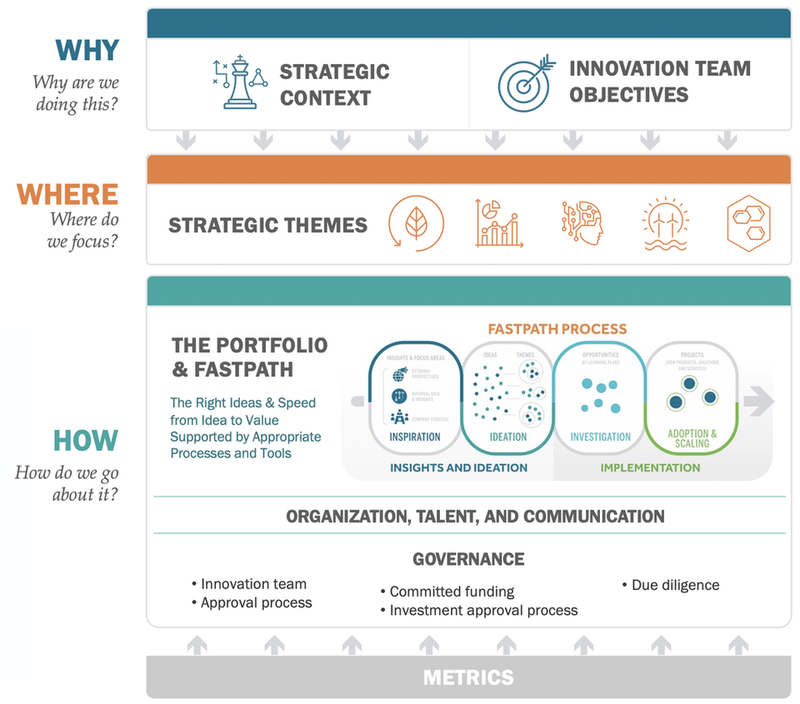

// The Making Innovation Work Framework. Credit: Clareo

Innovation only works when you get all the elements of the Making Innovation Work Framework in sync – when any of the elements in the framework are underperforming, innovation will fail to deliver the value.

And even then, there are common pitfalls in the actual execution that undermine performance and again result in the failure to deliver. It is not so much the why and what that are letting companies down but more the how; the capabilities, approach, tools, and the cultural mindset are often still anchored in the traditional mode of operating with limited recognition of the needs for innovation.

This is much like the difference between what is needed for exploration versus building and operating a mine. Exploration, by its nature, is high risk, and operates with a lot of ambiguity; it is about testing assumptions rather than learning and iterating – so it has different approaches and processes. As one executive once told me: “you would never have an exploration team operate a mine and vice versa – different skills and mindset!”

Persistent under-investment in mining and applying old mindsets and approaches

Mining companies continue to under-invest in innovation despite the progress towards acting upon the need for innovation and the increased urgency to tackle some of the biggest challenges.

This under-investment manifests itself in three ways: a company’s poor investment in its own innovation efforts; the low availability of venture capital and corporate venture capital; and the low levels of investment in R&D by research bodies. This could be further eroded if complacency from current commodity processes leads to more of a focus on incrementalism or that, despite missteps, companies’ stock price will not be impacted.

A recent report by CRC ORE on the levels of R&D in mining in Australia was simply shocking. Its analysis showed a paltry annual amount of $163m, primarily focused on incremental innovation and thinly spread, with poor industry collaboration/coordination.

For such a large, critical industry, current R&D funding levels are significantly lower than desirable.

The report states: “The total funding of $163m per annum might appear to be a large number, but not when compared with the combined R&D expenditure of Australian universities and CSIRO of over A$12bn (Ferguson, 2019; and CSIRO, 2019), or minerals industry export revenues of over A$200bn (MCA, 2020). Arguably, for such a large, critical industry, current R&D funding levels are significantly lower than desirable.”

Investment levels remain an impediment to the performance improvements that miners desperately need. For innovation and digital transformation to meet the challenges presented by the significant headwinds, companies need to have a much more entrepreneurial and speed-based approach. It means embracing a culture of experimentation and learning. It means tolerating higher levels of risk and ambiguity. It means focusing on the cost of failure and not the rate of failure.

The pandemic has catapulted sustainability and digital transformation to the top of innovation agendas for mining. Digital opportunities are abundant for the sector to capture the productivity and efficiency gains, but the mere ownership of 21st century technology is not enough.

The sustainability and digital transformation opportunities demand that miners embrace a new mindset, a new approach, new business models, higher levels of true collaboration, and hyper-transparency. This shift must be met with more urgency if miners have any chance to deliver on an innovation agenda that spans ambitious performance improvement goals to emission reduction targets.

Comment