The future of coal mining in Australia stands at a crossroads, influenced most notably by the global shift towards cleaner and sustainable energy sources. Mounting pressure to curtail carbon emissions in Australia has sparked discussions on phasing out coal-fired power plants and embracing cleaner energy alternatives.

Evolving market dynamics will also shape Australia’s coal future, particularly in major coal export destinations such as China, where trade conditions are uncertain, and India, which is seeking reduce its dependence on imports.

In the immediate term, coal mining is anticipated to retain a significant role in Australia’s domestic energy mix and export markets.

The current government, after taking office in May 2022, pledged to support the coal industry while also committing to reducing greenhouse gas emissions. The government's ambitious targets include a 43% reduction in CO₂ emissions by 2030 (relative to 2005 levels) and achieving net zero emissions by 2050.

Since the beginning of 2023, the government has granted approval for the operation of four coal mines – Ensham Gregory, Issac River, and Star Coal – indicating its intent to balance net-zero goals with coal interests.

Australia’s coal reserves

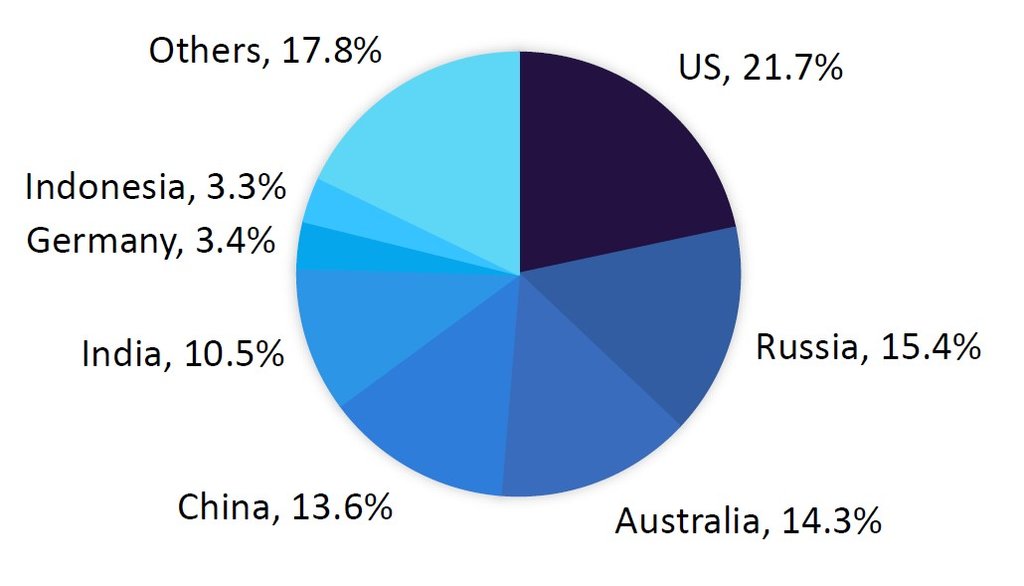

Australia has the third-largest coal reserves in the world, accounting for around 14.3% of total global reserves, after the US (21.7%) and Russia (15.4%). The country’s proven coal reserves stood at 150.3Bt as of December 2021, according to the US EIA.

Coal reserves by country. Source: GlobalData, US EIA

Australia categorises its coal into black coal, which comprises anthracite, bituminous and sub-bituminous, and brown (lignite) coal. The country has 6% of the world’s black coal, with reserves located mainly in Queensland and New South Wales, and Western Australia, South Australia and Tasmania containing relatively smaller quantities. Brown coal is of a lower grade compared with its counterpart and is mainly found in Victoria.

As of December 2021, Australia’s total recoverable identified resources of black coal were estimated at 162,279Mt, of which economic demonstrated resources (EDR) were 75,433Mt and subeconomic demonstrated resources (SDR) were 5,269Mt and 81,577Mt of inferred resources. Total recoverable identified resources of brown coal were estimated at 436,652Mt, of which EDR are 74,039Mt and SDR are 257,385Mt and 105,228Mt of inferred resources.

Coal production in Australia

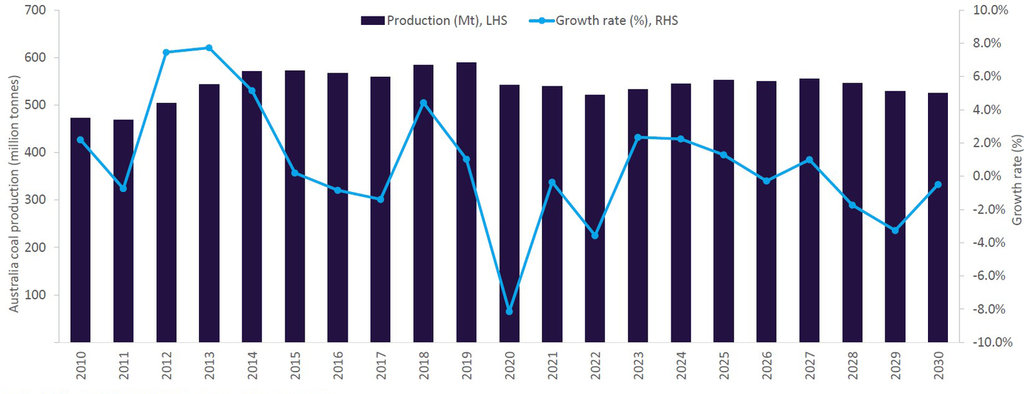

Coal production in Australia increased by around 2.3% to 532.9Mt in 2023, driven by consistent production levels from key mines such as Loy Yang, Moolarben, Mount Arthur, Yallourn and Rolleston. The restart of operations at the Grosvenor mine in the second quarter of 2022, following a gas ignition incident in May 2020, also contributed to this growth.

