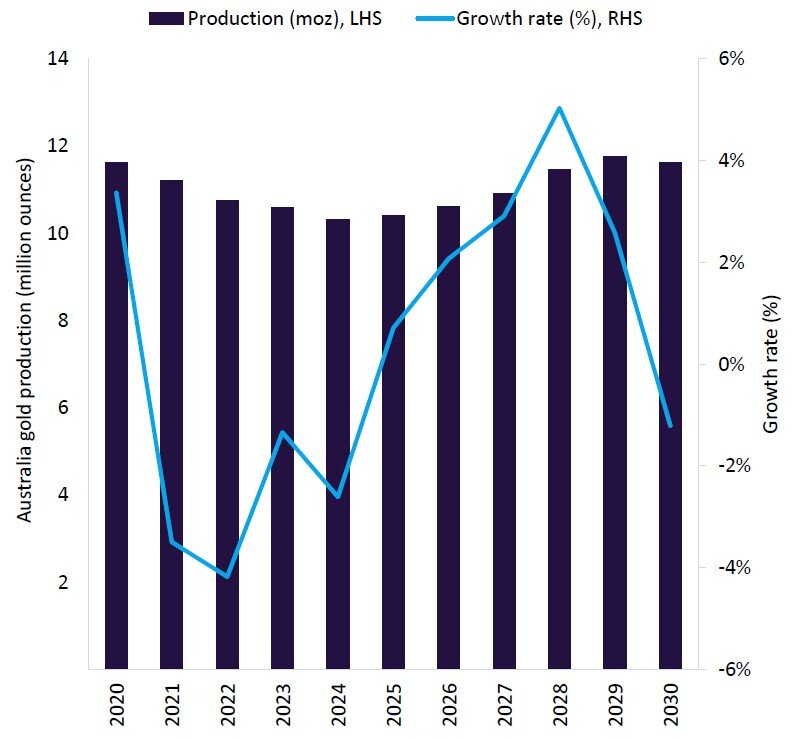

Australia’s gold mine production is predicted to fall for the fourth consecutive year in 2024 to 10.3 million ounces (moz), a 2.6% decrease from 2023. This will be primarily due to a planned reduction in head grades at the country’s major mines such as the Cadia, Boddington, Telfer, Fosterville and Tanami. Combined production from these mines is expected to decline from 1,785 thousand ounces (koz) in 2023 to 1,696.8koz in 2024.

Several mines have been placed under care and maintenance due to increasing costs and declining margins. These include Mount Morgans, Mount Carlton, Halls Creek, DeGrussa and Monty.

Operations in Western Australia also suffered from significant rainfall in March 2024, affecting production at gold mines such as Regis Resources, Capricorn Metals and Gold Road Resources Ltd.

This is likely to be partially offset by the start of the Bellevue, Paulsens Restart, Mount Morgan, Leonora and Devon Pit Extension projects in 2024, as well as the ramping up of the Penny and Norseman Gold projects.

Forecast for gold production in Australia to 2030. Source: GlobalData, Australian Department of Industry, Science and Resources

Overall, production is expected to recover in 2025, albeit by a marginal 0.7%, and then steady through to 2029 before decreasing in 2030. This short-term growth will be supported by project expansions and the scheduled start-up of projects including Yandal (2025), Trident (2025), Hemi (2026) and Mcphillamys (2028).

Overall, Australia's gold mine production is predicted to increase at a compound annual growth rate (CAGR) of 2.0% between 2024 and 2030, reaching 11.6moz. Growth is predicted to slow after 2028 due to the closure of key mines such as the Duketon South, Agnew/Lawlers and Beta Hunt.