Latest Deals

Credit: yuda chen / Shutterstock

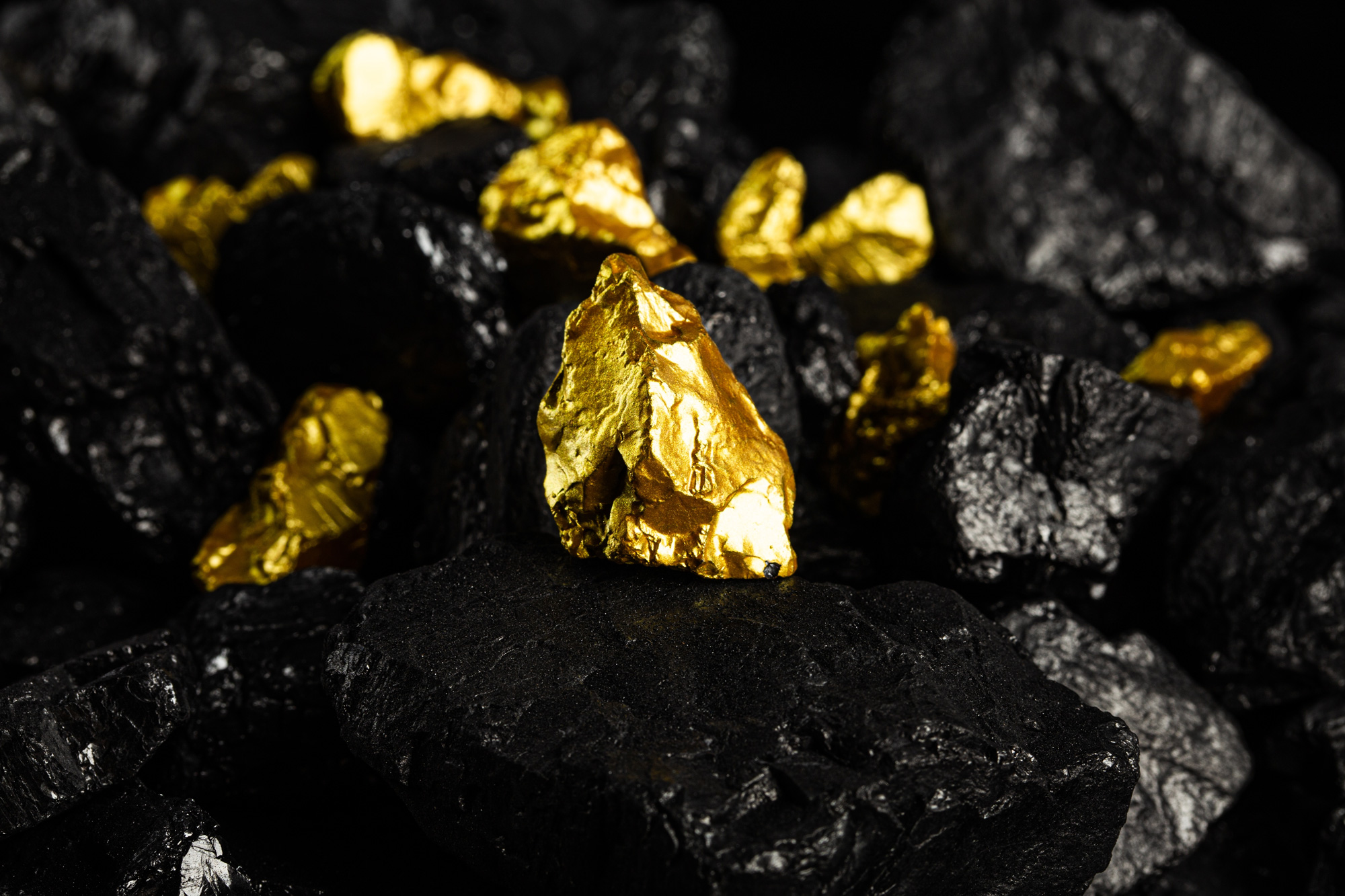

Northern Star agrees to acquire De Grey Mining for A$5bn

Australian gold miner Northern Star Resources has agreed to acquire gold mining company De Grey Mining in an all-share deal valuing the latter at around A$5bn ($3.25bn). As per the terms of the binding scheme implementation deed, shareholders of De Grey will receive 0.119 new Northern Star shares for each share held, equating to an offer price of A$2.08 per De Grey share. The merger will create a combined entity with pro forma mineral resources of 74.9 million ounces (moz) and ore reserves of 26.9moz.

Peabody to acquire Anglo's steel-making coal assets

US coal producer Peabody Energy has agreed to purchase steel-making coal assets being divested by Anglo American as it exits the coal industry. The $2.32bn transaction includes four high-grade coal mines in Australia’s Bowen Basin – Moranbah North, Grosvenor, Aquila and Capcoal. The cash consideration for the acquisition comprises $1.69bn at closing and deferred payments of $625m over four years. Additional contingent payments of up to $1bn have also been agreed upon, dependent on favourable future events. The deal is due to be finalised by mid-2025.

Rua Gold completes on Reefton assets in New Zealand

Canadian miner Rua Gold has completed the acquisition of Reefton Resources, previously a wholly owned subsidiary of Siren Gold. The acquisition expands Rua Gold’s tenement package to more than 95% in the Reefton Goldfield in the Buller Province of New Zealand’s South Island. The A$20m acquisition was completed under a share purchase agreement signed in July 2024, and amended in October 2024. Reefton now operates as a wholly owned subsidiary of Rua Gold.

Carnaby Resources to acquire Trekelano deposit

Carnaby Resources has entered into a binding asset sale agreement with Chinova Resources to acquire the Trekelano copper-gold deposit, near Mount Isa in Queensland. Carnaby will acquire a 100% interest in three mining leases, ML90128, ML90125 and ML90183, under the agreement. Carnaby has paid a A$3m deposit. Upon completion, a final cash payment of about A$6m will be made to Chinova.