Looking ahead to 2030, GlobalData expects a marginal decline of 0.6% in coal production, to 525.7Mt. This can be attributed to the closure of around 30 coal mines, including the Newlands Coal and Clermont mines (2027) Yallourn (2028) and Aquila (2029). These closures reflect a broader shift away from coal as Australia tries to reduce its reliance on fossil fuels for environmental reasons.

Source: GlobalData, Department of Industry, Science, Energy and Resources, Australia

Queensland and New South Wales are the two top coal producing states and together accounted for 98.8% of the country’s coal production in 2022. The remainder as contributed by other states, including Western Australia (1.19%) and Tasmania (0.1%).

Queensland is the largest coal producing state in Australia with 57 operating coal mines and 69 projects in various stages of development. In 2022, it produced 294Mt of coal, up by 1.1% over 2021, owing to the start of new mines such as Aquila (2.3Mt) and Broadmeadow East (0.9Mt), coupled with strong output from the Clermont, Carmichael, Hail Creek and Rolleston mines.

In contrast, output from New South Wales fell by 9.2% to 220Mt in 2022, as production from the Moolarben, Warkworth, Bengalla and Mount Arthur Coal mines declined by 17.8% due to bad weather conditions. New South Wales has 41 operating mines and 20 projects in development.

Domestic coal demand and export markets

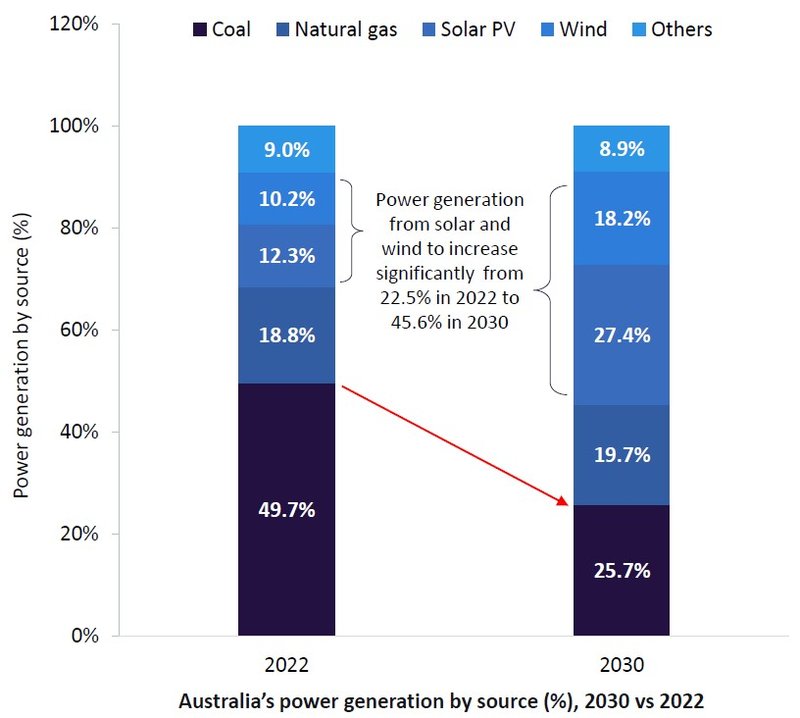

Coal consumption in Australia saw an estimated 5.1% decline in 2023, to 92.4Mt. Coal has traditionally been the country’s dominant source of fuel for electricity generation, but there has been a noticeable departure from coal in recent years as Australia tries to shift towards cleaner and more sustainable energy sources.

GlobalData expects a steady decline in Australia’s coal consumption at a CAGR of 6%, to a little over 60Mt in 2030. This decline can be attributed to several factors, including stringent governments policies, ambitious emissions reduction targets, opposition from environmental groups and communities and the retirement of older, less efficient coal-fired power plants.

Credit:

While domestic demand continues to decline, Australia remains one of the world's largest coal exporters. The largest share of its exports, typically around 85-90%, go to Asian markets such as China, Japan, South Korea, and India.

Trade tensions with China have affected Australian exports, resulting in a drop of 14% in 2022 compared to 2019. However, exports saw around 5.1% growth in in 2023, reaching 355Mt, due to the reopening of export channels to Chinese markets. This development comes as a result of China lifting the coal ban effective February 2023 that was imposed in late 2020.

Australia's export relationship with India also faces uncertainty as India seeks reduce its reliance on imports and build self-sufficiency, which is expected to gain momentum from 2027 onwards. The entry of private players as part of India’s initiative to commercialise its coal sector will play a major role in this shift.

GlobalData’s forecast indicates an initial period of stability between 2024 and 2027, with exports expected to hover around 365-370Mt. However, a decline is expected from 2028 to 2030 as global emission targets and changes in energy policy continue to reshape the landscape for coal.

This article is based on information from GlobalData’s report ‘Australia coal mining to 2030’. The full report includes a forecast to 2030, detailed breakdowns of Australia’s coal reserves and production, price trends and exports, details of key assets and development projects, the competitive landscape as well as the country’s fiscal regime, taxes and royalties. You can buy the full report here.