Ukraine crisis briefing

Powered by

Download GlobalData’s Ukraine Crisis Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 16 August 2022

American agriculture firm Bunge and Norwegian energy company Scatec could be among the multi-national firms most affected by the war, as each owns ten subsidiaries based in Ukraine

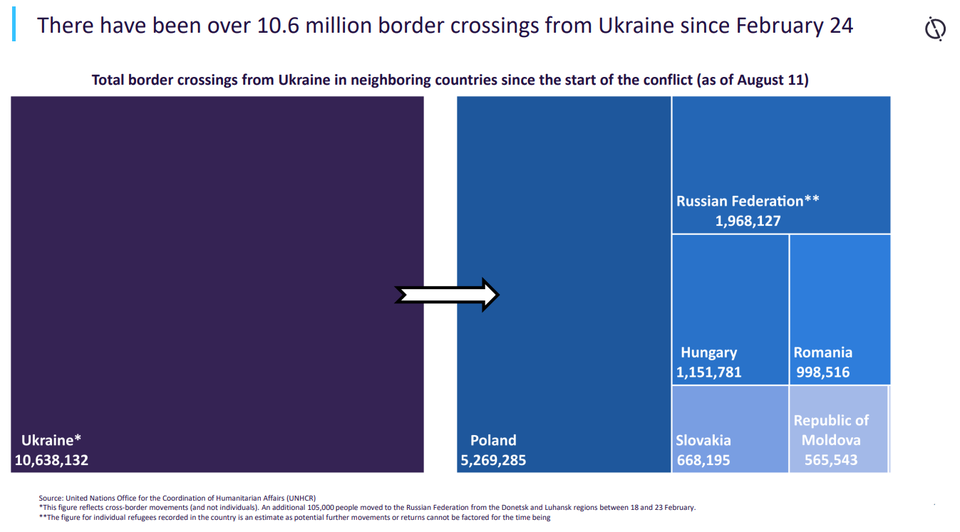

Data from the United Nations’ Refugee Agency indicates that over 10.6 million people have crossed the Ukrainian border as of 10 August, while 3.8 million have returned

97.2%

Cyprus-based Globaltrans Investment could be affected significantly by the war with over 97% of its total revenue coming from operations in Russia and Ukraine

5,500

Ros Agro is one of the largest employers in Russia, with over 5,500 new jobs based in Russia posted between January and March this year

// Asterisk (*) denotes the company HQ is in a country imposing economic sanctions on Russia. Companies with HQ in Russia are not included in these charts.

- SECTOR IMPACT: MINING -

Latest update: 16 August 2022

SUPPLY DISRUPTIONS

Russia is among the top three producers of diamond, gold, platinum group metals and nickel. It is also a key supplier of iron ore, steel and aluminium, alongside seaborn and metallurgical coal to European markets. Meanwhile Ukraine is principally a supplier of coal, iron ore and uranium, though on a much smaller scale.

INDUSTRY IMPACT

Of the leading miners, Nornickel initially stated that operations were continuing and in May confirmed supply of palladium and nickel sales were unaffected with no change to its 2022 guidance. However, while not directly affected by sanctions, it is adjusting its supply routes.

OVERSEAS INVOLVEMENT

Linked to Australia's response to the war, Rio Tinto severed ties with Russian businesses and took sole control over Queensland Alumina, which operates an alumina refinery in Australia, in which Rio owns 80% and Rusal 20%. Rusal has since filed a lawsuit to win back access to its share.

DOMESTIC CONSEQUENCES

In March, Canadian miner Kinross announced that it was suspending all activities in Russia, including its Udinsk development project in Khabarovsk Krai, and operations at its Kupol gold mine. Further to that, in June 2022 it sold its operations to Highland Gold Mining, one of the larger gold producers in Russia, for $340m.