US coal output to remain flat for the next five years due to scheduled closures

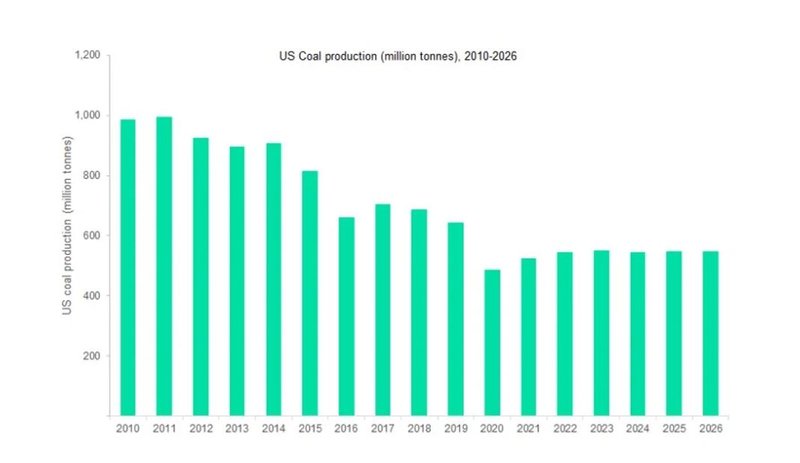

The US coal mine production saw an increase in 2021 after disruptions and is expected to remain flat from 2022 to 2026.

After declining for three years in a row, the US coal mine production recovered by 7.9% year on year (YOY) in 2021, primarily due to a recovery from Covid-19-related disruptions that significantly affected the previous year’s production.

Furthermore, the country produced 219Mt of coal during the first five months of 2022, up by 3.1% YOY. Despite the declining use of coal in electric power, the US coal production is predicted to grow in 2022, helping to replenish low coal stocks at power stations which declined to 86.2Mt by March 2022, down by 22.7% YOY.

In addition, Russia’s invasion of Ukraine, unprecedented economic sanctions and rising natural gas prices will encourage further growth in coal production in 2022, with output forecast to reach 542.8Mt, up by 3.5% YOY, before gradually declining thereafter as the country transitions from coal to renewable energy in the power mix.

Looking ahead, the US coal mine production is expected to remain flat over the forecast period (2022–26), at a compound annual growth rate of 0.1%, to reach 545Mt in 2026.

Coal output will be affected by the gradual closure of mines such as Buckskin, San Juan, Kemmerer, Coal Creek, Black Butte and Leucite Hills, Trapper, Absaloka and the Cadiz Mining Complex, which produced a combined 20.5Mt of coal in 2021.

Further, according to the US Energy Information Administration, about 12.6GW, or 6% of the coal-fired generating capacity that was operational in 2021 is scheduled to retire in 2022, requiring less coal to be mined in the country. In addition, declining renewable energy costs, combined with low natural gas prices, will lead to lower coal production in the country.

// Main image: Coal mining. Credit: Harry Husnan Kurniawan via Shutterstock

COMMENT